This Miner-Related Index Shows That the Next Bitcoin Bull Run is Coming

Bitcoin’s price action as of late has done little to offer investors with insights into its near-term outlook. Its price has mainly been oscillating between highs of $11,000 and lows of $10,000, with each attempt to break out of this tight trading range resulting in the cryptocurrency seeing massive inflows of selling pressure that force […]

Related News

On-chain analysis shows Bitcoin miner reserves seem to be closing in on the ATH seen in May, as the BTC bull rally continues. Bitcoin Miner Reserves Reach Close To May ATH Levels As pointed out by a CryptoQuant post, the BTC miner reserves seem to be on the rise, and look to be close to the levels seen during the 9 May all-time-high (ATH). The BTC miner reserves is an indicator that shows how many coins miners are holding in their wallets. More the value of this metric, less the selling pressure for miners in the market. Related Reading | S2F Creator Beckons Beginning Of Second Leg Of....

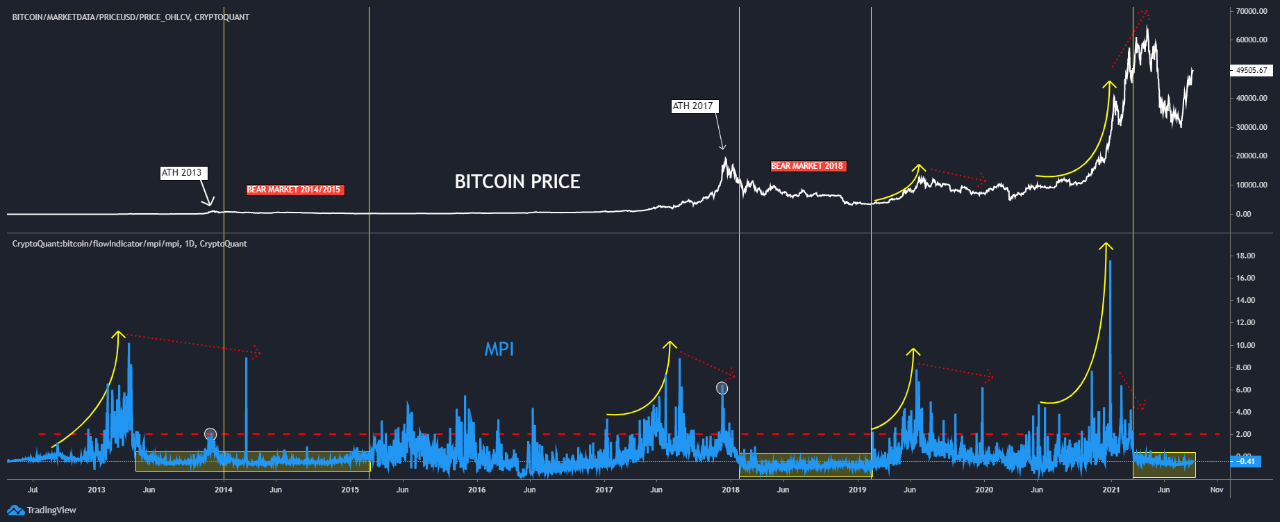

A look at the history of the Miner’s Position Index (MPI) would suggest Bitcoin miners usually sell before the bull run cycle top. The Bitcoin Miner’s Position Index Vs The Price For Various Cycles As pointed out by a crypto analyst on CryptoQuant, the BTC Miner’s Position Index may suggest that miners aren’t good at […]

Data shows Bitcoin miner revenues have been coming under stress recently as they are now making 61% less than the average during the last year. Bitcoin Miner Revenues Come Under Pressure As Puell Multiple Sharply Drops As per the latest weekly report from Glassnode, the miner income contraction right now is greater than during the […]

CryptoQuant’s Bitcoin Bull Score Index has jumped from 20 to 50 in just four days, suggesting a swift shift out of bearish territory for the asset. Bitcoin Bull Score Index Is Back In Neutral Region In a new post on X, CryptoQuant head of research Julio Moreno has talked about the latest trend in the analytics firm’s Bull Score Index. This indicator basically tells us about which phase of the market Bitcoin is in right now. The index combines the data of several key on-chain metrics to determine its value. Some of these indicators include the Market Value to Realized Cap (MVRV)....

CryptoQuant’s Bitcoin Bull Score Index has dropped to a value of 20, hinting that a potential bearish transition could have occurred for the asset. Bitcoin Bull Score Index Is Now In “Extra Bearish” Territory In a new post on X, CryptoQuant community analyst Maartunn has shared how the analytics firm’s “Bull Score Index” has changed for Bitcoin after its recent price drawdown. The Bull Score Index is an indicator that tells us about the market phase the cryptocurrency is currently going through. It determines this by referring to a bunch of key on-chain....