Bitcoin price dives back under $16,900 as whale deposits spike again

Bitcoin loses $17,000 as whales started to deposit BTC to exchanges once again. The price of Bitcoin (BTC) dropped below $16,900 again on Nov. 27 across top exchanges, including Binance. The recent pullback comes as whale exchange deposits started to increase.Ki Young Ju, the CEO of CryptoQuant, reported that the All Exchange Inflows Mean indicator reached the “danger zone.” Historically, this caused BTC to suffer short-term corrections.Bitcoin struggles to regain momentum above $17,000After the price of Bitcoin briefly dropped to $16,200 on Nov. 27, it started to show some signs of....

Related News

A swift recovery from Bitcoin and altcoins are signals that BTC may have bottomed at $17,650. Bitcoin's (BTC) sharp correction to $17,650 came as no surprise to investors and many expected the digital asset to fall as low as $16,000. Thus, the quick recovery back to $18,600 is intriguing and it bolsters the popular belief that retail and institutional investors are keen to purchase every BTC dip. Although the possibility of another drop remains, three factors point toward a Bitcoin bottom at $17,650. The factors are, whale deposits hitting a peak, BTC posting a quick recovery, and trading....

Bitcoin has bounced back from its latest low as on-chain data shows the Whale Transaction Count has witnessed a spike on the network. Bitcoin Whale Transaction Count Has Just Seen A Large Spike As pointed out by analyst Ali Martinez in a new post on X, whales notably upped their activity during the recent price surge. The indicator of relevance here is the “Whale Transaction Count” from the on-chain analytics firm Santiment, which measures the total number of transfers occurring on the Bitcoin blockchain that are carrying a value of more than $1 million. Only the whale entities....

Bitcoin has undergone some shaky price action after a push to $19,000 this past week. Ki Young Ju, CEO of Crypto Quant, recently said that the coin could face a correction in the days and weeks ahead. The percentage of whale deposits relative to retail deposits into Coinbase addresses has increased, he noted. Bitcoin Could See Price Drop As Whale Deposit Ratio Spikes Bitcoin has undergone some shaky price action after a push to $19,000 […]

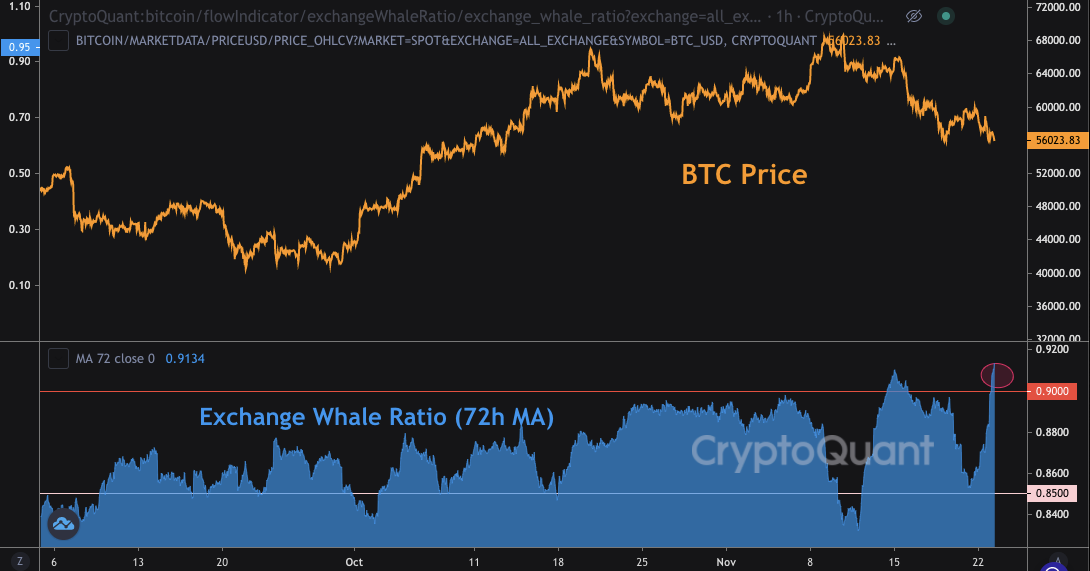

The Bitcoin all exchanges whale ratio has soared, which might be an indicator that a crash could be coming soon, based on past patterns. The All Exchanges Whale Ratio Soars As pointed out by a CryptoQuant post, the Bitcoin All Exchanges Whale Ratio had a sharp spike on Sunday. The BTC All Exchanges Whale Ratio […]

Data shows Bitcoin whales now account for 91% of the deposits going to exchanges, a trend that could be a bearish signal. Bitcoin Exchange Whale Ratio Surges To 91% As pointed out by a CryptoQuant post, the BTC all exchanges whale ratio has now risen to 91%, a historically bad sign for the crypto. The […]