Uniswap (UNI) price jumps by 15% in DeFi, cryptocurrency market rebound

The jump in UNI/USD rates has quickly met with sellers at local top levels. Uniswap (UNI) was among the best performers among the top-cap cryptocurrency tokens in the previous 24 hours, logging better gains than some top cryptocurrencies, namely Bitcoin (BTC), Ether (ETH), and Binance Coin (BNB).On Sept. 15, the UNI/USD exchange rate jumped 13.26% to hit its seven-day high $25.68. Traders continued to bid higher on the pair entering Wednesday, pushing its value higher to $26.07 at one point in time, up more than 15% from the previous session's open of $22.66.Market-wide recovery behind UNI....

Related News

While a number of popular crypto-assets like bitcoin have been consolidating, decentralized finance (defi) tokens have captured significant gains during the last 24 hours. A few defi crypto assets have seen double-digit gains and the leader of the pack is Uniswap which has jumped 20.9% in the last 24 hours.

Uniswap’s Defi Token Leads the Percentage Gains on Sunday

Decentralized finance (defi) tokens are making waves during Sunday’s crypto trading sessions, as a dozen defi tokens have seen better gains than most of today’s well known digital assets.

....

The Uniswap price appears to be recovering nicely after a disappointing performance at the beginning of the year. The DeFi token rallied past the $10 mark in the final hours of Friday, February 14, reflecting the improving climate of the general crypto market. Uniswap Price Jumps 10% In The Past Week The UNI token was one of the beneficiaries of the bullish momentum that shook the market on Friday evening. As of this writing, the price of Uniswap stands at around $10.18, reflecting an over 3% increase in the past 24 hours. Related Reading: Bitcoin At Risk? Analyst Says Breaking This Price....

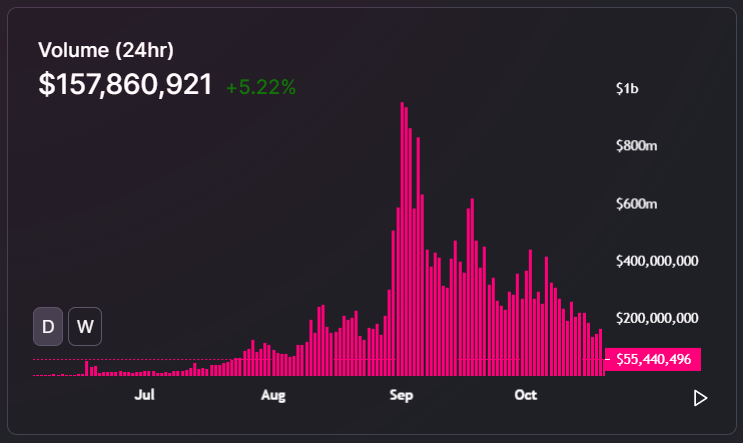

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

UniSwap’s governance token UNI was among the biggest gainers on Friday as the rest of the cryptocurrency market succumbed to a bearish fundamental. The crypto index lost about $7 billion as trades panic-sold a portion of their holdings under the influence of OKEx. This Malta-based exchange landed itself in the middle of a criminal investigation. […]

Numbers don’t lie: Uniswap v3 gains traction with DeFi users despite May’s crypto market crash. Decentralized exchange Uniswap successfully launched version 3 of its platform in May — resulting in high trade volumes despite a downturn across the cryptocurrency markets.The latest version of the hugely popular decentralized finance (DeFi) automated market maker (AMM) has quickly attracted a sizable amount of trade volume, seeing it move into the top five decentralized exchanges alongside Sushiswap, PancakeSwap v2 and its predecessor, Uniswap v2.The success of v3 cannot be understated, as the....