Crypto Institutions Gobble Up Billions In Bitcoin ETFs, Stockpiling 250,000 B...

The tides are turning in the cryptocurrency world, with institutional investors making a big splash in Bitcoin exchange-traded funds (ETFs) while retail investors seem content to bob on the sidelines. A recent report by IntotheBlock paints a picture of a two-tiered market, where hedge funds and even pensions are accumulating Bitcoin through ETFs, but the […]

Related News

Data shows Bitcoin spot exchange-traded funds (ETFs) have seen netflows flip red, implying a slowdown in demand among institutions. Bitcoin Spot ETFs Have Switched To Net Outflows Recently In a new post on X, on-chain analytics firm Glassnode has discussed about the latest trend in the netflow of the US Bitcoin spot ETFs. The spot […]

Crypto pundit X Finance Bull has highlighted how institutions are accumulating XRP amid the crypto market crash. His comment comes amid the XRP price drop below the psychological $1.6 level, which has further sparked bearish sentiments among retail investors. Institutions Are Still Accumulating Amid XRP Price Crash In an X post, X Finance Bull noted that while retail investors are panicking over the XRP price crash, institutional investors continue to accumulate the Ripple-linked token. The crypto pundit pointed to inflows into XRP ETFs, while Bitcoin and Ethereum ETFs continue to see....

In the dynamic financial sector, Bitcoin ETFs are rapidly gaining ground against their gold counterparts, with inflows pushing total assets under management toward record highs. Bitcoin ETFs are set to overtake gold ETFs in total assets under management. Bitcoin ETFs Cement Role As Institutional Gateway To Crypto Bitcoin Exchange-Traded Funds (ETFs) are on the brink […]

Crypto analyst Jungle has revealed what to expect if the SEC approves the XRP ETFs. He predicts that these funds could have a similar effect on XRP, just the way the Bitcoin ETFs did on BTC. What Happens If The XRP ETFs Get Approved In an X post, Jungle stated that if a spot XRP […]

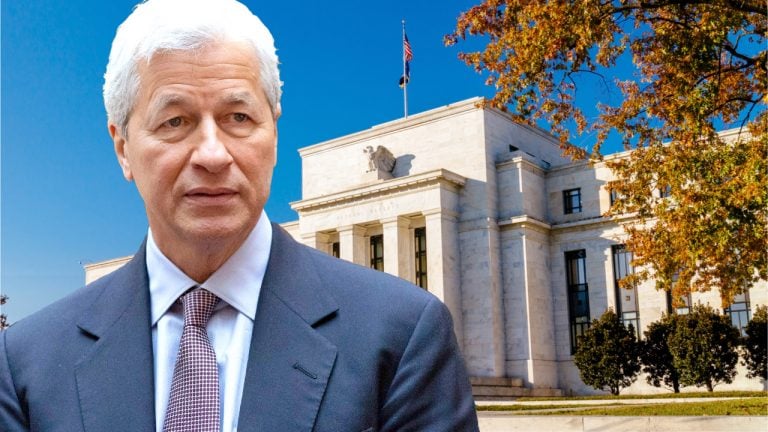

Investment bank JPMorgan Chase is stockpiling cash according to the company’s CEO Jamie Dimon. The investment banker doesn’t seem to believe inflation is “transitory” and he thinks there’s a “very good chance” inflation could stick around. JPMorgan Chase CEO: ‘I Do Expect to See Higher Rates and More Inflation’ At the end of April, Bitcoin.com News reported on the Federal Open Market Committee (FOMC) and explained how FOMC members said the benchmark interest rate will be kept near zero. Moreover, members of the FOMC also said the....