Here’s why analysts are saying ‘No FOMO’ ahead of Bitcoin’s ETF launch

The upcoming launch of a BTC ETF has bulls proclaiming that a $100,000 Bitcoin price is imminent, but several analysts warn that a sharp short-term pullback could also occur. The day the crypto traders have long-awaited is almost here. At the opening bell on Oct. 19, a ProShares futures-based BTC ETF is scheduled to launch and analysts are predicting that additional ETFs will rollout over the coming week. Data from Cointelegraph Markets Pro and TradingView shows that an early morning attempt by bears to drop the price back below $60,000 was well defended by traders and at the time of....

Related News

Ethereum is expected to shoot higher in the weeks ahead despite the recent price consolidation. The cryptocurrency has held well in the high-$500s despite some downward pressure in the Bitcoin price. Analysts think that ETH could push toward $900 and beyond in the near future, especially due to the positive fundamental event of the ETH2 launch. Boosting Ethereum’s prospects, analysts are also bullish on Bitcoin. Ethereum Could Shoot Even Higher, Leading Analysts Say Ethereum is […]

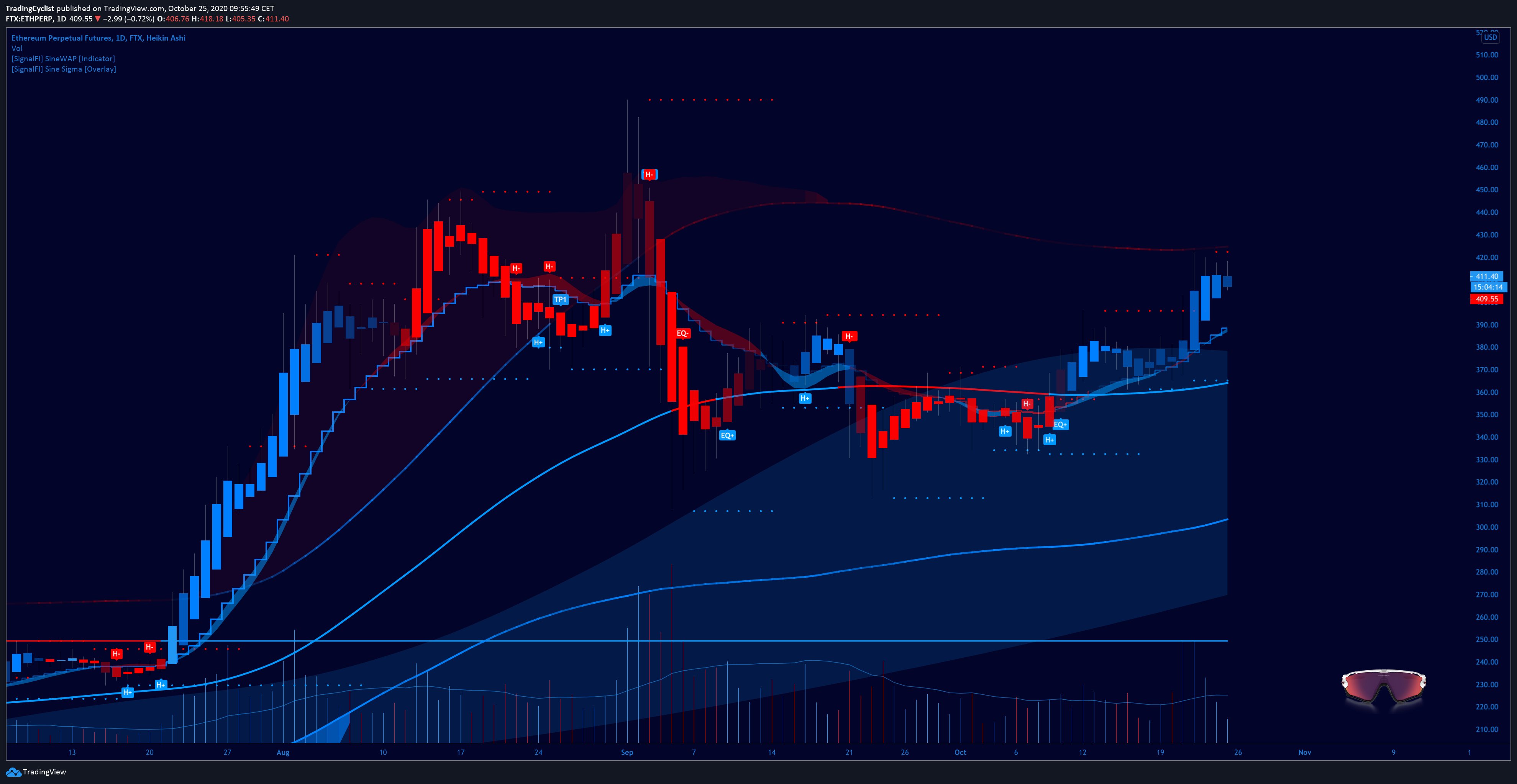

Ethereum has stalled after hitting the pivotal highs of $420 earlier this week. The coin now trades for $408, failing to break higher even as Bitcoin flirts with yet another breakout ahead of the weekly close. Despite the mixed price action, analysts think ETH remains in bullish standing. Ethereum Analysts Thinks the Uptrend Is Intact One crypto-asset analyst shared the chart below on October 25th. It shows that Ethereum remains in a consolidation below a […]

Much of bitcoin’s recent rally has been attributed to the tremendous success of the first bitcoin ETF to trade on Wall Street. The ProShares ETF had seen over $1 billion in trading volume in the first 24 hours alone. However, JPMorgan analysts do not believe that this is the driving force behind BTC breaking a […]

Among all the cryptocurrencies in the industry, few have seen as many comments and predictions as XRP. Once trapped under legal uncertainty, XRP has begun to reclaim attention thanks to favorable legal developments and the anticipated launch of Spot XRP ETFs. However, XRP’s current valuation is significantly below that of the largest cryptocurrency, Bitcoin. But what if XRP were to rise to the same market capitalization as Bitcoin? Data from MarketCapOf offers a glimpse into how much each XRP token would be worth if it reached Bitcoin’s current market cap. Linking XRP’s Price....

The Dogecoin price is expected to stage a breakout in the days ahead, with crypto analysts highlighting key catalysts that could drive this rally. Despite weeks of sideways movement and steady dumping by whales, attention is now shifting to emerging technical indicators and a potential Dogecoin ETF as possible triggers for a price explosion this […]