DeFi bucks crypto market correction as Uniswap v3 leads the charge

Numbers don’t lie: Uniswap v3 gains traction with DeFi users despite May’s crypto market crash. Decentralized exchange Uniswap successfully launched version 3 of its platform in May — resulting in high trade volumes despite a downturn across the cryptocurrency markets.The latest version of the hugely popular decentralized finance (DeFi) automated market maker (AMM) has quickly attracted a sizable amount of trade volume, seeing it move into the top five decentralized exchanges alongside Sushiswap, PancakeSwap v2 and its predecessor, Uniswap v2.The success of v3 cannot be understated, as the....

Related News

While a number of popular crypto-assets like bitcoin have been consolidating, decentralized finance (defi) tokens have captured significant gains during the last 24 hours. A few defi crypto assets have seen double-digit gains and the leader of the pack is Uniswap which has jumped 20.9% in the last 24 hours.

Uniswap’s Defi Token Leads the Percentage Gains on Sunday

Decentralized finance (defi) tokens are making waves during Sunday’s crypto trading sessions, as a dozen defi tokens have seen better gains than most of today’s well known digital assets.

....

Leading DeFi token Uniswap has seen massive losses recently following in the footsteps of CRV and SUSHI. In the previous weeks, the majority of the cryptocurrencies have seen a massive crash. Losses of 50-80% have been witnessed in the markets, particularly affecting the DeFi space.The major losers in the previous weeks were Curve DAO Token (CRV) and SushiSwap (SUSHI). Next to that, one of the biggest decentralized exchanges UniSwap (UNI) has also seen a substantial correction. Its token UNI dropped by 57% since its recent high at $8.65.Is the correction over for the DeFi sector, or will....

Ethereum’s correction triggered a DeFi-token collapse which resulted in YFI and UNI dropping by 46%. After outperforming Bitcoin (BTC) and Ether (ETH) strongly in August, Decentralized Finance (DeFi) tokens are now plummeting as many registered losses of up to 50%. Cryptocurrency daily market performance snapshot. Source: Coin360At the moment, the two coins garnering the most attention are Yearn.finance (YFI) and Uniswap (UNI) as both have dropped by 46% and 48% since reaching a monthly peak.YFI/USDT 4-hour chart. Source: TradingView.comThree catalysts appear to be behind the correction:....

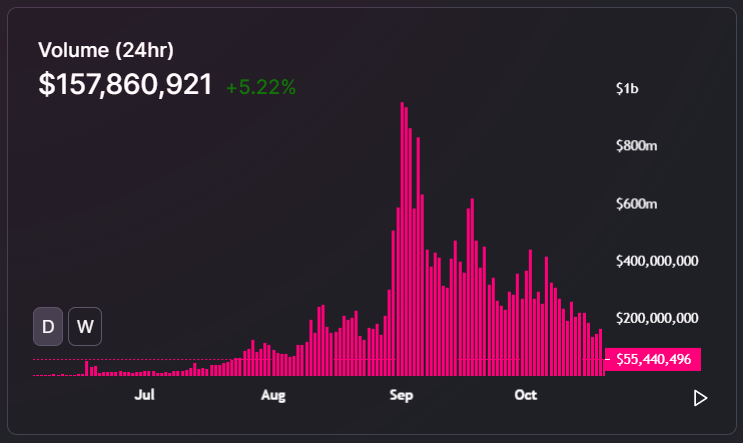

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

The popularity of Uniswap v2 in 2020 was unprecedented for a DeFi protocol. The decentralized exchange seemed to be the epicenter of the new financial revolution. First matching and then outperforming major trading platforms in terms of volume, Uniswap has been forked countless times to try and mimic its success. The launch of its third […]