Bitcoin Under Pressure? Rising Exchange Inflows Signal Potential Supply Build-Up

Bitcoin remains under the $120,000 price mark following a pullback triggered by remarks from the US Treasury that the federal government will not be purchasing the cryptocurrency. At the time of writing, BTC is valued at approximately $118,612, representing a 4.1% decline from its record high above $124,000 reached earlier this week. The market seems to be currently assessing whether this consolidation phase will lead to renewed upward momentum or extend the correction. Recent blockchain data has brought attention to activity on Binance, the world’s largest cryptocurrency exchange by....

Related News

On-chain data shows the Bitcoin stablecoin supply ratio is now showing a green signal that has proved to be profitable for the crypto several times in the last two years. Bitcoin Stablecoin Supply Ratio Shock Momentum Forms “Buy” Signal As pointed out by an analyst in a CryptoQuant post, out of the 11 previous such buy signals, 10 ended up profitable for the crypto. The “stablecoin supply ratio” (or the SSR in brief) is an indicator that measures the ratio between the market cap of Bitcoin and that of all stablecoins. Generally, whenever investors want to avoid....

Recent on-chain data suggests that Bitcoin (BTC) whales may be preparing for a potential rally, as Binance BTC withdrawals have seen a notable spike. Additionally, rising stablecoin inflows to exchanges indicate growing buy-side liquidity, reinforcing the market’s bullish sentiment. Bitcoin Whales Foreseeing Major Rally Ahead? According to a recent CryptoQuant Quicktake post by contributor Amr Taha, Bitcoin whales recorded one of the largest BTC outflows from Binance this month. The chart below shows that nearly 4,500 BTC were withdrawn on June 16. Bitcoin whales are defined as wallet....

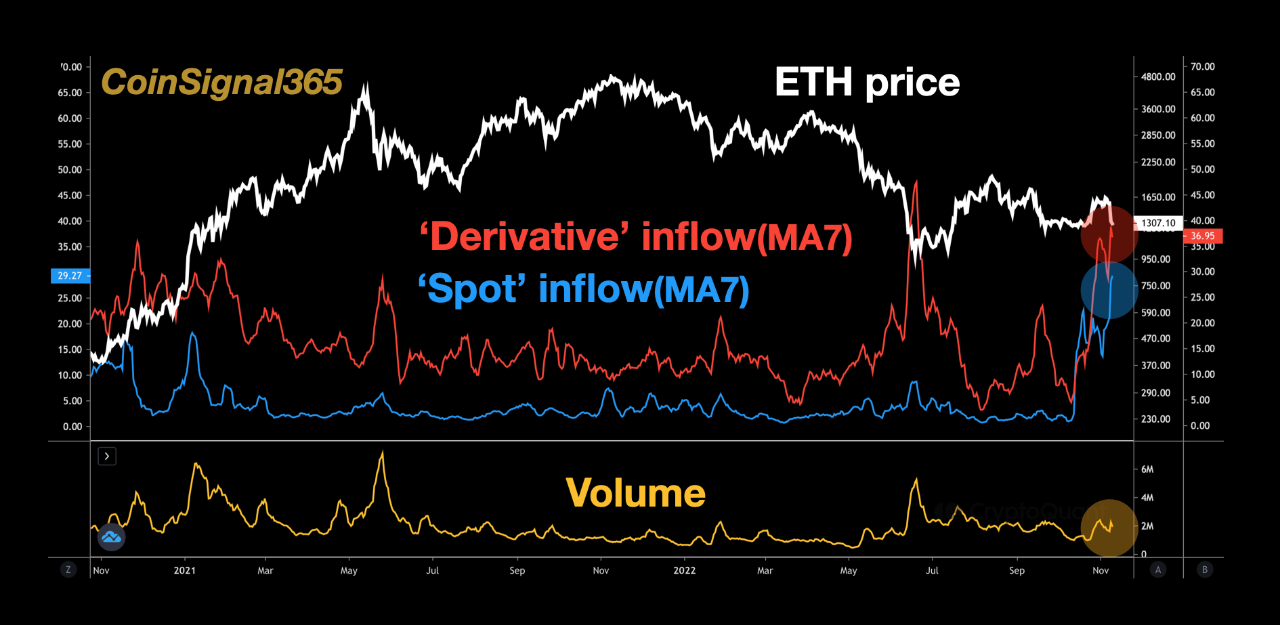

Ethereum has plunged below $1.3k today, but the decline may not be over quite just yet as on-chain data shows selling pressure continues to rise in the market. Ethereum Exchange Inflows Have Continued To Go Up During The Past Day As pointed out by an analyst in a CryptoQuant post, the ETH derivative and spot exchange inflows are both still on the rise. The “exchange inflow” is an indicator that measures the total amount of Ethereum entering into the wallets of centralized exchanges. There are two versions of this metric, the first notes the inflows specifically going to....

Bitcoin has continued its downward trajectory when observed over weekly and monthly timeframes, recording an 8.4% decline in the past week and a 16.2% drop over the past month. However, in the shorter time frame, signs of potential reversal are emerging. Over the past 24 hours, Bitcoin has seen a slight recovery, with its price rising to $81,647. This shift has led analysts to closely examine whale activity and exchange trends to determine whether the correction phase may be nearing an end. Related Reading: Bitcoin’s SOPR Nears Critical Level—Is a Deeper Correction Ahead? Binance’s Whale....

On-chain data shows the recent trend in the Bitcoin Stablecoin Supply Ratio may suggest the crypto could see a buy signal soon. Bitcoin Stablecoin Supply Ratio RSI 14 Is Near A “Buy” Signal As explained by an analyst in a CryptoQuant post, whenever the SSR RSI has gone below a value of 25 during recent years, the crypto has observed a buy signal. The “Stablecoin Supply Ratio” (or SSR in brief) is an indicator that measures the ratio between the market cap of Bitcoin, and that that of all stablecoins. As their name implies, “stablecoins” are quite stable....