Bitcoin Miner Health Index Hits 59%: A Bullish Signal For The Market?

Bitcoin is currently consolidating below the $125,000 level after a sharp correction that pushed the price down to $120,000, a key psychological and technical area of support. Despite the recent volatility, bulls are showing resilience, holding price levels that suggest the broader uptrend remains intact. However, uncertainty persists as some analysts warn that a deeper […]

Related News

Bitcoin continues to struggle below the $90,000 level as volatility remains elevated and market conviction weakens. Short-term price swings have failed to establish a clear directional bias, reinforcing a broader sense of uncertainty among traders and investors. While price remains historically high, internal market conditions suggest that underlying stress is building beneath the surface, particularly within the mining sector. Related Reading: Bitcoin Faces Elevated Downside Risk: Loss Selling Takes Hold As STH SOPR Falls Below 1 A recent analysis by Axel Adler highlights growing pressure....

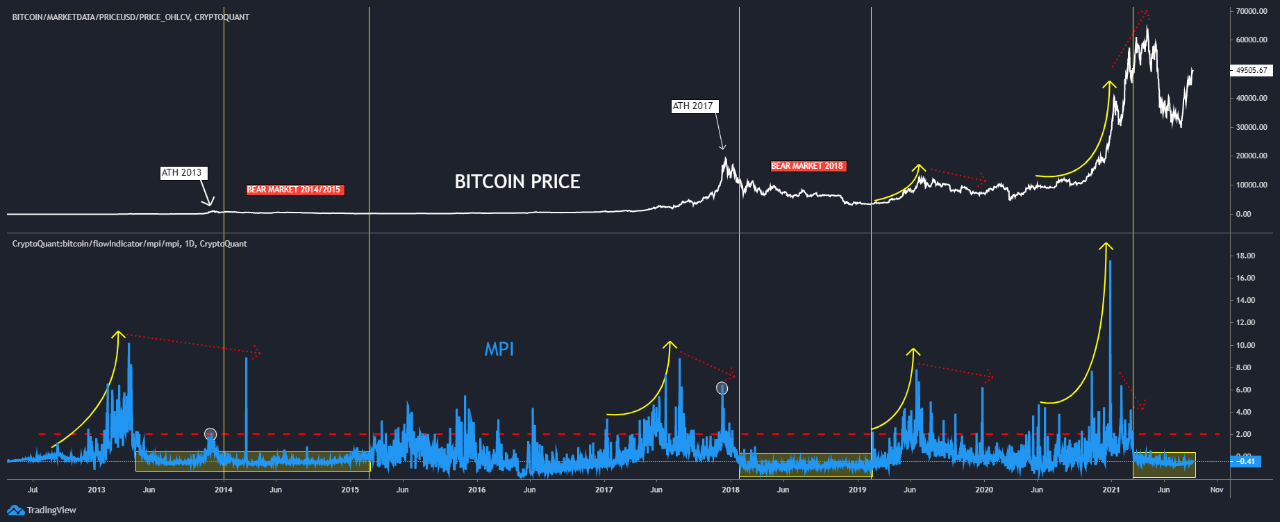

The Bitcoin Miners’ Position Index achieved a three-year high, indicating that miners are likely in a selling mood. Bitcoin (BTC) miners appear to be selling large amounts of BTC once again. Data from CryptoQuant shows that the BTC Miners’ Position Index — a metric tracking the ratio of BTC leaving miners’ wallets — achieved a three-year high. This trend indicates that miners are likely selling BTC on over-the-counter or spot exchanges.Bitcoin Miners' Position Index. Source: CryptoQuantOn Dec. 10, two large miner-linked Bitcoin transactions were spotted right as the Miner’s Position Index....

A look at the history of the Miner’s Position Index (MPI) would suggest Bitcoin miners usually sell before the bull run cycle top. The Bitcoin Miner’s Position Index Vs The Price For Various Cycles As pointed out by a crypto analyst on CryptoQuant, the BTC Miner’s Position Index may suggest that miners aren’t good at […]

An important fundamental health signal of the Bitcoin network just crossed into “capitulation” territory, which in the past was associated with downside risk. However, the tool’s creator says that it wasn’t designed to give sell signals, and shouldn’t be interpreted that way. But because of how profitable its been used as a buy signal over […]

Bitcoin price closed the month of October with a higher high on the candle closing, a feat that has throughout history always led to a renewed bull run and additional all-time highs. Coinciding with the November monthly open, here are ten bullish Bitcoin price charts that suggest bullish continuation is ahead – but also warns that the eventual end to the market cycle is near as well. Ten Bullish Monthly Bitcoin Price Charts The leading cryptocurrency by market cap has made a higher high on the highest timeframes – a clear signal that the trend has yet to conclude. By pure definition, an....