As Bitcoin Breaks $57k, Quant Explains Why It Could See A Pullback Here

As Bitcoin rallies past $57k, Quant explains using on-chain analysis why the cryptocurrency may see a pullback here. Bitcoin Funding Rate And Futures Open Interest Show Rising Values As explained by an analyst in a CryptoQuant post, some BTC indicators are showing values that have historically signaled that a correction could be coming soon. The first metric of relevance is the Bitcoin funding rate, which is defined as the periodic payment that futures contract traders have to pay. Positive values imply most traders are bullish and long traders are paying this fee to short traders. While....

Related News

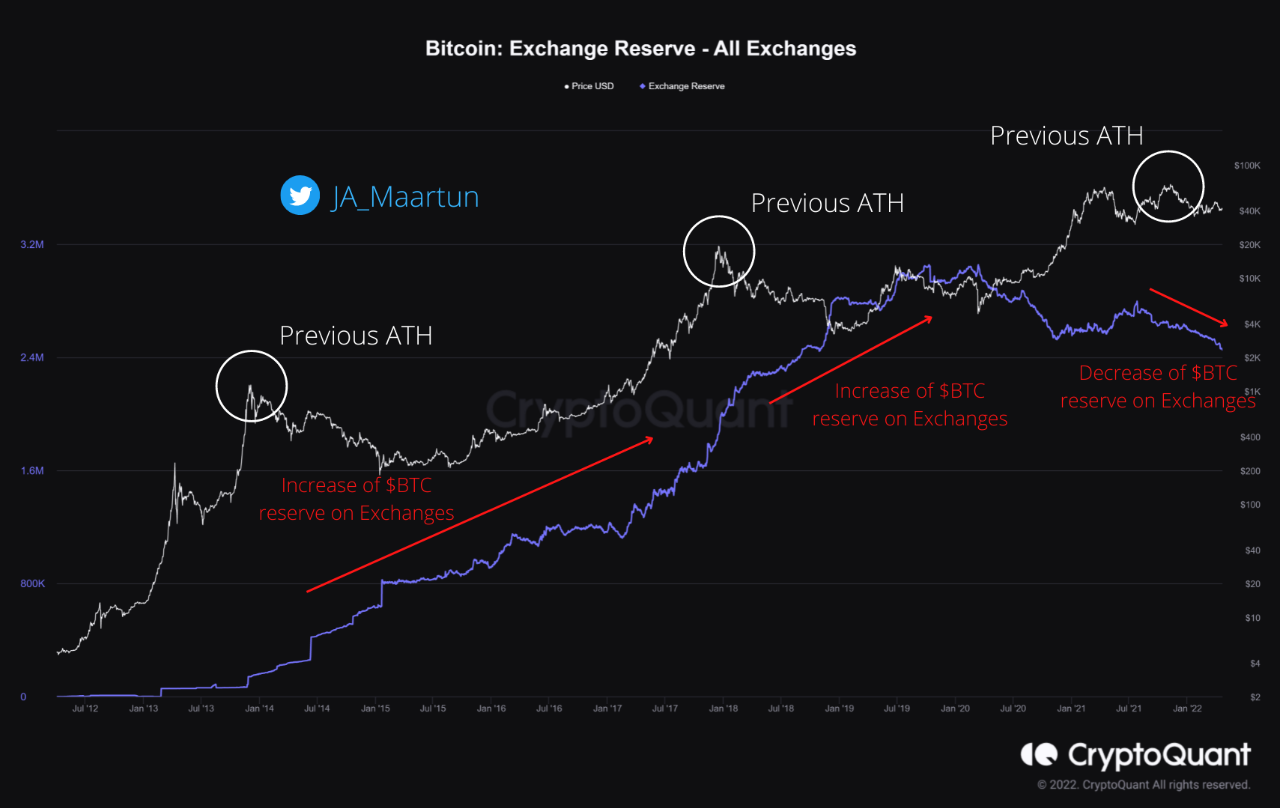

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

A quant breaks down how the Bitcoin NUPL indicator may be able to predict the beginning of a new bull run based on past pattern. How The Bitcoin NUPL Metric May Predict The Start Of Bull Run As explained by an analyst in a CryptoQuant post, the various phases of the NUPL indicator may shed some light relating to the bull run status for BTC. The net unrealized profit and loss (or NUPL in short) is a metric that’s defined as the difference between the market cap and the realized cap, divided by the market cap. NUPL = (Market Cap – Realized Cap) ÷ Market Cap In simpler terms, what....

A quant has explained how the Bitcoin exchange reserve on-chain indicator differs between the current crash and that of May’s. After Spiking Ahead Of The Crash, Bitcoin Exchange Reserves Have Resumed Downtrend As explained by an analyst in a CryptoQuant post, the current trend in BTC exchange reserves is quite different from when the crypto […]

Quant rose to its highest point since the start of the year on Saturday, as prices climbed for a third straight session. In addition to this, tron was also higher, as the token attempted to break out of a key resistance point. Overall, cryptocurrency markets were down 1.95% as of writing. Quant (QNT) Quant (QNT) was one of the notable movers to start the weekend, as the token surged to a ten-month high. Following a low of $162.00 on Friday, QNT/USD surged to an intraday peak of $184.98 earlier in today’s session. This move saw the token climb to its highest point since January 8,....

Quant (QNT) has been a shining star in the cryptocurrency market recently, posting a remarkable 28% gain in just seven days. As the price of Quant (QNT) climbs to new heights, savvy investors are beginning to look for new opportunities with even greater profit potential. Enter Mpeppe (MPEPE), a meme coin that has been gaining […]