Quant Explains Why The Bitcoin Cycle Top Isn’t In Yet

According to a CryptoQuant analyst, the Bitcoin price top isn’t in yet if the pattern of past bull cycles holds any weight. Bitcoin Might Reach A New ATH In This Cycle As per a CryptoQuant post, it’s possible that Bitcoin hasn’t yet reached the cycle top, and that a new all time high (ATH) might be achieved soon. There are two ways to define a cycle. The first is to make the initial point the BTC halving. Here is a chart that shows how the price of the coin moved in the 2012, 2016, and 2020 bull cycles based on this criterion: Price vs the number of days after halving in....

Related News

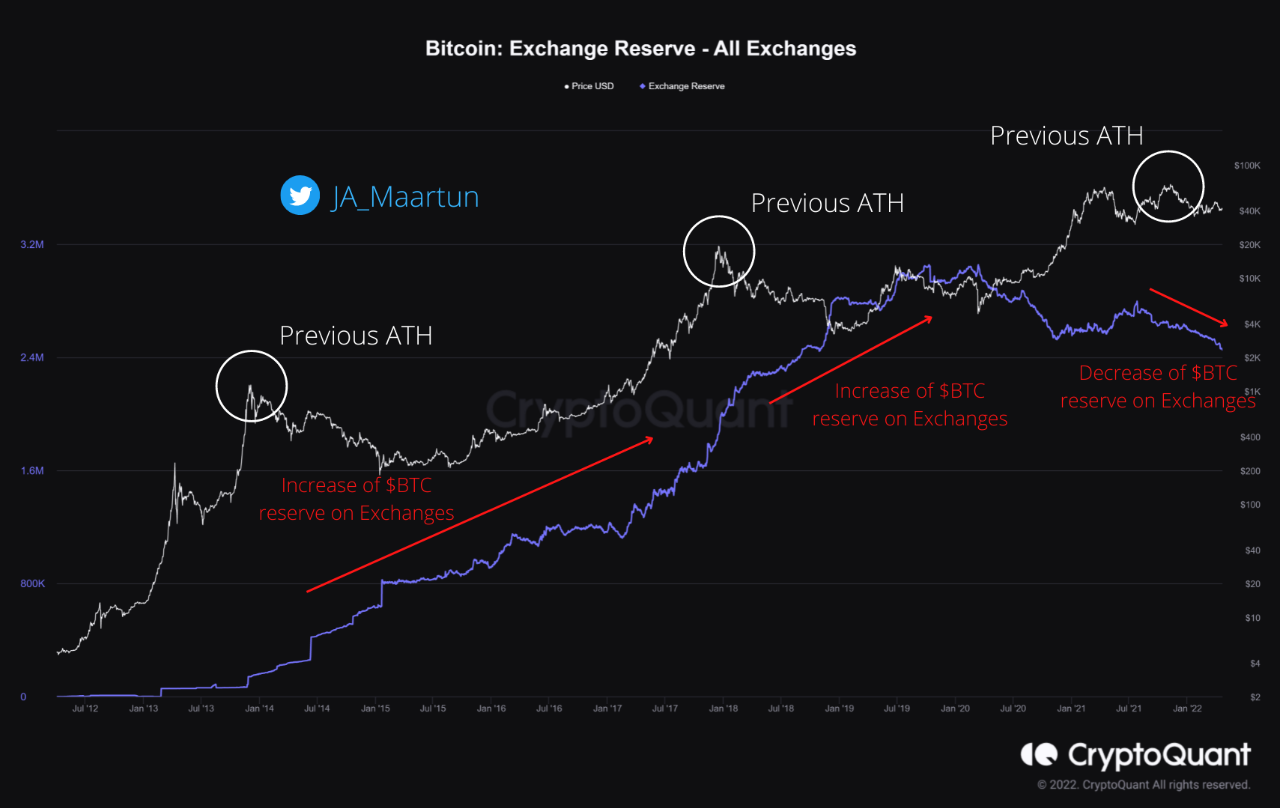

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

Top Quant uses the puell multiple to point out a pattern that explains why the current Bitcoin bull cycle is only in the first phase. The Bull Market Is Not Over, Phase 1 Has Just Begun According to a CryptoQuant analyst, past cycles show that the current Bitcoin bull market isn’t over yet. The puell multiple seems to reveal where the price might head next. The puell multiple is a BTC indicator used to tell how healthy miners’ revenue is. It’s calculated by dividing the mining revenue by the 365-day moving average (MA) of the same. Puell Multiple= Mining Revenue USD ÷ 365....

A quant has pointed out parallels between the current and the 2017 Bitcoin cycles, something that may contain hints about what’s next for the asset. The Current Bitcoin Cycle Has Shown Interesting Parallels With The 2017 Cycle As explained by an analyst in a CryptoQuant post, there have been five interesting recent events in the current cycle that are similar to what was seen in the 2017 cycle. The 2017 cycle hit its top in December of that year, while the current cycle hit its top back in November of 2021. The entirety of these cycles isn’t relevant in the context of the....

A quant has explained how the Bitcoin exchange reserve on-chain indicator differs between the current crash and that of May’s. After Spiking Ahead Of The Crash, Bitcoin Exchange Reserves Have Resumed Downtrend As explained by an analyst in a CryptoQuant post, the current trend in BTC exchange reserves is quite different from when the crypto […]

Quant rose to its highest point since the start of the year on Saturday, as prices climbed for a third straight session. In addition to this, tron was also higher, as the token attempted to break out of a key resistance point. Overall, cryptocurrency markets were down 1.95% as of writing. Quant (QNT) Quant (QNT) was one of the notable movers to start the weekend, as the token surged to a ten-month high. Following a low of $162.00 on Friday, QNT/USD surged to an intraday peak of $184.98 earlier in today’s session. This move saw the token climb to its highest point since January 8,....