Number Of Short-Term Bitcoin Holders Hits All-Time Low, How This Affects The ...

Bitcoin has been doing good lately in the market. The digital asset broke the $50K price point earlier this week, before seeing a slight retracement down to $49K. This has been driven by a number of factors in the market. Growing interest is at the top of the list. As the price rallies, a number of interesting things have been happening in the Bitcoin space, ranging from holding patterns to the duration of the hold. Recent data shows that the number of short-term bitcoin holders has declined to new lows. Most investors are now just holding their coins and not moving them out of their....

Related News

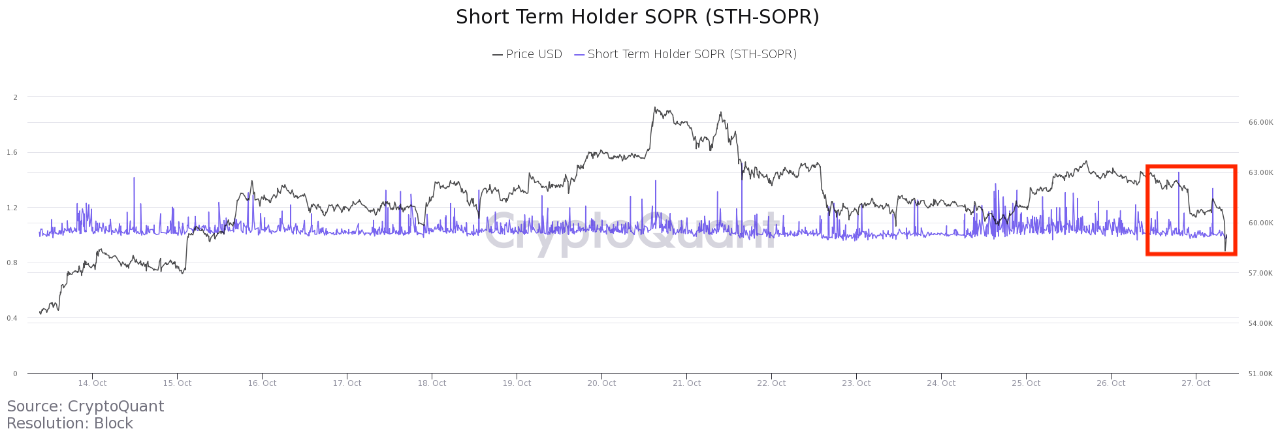

On-chain data may suggest short-term Bitcoin holders could be behind the latest correction in the cryptocurrency’s price. Bitcoin Short-Term Holders Behind The Correction? As pointed out by a CryptoQuant post, on-chain data may hint that selling from short-term holders might be the drive behind the recent correction. The relevant indicator here is the Spent Output […]

Bitcoin has crashed to $58k, and on-chain data may suggest that profit-taking from short-term holders may be behind the event. On-Chain Data Shows Bitcoin Short-Term Holders Are Taking Profits As pointed out by an analyst in a CryptoQuant post, short-term holders seem to have started taking their profits. And the timing may suggest this to […]

On-chain data suggests the Bitcoin Long-Term Holders are currently putting more selling pressure on the market than short-term holders. Bitcoin Long-Term Holder SOPR Has Spiked Up In Recent Days As explained by an analyst in a CryptoQuant post, Short-Term Holders and US investors haven’t sold as much lately as during the start of June. The […]

Short term Bitcoin holders (STHs) have been aggressively adding the OG cryptocurrency to their portfolios since September 2024, adding over 1.5M BTC. This takes the total tally of Bitcoin with STHs to 4M. In case you didn’t know, short-term holders are those market participants who hold the token for less than 155 days. Can Short-Term Holders Buy More $BTC? Interestingly, all of the previous Bitcoin rallies have come when short-term holders have exhausted their buying momentum. For instance, in the 2013 cycle, STHs held almost 5M BTC, while in the 2017 cycle, they had 6.2M coins.....

Data shows Bitcoin short-term supply has reached an all-time low value. This may mean that investors aren’t keen to sell at this level despite the latest rally up where the coin broke $57k. Bitcoin Short-Term Supply Records All-Time Lows According to the latest Arcane Research weekly report, the BTC short-term supply is currently floating around all-time low values. The “short-term supply” here refers to the supply of coins that were moved on the chain within the last three months. When this indicator’s value moves up, it means there are a lot of short-term holders....