Bitcoin Shows Parallels With 2017 Cycle, Here’s What Can Happen Next

A quant has pointed out parallels between the current and the 2017 Bitcoin cycles, something that may contain hints about what’s next for the asset. The Current Bitcoin Cycle Has Shown Interesting Parallels With The 2017 Cycle As explained by an analyst in a CryptoQuant post, there have been five interesting recent events in the current cycle that are similar to what was seen in the 2017 cycle. The 2017 cycle hit its top in December of that year, while the current cycle hit its top back in November of 2021. The entirety of these cycles isn’t relevant in the context of the....

Related News

Popular analyst Justin Bennett has explained why the Bitcoin four-year cycle might be over for the foreseeable future. He indicated that the crypto’s projected price surge in this market cycle might not happen as planned and that Bitcoin could suffer a severe price crash soon enough. Why The Bitcoin Four-Year Cycle Might Be Over In […]

The Bitcoin bull cycles have always been similar in the fact that each one has always ended with the Bitcoin price multiples higher than the previous high. While the digital asset has hit new all-time highs this cycle, it is far from being multiples of the previous all-time high, and has yet to hit the 2x mark. However, with a lot of similarities popping up between this cycle and what was seen in 2017, there is still the possibility that the Bitcoin price will run higher from here. Bitcoin Price Mirroring 2021 Cycle Moves Crypto analyst Merlijn The Trader took to X (formerly Twitter) to....

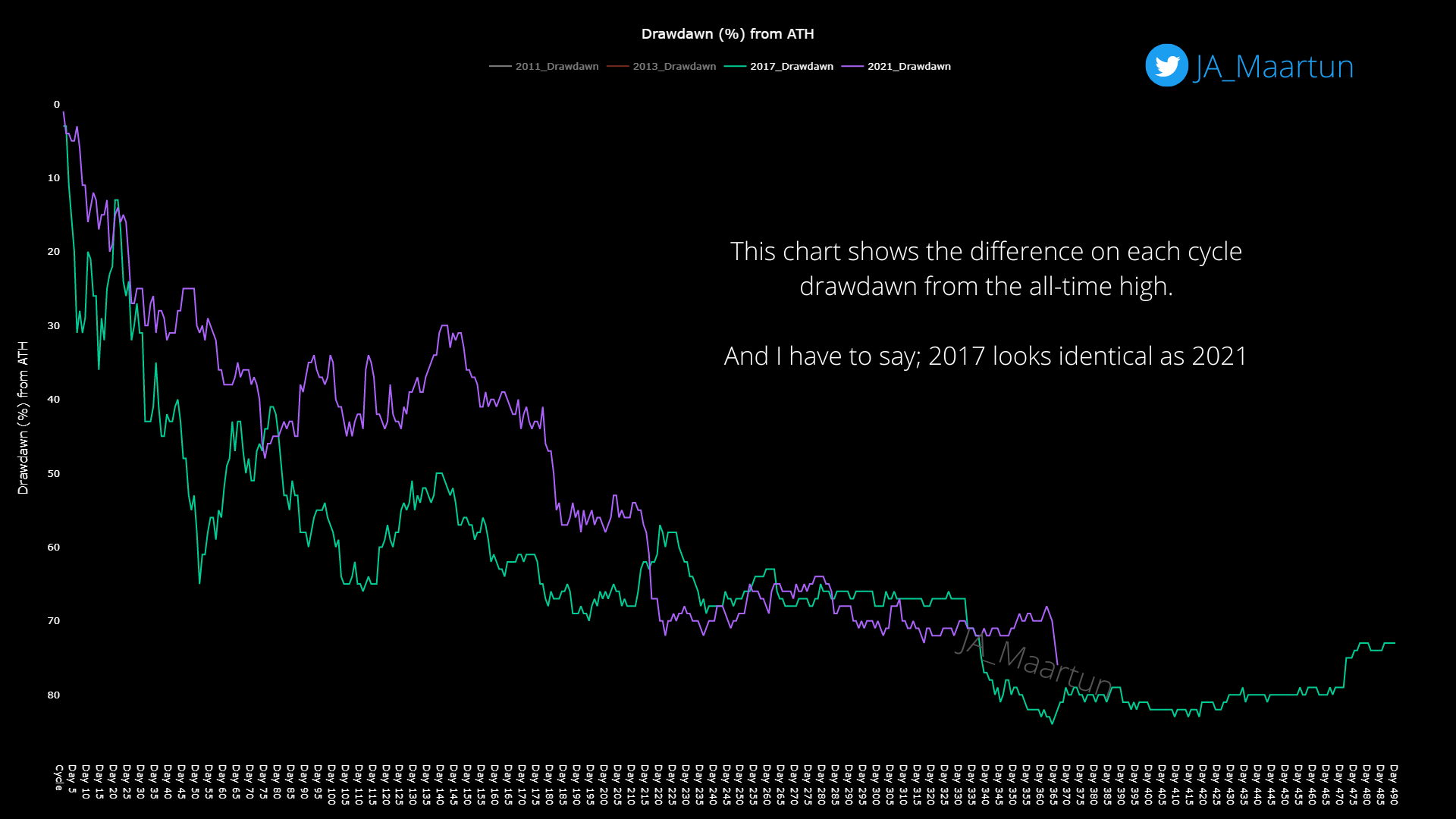

A quant has pointed out the similarities between the 2017 and 2021 Bitcoin cycles, something that could hint at how the rest of this bear market might play out. Both 2017 And 2021 Bitcoin Cycles Saw New Lows Around The 365-Day Mark Since The Top As explained by an analyst in a CryptoQuant post, the two cycles are more similar than one might expect them to be. The indicator of relevance here is the “drawdown from ATH,” which measures the percentage decrease in the price of Bitcoin following the all-time high during each cycle. Here is a chart that shows the trend in this metric....

According to a CryptoQuant analyst, the Bitcoin price top isn’t in yet if the pattern of past bull cycles holds any weight. Bitcoin Might Reach A New ATH In This Cycle As per a CryptoQuant post, it’s possible that Bitcoin hasn’t yet reached the cycle top, and that a new all time high (ATH) might be achieved soon. There are two ways to define a cycle. The first is to make the initial point the BTC halving. Here is a chart that shows how the price of the coin moved in the 2012, 2016, and 2020 bull cycles based on this criterion: Price vs the number of days after halving in....

Crypto pundit Master Kenobi has remarked that the Dogecoin price is giving 2017 vibes. This presents a bullish outlook for DOGE, given the foremost meme coin’s price action in the 2017 bull cycle. Dogecoin Price Replicating 2017 Bull Run In an X post, Master Kenobi stated that the Dogecoin price is giving 2017 vibes, indicating […]