Crypto Downtrend Led Investors To Liquidate Over $432 Million

The overall financial market is discouraging this week. Stocks and cryptos are plummeting as anticipation of the upcoming rate hike grows. The latest CPI for August was a force that pushed the market towards the edge. The figure was higher than expected, increasing fear in the industry. As the Feds prepares to hit the market with the biggest rate hike, exchanges have started liquidating leveraged positions. This strategy is geared at cutting down losses as events unfold. Related Reading: WATCH: Bitcoin Bloody Monday Leads To Reversal Hammer | BTCUSD September 19, 2022 Traders’....

Related News

‘We can liquidate it any day of the week, any hour of the day,’ said Michael Saylor. Michael Saylor has said that all $400 million of business intelligence firm MicroStrategy’s Bitcoin reserve holdings could be liquidated at any time.In a Sept. 22 interview, Saylor told Bloomberg that although “volatility isn’t really a reason to sell,” he would not hesitate to dump MicroStrategy’s 38,250 Bitcoin (BTC) at a moment’s notice if an alternative asset’s yields were to jump.Selling such a large amount of the crypto asset could easily cause a significant price drop, as happened in June when....

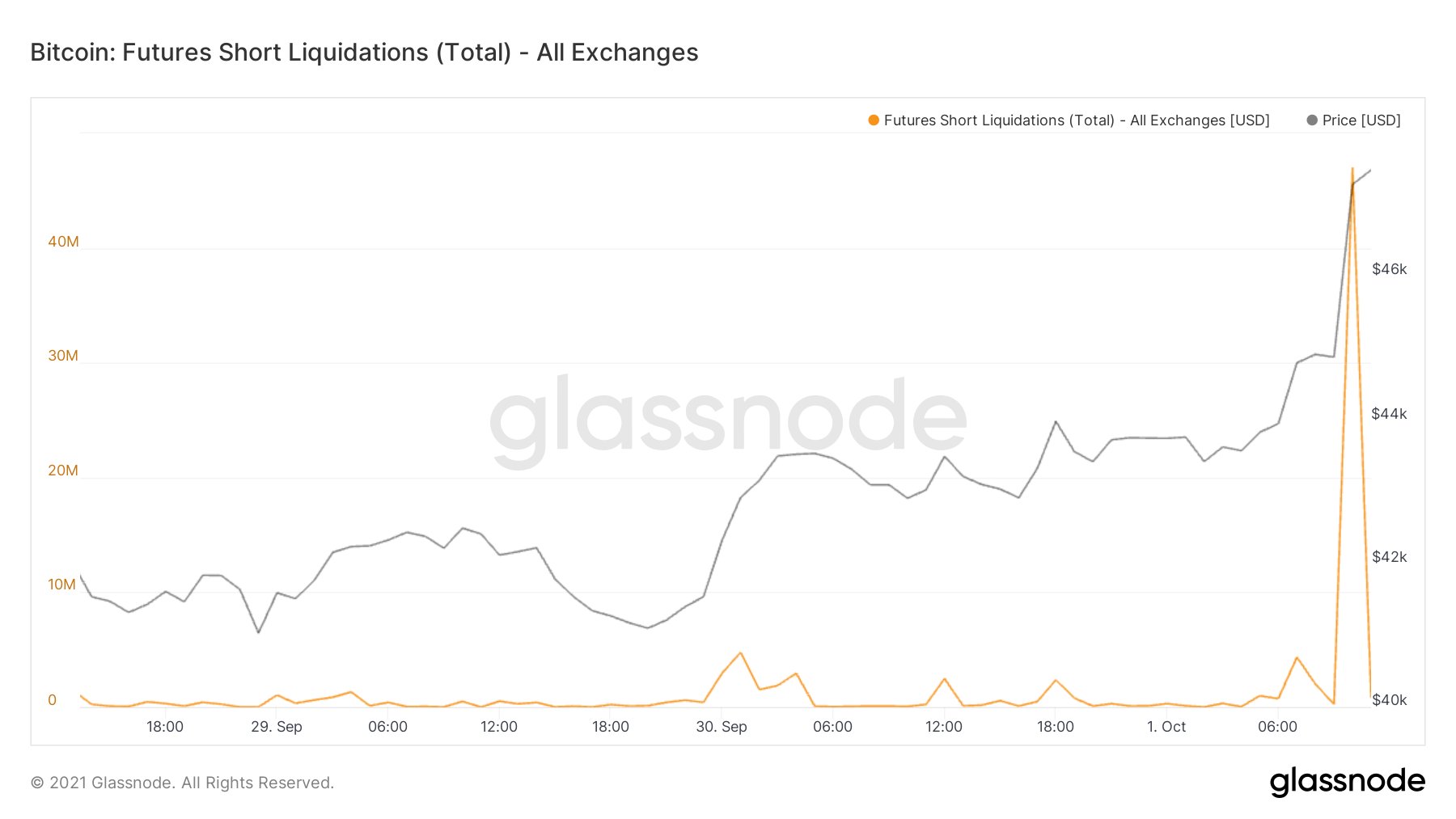

After today’s incredible Bitcoin move where the price climbed to $47.5k, shorts worth around $47 million liquidated within an hour. $47,000,000 In Bitcoin Futures Shorts Liquidate Within Just An Hour As pointed out by an analyst on Twitter, around $47 million in Bitcoin futures shorts have liquidated within an hour today. If you don’t know […]

A South African High Court recently granted a provisional liquidation order against Mirror Trading International (MTI) following an application for relief by two investors who failed to withdraw their bitcoin. According to a statement released by lawyers of one of the aggrieved investors, this provisional order paves the way for the appointment of a liquidator to take control of MTI’s assets and liabilities. Provisional Order The order by the Cape Town court came after the Financial Sector Conduct Authority (FSCA) reported receiving complaints from investors who failed to withdraw....

It is not surprising to see the demand for Bitcoin increase in Turkey over the past few weeks. Investors diversify their portfolios by investing in many different assets and foreign currencies. People holding the Turkish Lira will start to liquidate that asset soon, though. The Lira remains the world’s most volatile currency, lost a whopping 11% in value since January 1st. Things are not looking all that positive for the Turkish Lira, and this trend will only continue over the coming weeks. The year 2017 has been horrible for the Turkish Lira so far. Things went from bad to worse during....

As the effects of the recent bloodbath in the crypto market started vanishing, the fledgling Bitcoin, after a long time, reached near the $32,000 level yesterday. But again, it failed to hold above $30,000. Following nine red weekly candles, BTC retested $31,700 in the first green week on June 06 and then plummeted sharply in the next 24 hours at $29,000. Fortunately, BTC’s price is rising again and currently trading above $31,000. The fall of the fledging coin leads altcoins to face dumps, too, mainly affecting the prices of SOL, AVAX, and BNB. Related Reading | Institutional....