Will the launch of Uniswap v3 spark a new DeFi boom?

With Uniswap’s TVL growing from $13.7 million to $8.5 billion since launching its v2 iteration, some onlookers believe the DEX’s v3 launch could spark the next DeFi rally. With the total value locked in decentralized finance on Ethereum now $89 billion, the market is eagerly waiting to see if the launch of UniSwap v3 could be the catalyst for DeFi’s next big bull run. Uniswap v3 promises advanced new features and opportunities for yield generation with its launch scheduled for May 5.Uniswap is emphasizing three new features for liquidity providers — customizable capital deployment across a....

Related News

The popularity of Uniswap v2 in 2020 was unprecedented for a DeFi protocol. The decentralized exchange seemed to be the epicenter of the new financial revolution. First matching and then outperforming major trading platforms in terms of volume, Uniswap has been forked countless times to try and mimic its success. The launch of its third […]

UNI, the native governance token of Uniswap, surged immediately after the Uniswap V3 launch. UNI, the governance token of Uniswap, the most widely utilized automated market maker (AMM) in DeFi, has surged significantly after the launch of Uniswap V3 on March 23. At just over $35 per token, UNI has gained nearly 23% in the past weekThe Uniswap team said:"Today, we are excited to present an overview of Uniswap v3. We are targeting an L1 Ethereum mainnet launch on May 5, with an L2 deployment on Optimism set to follow shortly after."With a market capitalization of $17 billion, it has....

Over the summer months, Ethereum transaction fees ran hot, causing the DeFi trend and Uniswap token swapping boom to finally run out of steam. But as transaction fees begin to pick up again after a period of inactivity and downtrend, could it be a signal that another phase of DeFi dominance is about to start? […]

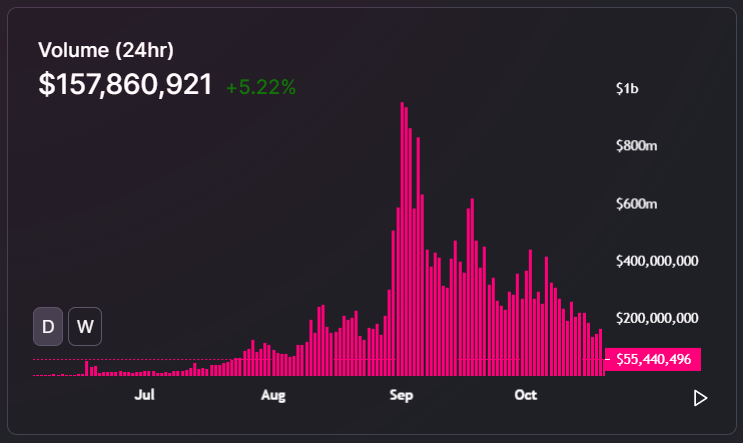

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

Despite the launch of Uniswap v3 decentralized exchange with its capital efficiency increase, Uniswap v2 is not out of the race yet. As one of the most eagerly anticipated rollouts of the decentralized finance (DeFi) sector, Uniswap v3 went live on May 5. The upgrade targeted greater capital efficiency and better flexibility for liquidity providers. The concept of Uniswap v3 includes features such as concentrated liquidity — which allows liquidity providers (LPs) to allocate their capital in certain price ranges rather than distribute liquidity across the entire price curve — as well as....