With inflation going through the roof, Sudan’s central bank cautions citizens...

Sudanese financial regulator considers cryptocurrencies to be the source of “high risks" as the demand grows. The Central Bank of Sudan (CBOS) cautioned the country’s citizens against dealing with “all types of cryptocurrencies” due to “the high risks” that they pose. This announcement came as a reaction to the increasing interest in digital assets among the country’s population, which has been facing three-digit inflation rates since the 2021 military coup. On March 27, the Sudan News Agency (SUNA) published a short announcement from the CBOS declaring that due to high risks, which....

Related News

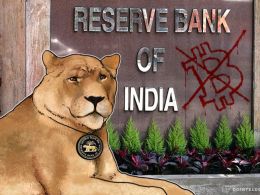

There has been a flurry of central bank activity recently spewing advice and cautioning citizens about virtual currencies like Bitcoin. First, it was PBOC and now the recently, the Reserve Bank of India (RBI), India’s central bank has come up with a press release that warns Indians about the dangers of dabbling in virtual currencies. RBI cautions holders and traders of Bitcoin. On Feb. 1, 2017, the Reserve Bank of India posted a brief press release on their website saying, “The Reserve Bank of India had cautioned users, holders and traders of Virtual Currencies (VCs), including Bitcoins,....

Central banks across the world have been increasing stimulus and letting inflation run high in order to combat the disastrous economic effects of the coronavirus outbreak response. The Bank of Japan has recently become the country’s largest stockholder and the European Central Bank is prepared to expand its colossal stimulus program. Meanwhile, Federal Reserve Chair Jerome Powell is calling on Congress to act fast on America’s stimulus program proposal as “the risk of overdoing it is less than the risk of underdoing it.” Bank of Japan’s $434 Billion Treasure....

According to Patrick Njoroge, the governor of the Kenyan central bank, the significant number of non-smartphones that are in use in Kenya means launching a central bank digital currency (CBDC) now may be premature and could lead to many citizens being financially excluded.

Central Bank Mulls Delaying CBDC Rollout

The governor of the Central Bank of Kenya (CBK), Patrick Njoroge, has suggested the lack of access to smartphones of more than half of Kenya’s mobile phone users is working against its plan to launch a CBDC. He warned the central bank may be forced to delay its....

While central banks are focusing on creating more stimulus and economists expect inflation in the U.S. to rise, a number of other countries are suffering from considerable inflation right now. On Monday, the chief strategy officer for the Human Rights Foundation, Alex Gladstein, explained that 1.2 billion global citizens are living under inflation rates as high as two to three-digits. Inflation: The Silent Killer of an Individual’s Purchasing Power During the last week, a number of analysts and economists have been discussing the possible inflation rise coming to the U.S., mostly....

The Central Bank of the Republic of Armenia has advised its citizens not to use digital currencies such as bitcoin. The Armenian central bank told regional news service ARKA last month that, in its view, the use of digital currencies should be avoided due to a lack of regulation in the industry. The comments appear to be some of the first from the institution on the technology. The central bank told ARKA: "According to Armenian legislation, virtual currencies, including bitcoins are not considered electronic money. This in view, the regulator calls on citizens to refrain from using them,....