Survey: Financial Sector Wants Ukraine’s CBDC to Facilitate Transactions in t...

A survey conducted among financial professionals has indicated that the industry wants Ukraine’s future digital currency to be used as a tool in the crypto space. The financial sector also favors a blockchain design for the e-hryvnia that would allow peer-to-peer transfers and fuel e-commerce. Financial Experts Define Potential Uses of Ukraine’s Digital Currency The National Bank of Ukraine (NBU) has published the results of a survey aimed to establish the potential demand for a central bank digital currency (CBDC). The regulator sent out a set of 30 questions to 100 financial....

Related News

The Zimbabwean central bank has said it is “conducting a CBDC [central bank digital currency] Consumer Survey to solicit opinions on the design and nature of the CBDC and its overall acceptance by the public.” The bank said the information obtained via this process will be “treated with the utmost confidentiality and the results will only be used for purposes of research on the design.” Assessing the ‘Acceptability of a CBDC in Zimbabwe’ The Reserve Bank of Zimbabwe (RBZ) has said residents can now share their views and thoughts concerning “the....

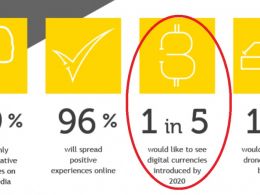

Bitcoin is expected to play a major role in the retail sector by the end of this decade, shows a survey conducted by Infomentum. The results of the survey was published in the report - Beyond Digital. The retail industry is one of the largest sectors in the world. The process of buying and selling goods has been around since the concept of money was introduced to mankind. Until now, the retail sector has not seen much change in the way trade is conducted. But in the coming years it may start bearing a new look resembling scenes from old science fiction movies. Bitcoin will also be included....

A new survey has found that Toronto ranks fourth in the world as a leading FinTech center with the sector disrupting at such a pace that it is often difficult to make sense of the developments in the industry. The survey, Trends and Innovations in Financial Services, [PDF] which was conducted last year received responses from over 300 financial services professionals during July and August around the world. Commissioned by the Toronto Financial Services Alliance (TFSA) and a leading U.K. think tank, Z/Yen, two online questionnaires were conducted in addition to desk research and informal....

A new survey finds that crypto adoption and DeFi usage among Americans is deceptively low despite the echo chamber of the industry-leading people to believe otherwise. A new survey by polling agency Morning Consult found that fewer than one third of ordinary Americans have heard of DeFi compared with 77% of crypto owners.Considering that about 87% or 290.9 million Americans did not yet own crypto through 2021 according to Statista, awareness of decentralized finance (DeFi) among non-owners is limited to about 90 million Americans and still has a long way to go.Morning Consult’s survey also....

The Retail CBDC will be tested in a limited retail environment with 10,000 participants and three major banks. On top of its wholesale central bank digital currency (CBDC) projects and proof-of-concept Retail CBDC testing with corporates, the Bank of Thailand (BOT) will extend the scope of CBDC development aimed at retail to a pilot phase. A possible real-life application of the "Retail CBDC" will be conducted inside the private sector on a limited scale. As the Aug. 5 announcement on the official page of the BOT goes:“The BOT will assess the benefits and associated risks from the Pilot to....