Data Shows 78% of the Circulating Bitcoin Supply Is Illiquid, Only 4.2M BTC i...

Onchain statistics show 78% of the circulating bitcoin supply is illiquid and barely accessible according to Glassnode research. Data indicates that the analysts have classified 14.5 million bitcoin as illiquid and only 4.2 million bitcoin in constant circulation. One of the most treasured parts of the Bitcoin (BTC) protocol is the fact that the system is mathematically provable, and bitcoins are scarce. When Satoshi Nakamoto created the crypto asset, the inventor set the supply cap to end at 21 million coins issued and today, there’s approximately 18.58 million BTC in circulation.....

Related News

Around 76% of the total circulating Bitcoin supply is now illiquid according to on-chain analytics from Glassnode. Bitcoin markets have been consolidating since the beginning of the year, but on-chain metrics are painting a more positive picture as more of the asset is becoming illiquid.On-chain analytics provider Glassnode has been delving into Bitcoin supply metrics to get a better view of the longer-term macro trends in its weekly report on Jan. 3.The findings revealed that although the asset has been trading sideways so far this year, more BTC has become illiquid. There has been an....

The total illiquid Bitcoin has reached a new high, providing a bullish outlook for the flagship crypto. This refers to the BTC supply that is unlikely to hit the open, given the long-term holding of the investors who own these coins. Bitcoin’s Illiquid Supply Hits New High Glassnode data shows that Bitcoin’s illiquid supply has reached a new high of 14.3 million BTC, marking over 72% of the flagship’s circulating supply. This supply is held by long-term holders (LTHs) who haven’t moved their coins in over seven years, highlighting a strong conviction in the flagship crypto. Related....

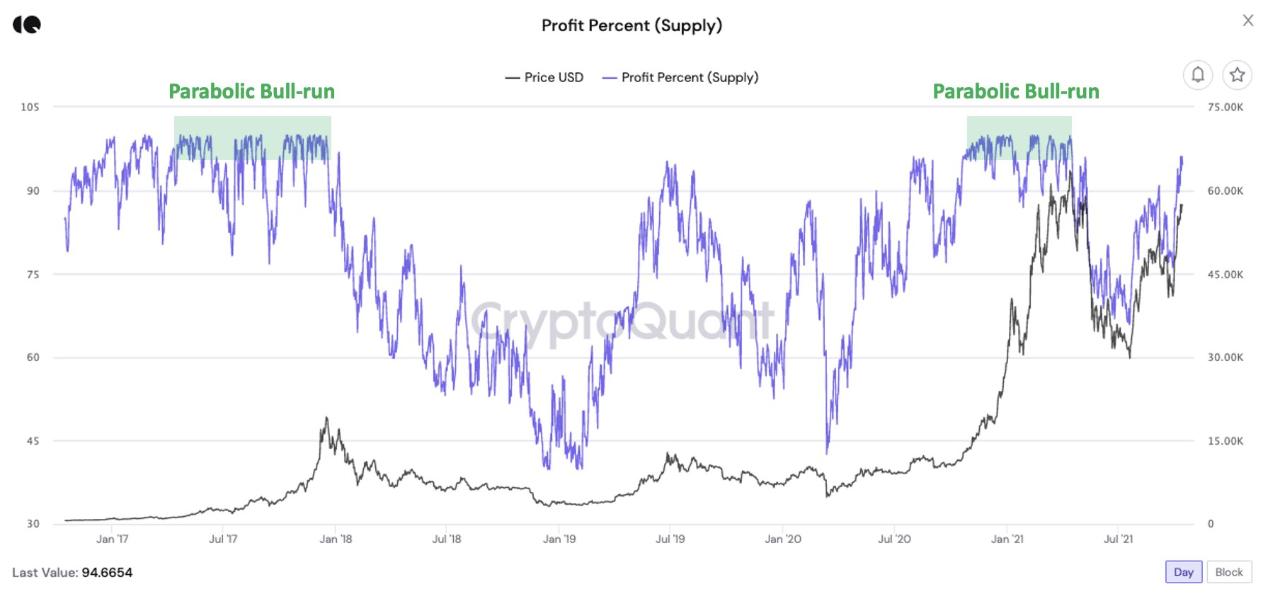

On-chain data shows 99% of the circulating Bitcoin supply has unrealized profits again. History may have the hint for where the market could head next. 99% Of The Circulating Bitcoin Supply Has Unrealized Gains As pointed out by a CryptoQuant post, the profit percent of the circulating BTC supply has reached 99% once again as […]

The way bitcoin holders move the BTC in and out of their wallets can often be a strong indicator of where the market might be headed next. Not just the movements of the asset, but where they are being moved to. An example of this is when more investors are moving their holdings to exchanges, which means that sell sentiment has risen and investors are dumping their coins, and vice versa. In this same line, looking at the liquid and illiquid supply of bitcoin can also be another strong indicator. And this time around, the percentage of bitcoin supply that remains illiquid point towards a....

Investors are in it for the long run, locking 270,000 BTC away over the last 30 days. Despite surging prices, Bitcoin investors are rapidly locking up their BTC for the long-term, with 270,000 BTC being taken out of liquid supply in the last 30 days.According to data published by crypto market data aggregator Glassnode, “liquid” Bitcoin wallets have shed 270,000 BTC over the past month, up from 175,000 Bitcoin at the start of January.Bitcoin Monthly Liquid Supply Change. Source: GlassnodeThe data shows that Bitcoin’s (BTC) liquid supply has consistently fallen over the last nine months,....