Bitcoin Supply In Loss Begins To Rise, Raising Early Bear Market Concerns

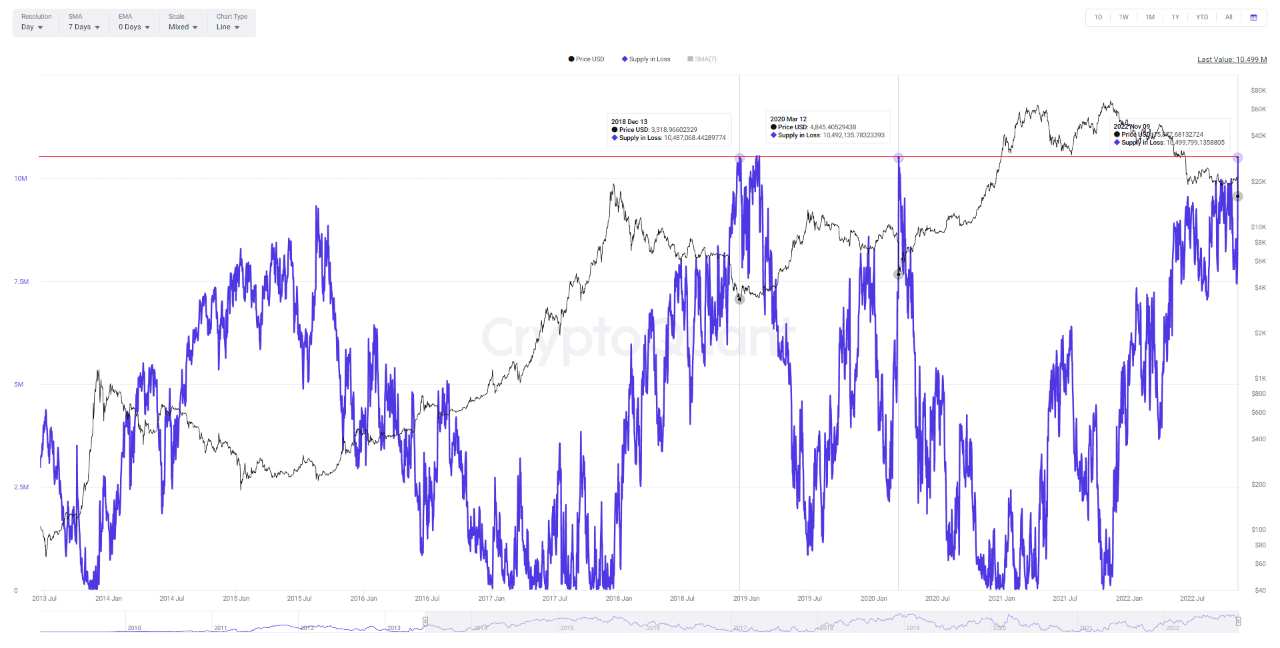

Crypto research firm CryptoQuant has flagged a potentially troubling development for Bitcoin (BTC) and the wider digital asset market, pointing to an early warning signal that has historically appeared ahead of prolonged downturns. In a report released Wednesday, the firm noted that Bitcoin’s supply in loss metric has begun to rise again, a shift that has often marked the early stages of past bear markets. Possible Shift Toward Bear Market Structure According to analysis by CryptoQuant contributor Woominkyu, increases in supply held at a loss tend to signal that market weakness is....

Related News

Bitcoin has once again fallen below a critical support zone, raising questions about whether the market is gearing up for a deeper sell-off. With selling pressure still intact, traders are now watching key levels closely to see if a final flush toward lower support is imminent. Price Faces Another Rejection MakroVision Research shared on X that Bitcoin has once again met strong rejection, resulting in a decisive break below several key support levels. Price has now slipped back into the range of the previous low and continues to trade beneath the critical green resistance zone between....

Hyperliquid (HYPE) has emerged as one of the few large‑cap cryptocurrencies showing sustained strength across multiple time frames, even as the broader digital asset market remains under pressure. While Bitcoin (BTC), Ethereum (ETH), and most major tokens have struggled amid a market‑wide pullback, Hyperliquid has continued to post notable gains, setting it apart during what many consider the early stages of a bear market. What’s Driving Hyperliquid Higher Market data from CoinGecko shows that HYPE surged roughly 31% over the past week, pushing the token toward the $34 level earlier in....

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....

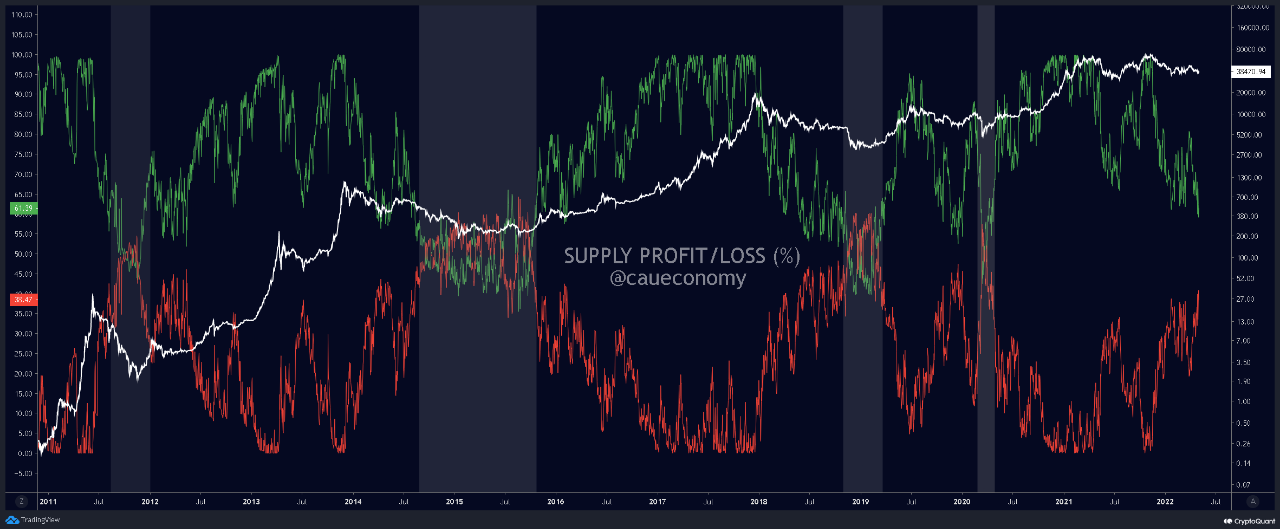

On-chain data shows Bitcoin hasn’t yet hit a bear market bottom as the supply in profit is still more than that in loss. Bitcoin Supply In Profit/Loss Says A Majority Of Network Is Still In Profit As explained by an analyst in a CryptoQuant post, past trend may suggest that the current BTC market still […]

On-chain data shows the Bitcoin supply in loss is still around 48%, which is lesser than the values observed during past bear market bottoms. About 52% Of The Total Bitcoin Supply Is In Profit At The Moment As pointed out by an analyst in a CryptoQuant post, BTC may see further decline before a bottom […]