How Uniswap v3 Begun a New Age Of Efficiency For DeFi

The popularity of Uniswap v2 in 2020 was unprecedented for a DeFi protocol. The decentralized exchange seemed to be the epicenter of the new financial revolution. First matching and then outperforming major trading platforms in terms of volume, Uniswap has been forked countless times to try and mimic its success. The launch of its third […]

Related News

Despite the launch of Uniswap v3 decentralized exchange with its capital efficiency increase, Uniswap v2 is not out of the race yet. As one of the most eagerly anticipated rollouts of the decentralized finance (DeFi) sector, Uniswap v3 went live on May 5. The upgrade targeted greater capital efficiency and better flexibility for liquidity providers. The concept of Uniswap v3 includes features such as concentrated liquidity — which allows liquidity providers (LPs) to allocate their capital in certain price ranges rather than distribute liquidity across the entire price curve — as well as....

Like many other exchanges, Coinbase has been focusing on decentralized finance (DeFi) over the past few months. The rise of decentralized exchange platforms such as Uniswap has begun to eat at the market share of these centralized exchanges. While Coinbase listed coins such as Compound and Uniswap, though, there was a lack of grassroots projects […]

Several users have aired complaints about the new version, especially its higher gas fees. The founder of Uniswap, Hayden Adams, has reported that the launch day of Uniswap’s v3 iteration was more successful than its predecessor in terms of volume.In a tweet on May 6th, Adams declared the launch of Uniswap v3 the day before a resounding success. He noted that over its first 24 hours of going live v3 had already processed more than twice the volume that v2 saw in its first month.Dividing Uniswap’s volume by total value locked, or TVL, Adams asserted the platform is operating with greater....

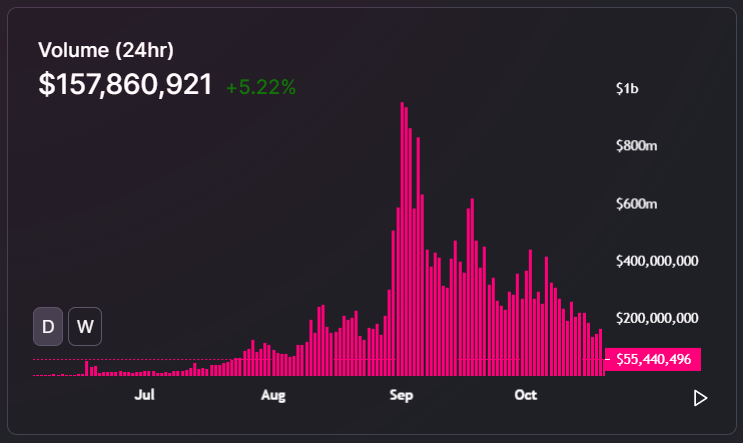

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

Major DeFi tokens, including UMA, Maker, and Uniswap have surged up to 22% in the past 24 hours. The decentralized finance (DeFi) market has generally rebounded following a sustained pullback. There are two main reasons behind the short-term recovery of major DeFi tokens. First, most DeFi tokens were heavily sold since September, causing most to […]