Key Indicator Shows Bitcoin Is Likely to Consolidate Despite $14k Break

Bitcoin has undergone yet another rally over the past 24 hours, rallying from yesterday’s lows near $13,300 to highs of $14,250. The coin currently trades for $14,100. A key technical indicator, though, indicates that the cryptocurrency may consolidate as the price action cools down. Bitcoin Primed to Consolidate, Or Even Drop: Key Analysis Shows The chart below was shared by an analyst amid Bitcoin’s latest leg higher. It shows BTC’s price action has recently printed […]

Related News

On-chain analysis shows huge Bitcoin outflows from crypto exchange Binance. BTC might keep the rally up and break $40k. Huge Bitcoin Outflows On Binance As pointed out by a CryptoQuant post, the crypto exchange has observed huge outflows of BTC on Monday. The Binance Outflows indicator shows the amount of Bitcoin transferred from the Binance exchange wallets to personal or other exchange wallets. On the other hand, the inflows show how many BTC were sent into Binance wallets from other types of wallets. The indicator of most interest here is the the Binance Bitcoin netflow, which is just....

Bitcoin’s price has entered a consolidation phase as it trades between $10,600 and $10,800 The cryptocurrency’s strong uptrend in recent days stalled as soon as it approached $11,000, as the selling pressure at this level has proven to be quite significant Analysts are now conflicted on where it may trend next, as it all depends on whether $11,000 proves to be a surmountable level One analytics firm is now noting that there is one indicator […]

The Bitcoin price could stagnate until early 2021, various on-chain indicators show, as investors could take profit. The Bitcoin price (BTC) reached the $19,400 mark in the past 24 hours, which has served as a critical resistance level since the start of December. However, on-chain indicators show that the dominant cryptocurrency could stagnate or consolidate until early 2021. Although BTC is nearing its all-time high at around $20,000, there are compelling reasons to expect more sideways action.On-chain analysts primarily explore two indicators to gauge the sentiment of an ongoing rally:....

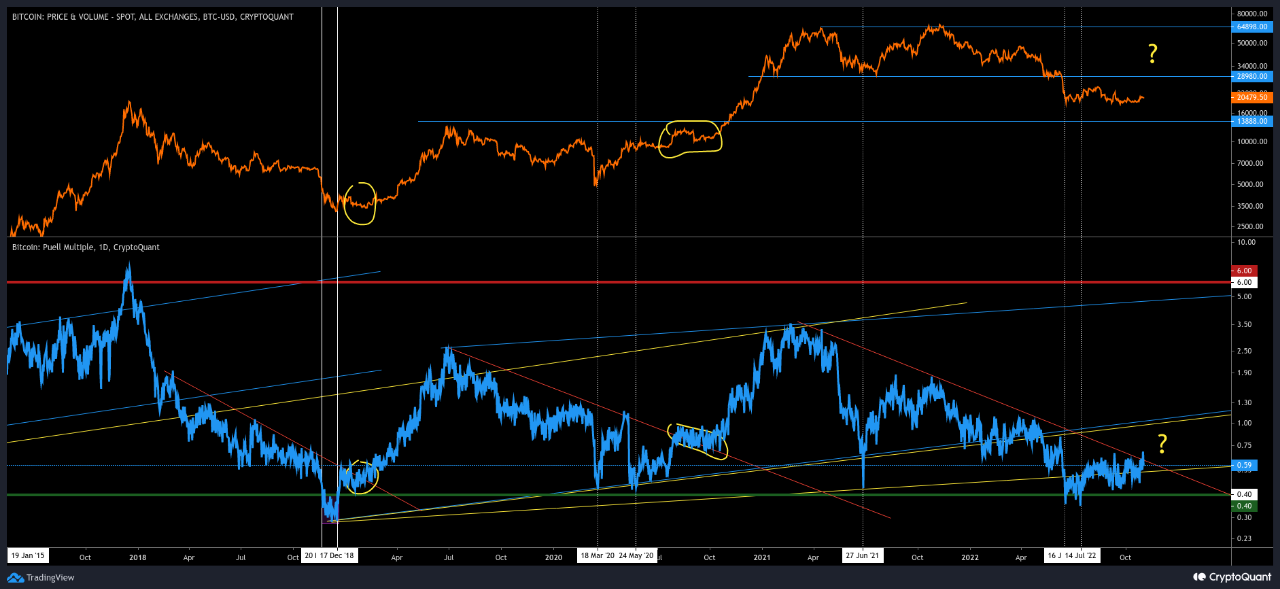

On-chain data shows the Bitcoin Puell Multiple is currently retesting the downtrend line, will the metric be able to break above it this time? Bitcoin Puell Multiple Has Gone Up A Bit During Recent Days As pointed out by an analyst in a CryptoQuant post, a trend reversal could be nearing in the BTC market. The “Puell Multiple” is an indicator that measures the ratio between the current daily Bitcoin mining revenues (in USD) and the 365-day moving average of the same. What this metric tells us is how much the BTC miners are making right now compared to the average during the....

Ethereum strongly underperformed Bitcoin during BTC’s move to $16,000. In fact, for most of the rally from $13,000 to $16,000, ETH was trading for $380-400, failing to break higher. But after BTC has begun to consolidate, ETH has finally started to break higher. Ethereum currently trades for $440, up 10% in the past 24 hours […]