JPMorgan Says a Lot of Clients See Cryptocurrency as Asset Class and Want to ...

JPMorgan says a lot of its asset and wealth management clients think cryptocurrency is an asset class and they want to invest in it. “Our job is to help them to put their money where they want to invest,” said the CEO of J.P. Morgan Asset & Wealth Management. A Lot of JPMorgan Clients Consider Cryptocurrency an Asset Class Mary Callahan Erdoes, J.P. Morgan Asset & Wealth Management’s CEO, talked about her firm’s approach to cryptocurrencies in an interview with Bloomberg Wealth, published Tuesday. JPMorgan Chase’s asset and wealth management line of business....

Related News

“The volatility you see in it today just has to play itself out,” JPMorgan’s director of asset and wealth management said. Despite Bitcoin (BTC) not yet emerging as an “asset class per se,” JPMorgan considers it important to meet the demand for cryptocurrency investment, according to a senior wealth management executive.A large number of JPMorgan clients see digital currencies like Bitcoin as an asset class, the company’s director of asset and wealth management, Mary Callahan Erdoes, said.In a Bloomberg interview released Tuesday, Erdoes stressed that the bank will continue providing....

Global investment bank JPMorgan has reportedly green-lighted its advisors to provide clients with access to five cryptocurrency funds. The funds are available to all JPMorgan’s wealth management clients seeking investment advice. The move makes JPMorgan the first large bank to expand crypto trading access beyond just ultra-wealthy clients. JPMorgan Now Offers Access to Crypto Funds JPMorgan has given its financial advisors the green light to give all its clients access to cryptocurrency funds, the Insider reported Thursday, citing people directly familiar with the matter. This move....

Advisers at the banking giant are reportedly only allowed to execute crypto trades at the direct request of a client rather than recommending the products themselves. Major U.S. investment bank JPMorgan Chase is reportedly allowing advisers to execute crypto trades for more of its clients.According to a Thursday report from Business Insider, retail wealth clients at JPMorgan now have access to cryptocurrency funds. A person directly familiar with the bank’s move to the digital space said all JPMorgan clients seeking investment advice — including those managed by financial advisers, retail....

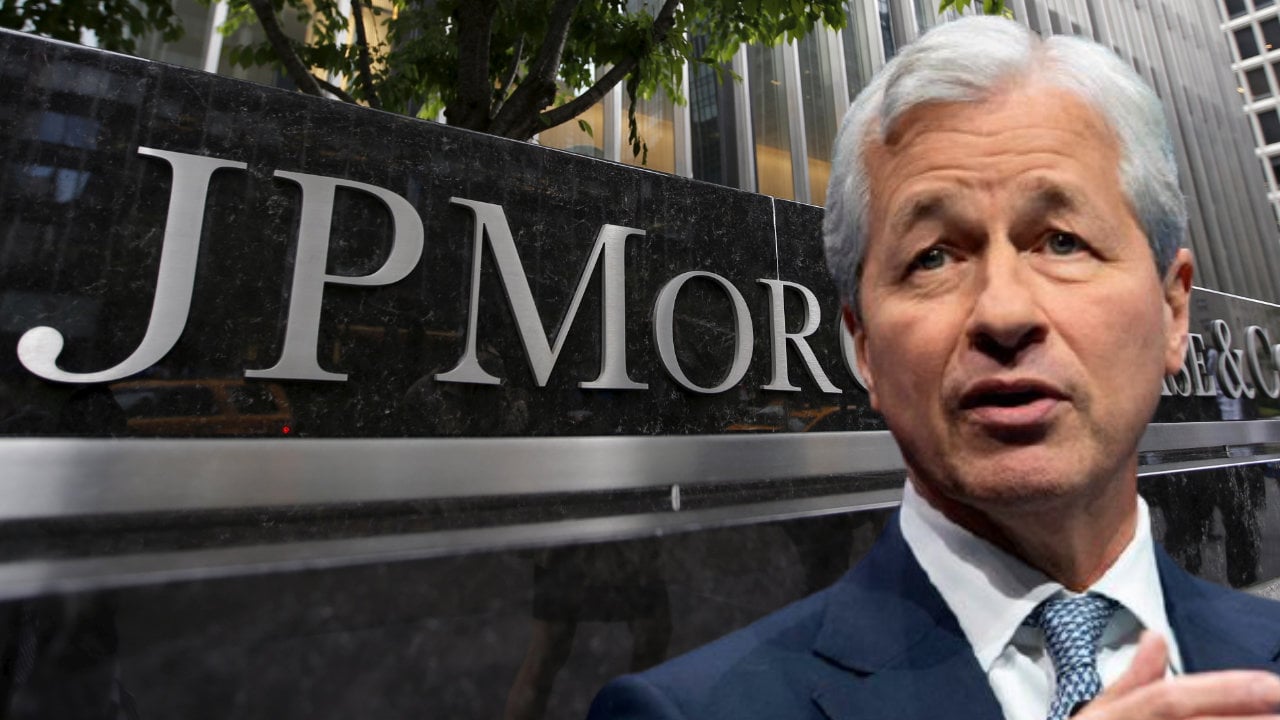

JPMorgan Chase CEO Jamie Dimon has given personal advice to investors regarding investing in cryptocurrencies, like bitcoin. He said that his own personal advice to people is to “stay away” from cryptocurrencies. However, his bank, JPMorgan, will not stay away as clients want exposure to this asset class. Jamie Dimon’s Personal Advice to Investors About Bitcoin, Other Cryptocurrencies Jamie Dimon, the CEO of JPMorgan Chase, the largest bank in the U.S., gave his congressional testimony before the House of Financial Services Committee regarding cryptocurrency on Thursday.....

Global investment bank JPMorgan is now offering six cryptocurrency investment funds to clients despite its CEO, Jamie Dimon, continually advising against investing in bitcoin and other cryptocurrencies. JPMorgan Chase has quietly begun giving its wealth management clients access to six cryptocurrency investment funds, CNBC reported Thursday, citing people with knowledge of the move. On Thursday, the bank’s financial advisors were allowed to begin placing private bank clients into a new bitcoin fund created by crypto firm New York Digital Investment Group (NYDIG), a subsidiary of....