Will Bitcoin Fall to $13,800? — What an 80% Drawdown Will Look Like From Here

On Monday, June 15, 2022, the price of bitcoin tapped a low not seen since mid-December 2020 as the price hit $20,080 per unit. A large number of crypto supporters are debating whether or not the drop is the market’s bottom or if the fall could lead to deeper losses. At the time of writing, bitcoin is 70% down from the $69K all-time high (ATH) but traditionally, bitcoin is known to drop around 80% or more from ATHs recorded in the past. Will Bitcoin Slide More Than 80% Down This Time Around? The crypto economy has had a rough couple of weeks as the leading crypto asset bitcoin (BTC)....

Related News

The drawdown in bonds is not much less than bitcoin’s drawdown from its all-time high. Legacy finance is demonstrating to be just as volatile as bitcoin.

On-chain and technical analysis indicators suggest BTC price may have bottomed, but several traders are still wary that BTC price could fall as low as $10,000 in the short-term. The crypto market is currently going through a period of heightened volatility as global economic conditions continue to worsen amid a backdrop of rising inflation and interest rates. As the headwinds impacting global financial markets beat down all traces of bullish sentiment, many crypto investors are predicting that Bitcoin (BTC) price could drop to as low as $10,000 before a market bottom is found. BTC/USDT....

Past trend of the Ethereum value captured per byte metric suggests that a 50% drawdown from here is still possible for ETH. Ethereum Value Captured Per Byte Currently Stands At $0.30, Double The Previous Bear Bottoms As per the latest data released by Glassnode, ETH may still possibly have potential for a further 50% plummet […]

Bitcoin has undergone a strong rejection over the past two days. The coin dropped from the $11,200 highs it was trading at just days ago to a recent low around $10,200 on Coinbase. BTC now trades for $10,450, having slightly bounced in tandem with other legacy markets. Bitcoin’s Monday drawdown came as the S&P 500 fell over 2.5% during the session lows and as the U.S. dollar jumped. Despite uncertainity about BTC’s price action in […]

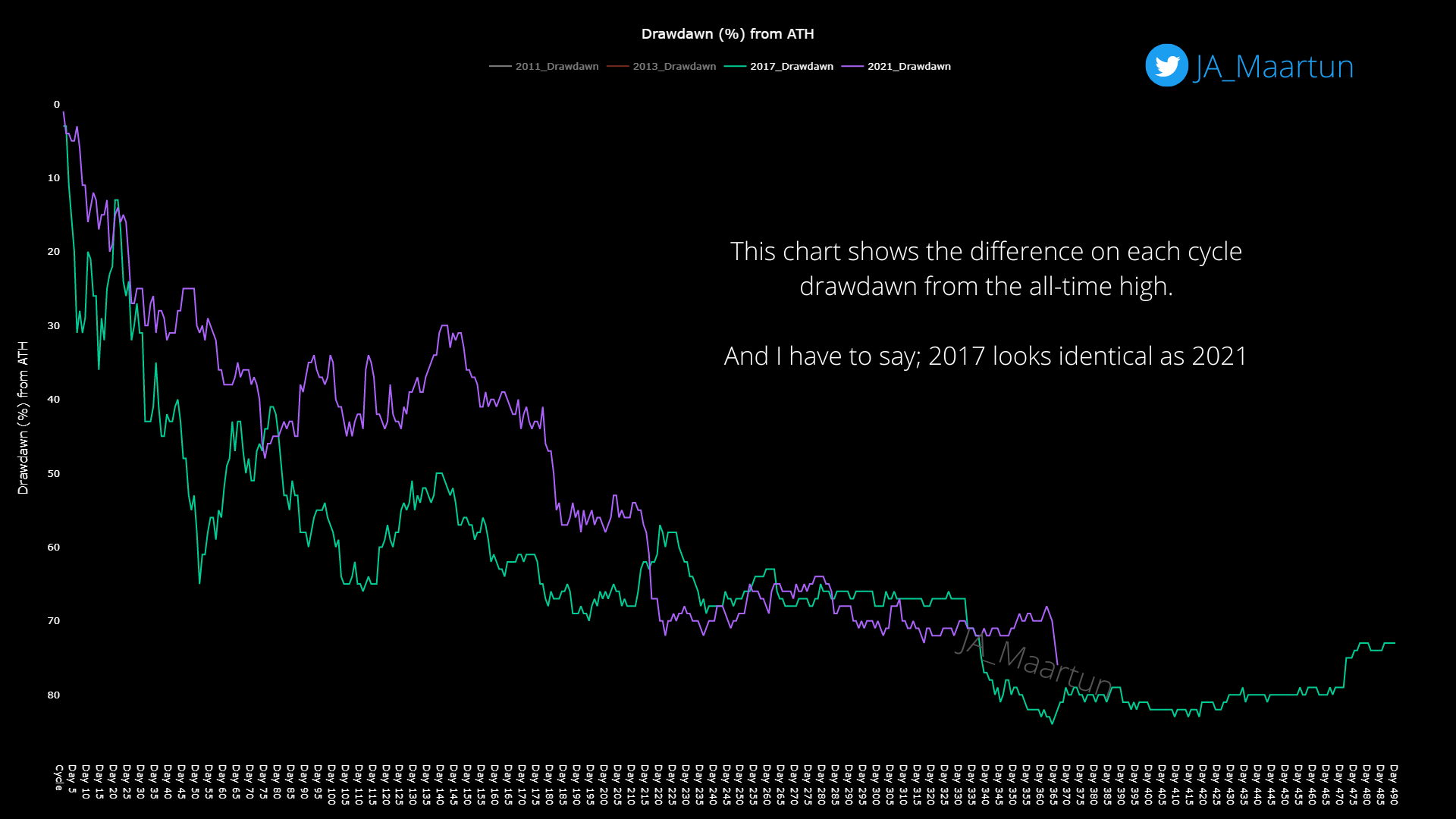

A quant has pointed out the similarities between the 2017 and 2021 Bitcoin cycles, something that could hint at how the rest of this bear market might play out. Both 2017 And 2021 Bitcoin Cycles Saw New Lows Around The 365-Day Mark Since The Top As explained by an analyst in a CryptoQuant post, the two cycles are more similar than one might expect them to be. The indicator of relevance here is the “drawdown from ATH,” which measures the percentage decrease in the price of Bitcoin following the all-time high during each cycle. Here is a chart that shows the trend in this metric....