Crypto Analyst Says Bitcoin Is At A High Premium, How To Trade It

Bitcoin is facing resistance at its yearly high of the $35,000 mark amidst a few days of eventful price action. Right now, all things seem poised for a retracement, considering past price action of the cryptocurrency after sudden price surges. However, according to some crypto analysts, Bitcoin is currently trading at a high premium. This means its price is inflated right now due to all the excitement and media attention. Data from crypto behavior analytics Santiment has shown euphoria regarding Bitcoin among investors on social media posts. This euphoria has occasionally preceded a....

Related News

Data shows the Bitcoin Coinbase Premium Gap has plunged into the negative territory following BTC’s latest high above $98,000. Bitcoin Coinbase Premium Gap Has Just Observed A Plummet As explained by CryptoQuant community analyst Maartunn in a new Quicktake post, the recent positive Coinbase Premium Gap has just disappeared. The “Coinbase Premium Gap” here refers […]

According to data from CryptoQuant, Bitcoin’s (BTC) Kimchi Premium has surged to a three-year high of 12%. This spike comes amid a steep decline in the flagship cryptocurrency, triggered by concerns over the economic impact of looming US trade tariffs on Canada, Mexico, and China. Kimchi Premium Rises To 3-Year High, What’s Driving It? Starting […]

Is a surging premium in South Korea a top signal or a sign that the Bitcoin rally is only getting started? The price of Bitcoin (BTC) is continuing to range between $56,000 and $60,000, as the so-called "Kimchi premium" is surging to yearly highs.Kimchi premium forms when Bitcoin is trading at a higher price in South Korea over other major markets like the United States.In 2017, the Kimchi premium surpassed 20%, causing Bitcoin to trade at around $24,000 in South Korea while it topped at nearly $20,000 in the U.S.Korea Premium Index. Source: CryptoQuant.comLast week, on March 29, this....

The Bitcoin Coinbase Premium Gap has continued to be at a notable green level recently, a sign that institutional traders are buying the asset. Coinbase Premium Gap Is Positive Right Now In a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the Bitcoin Coinbase Premium Gap. This indicator […]

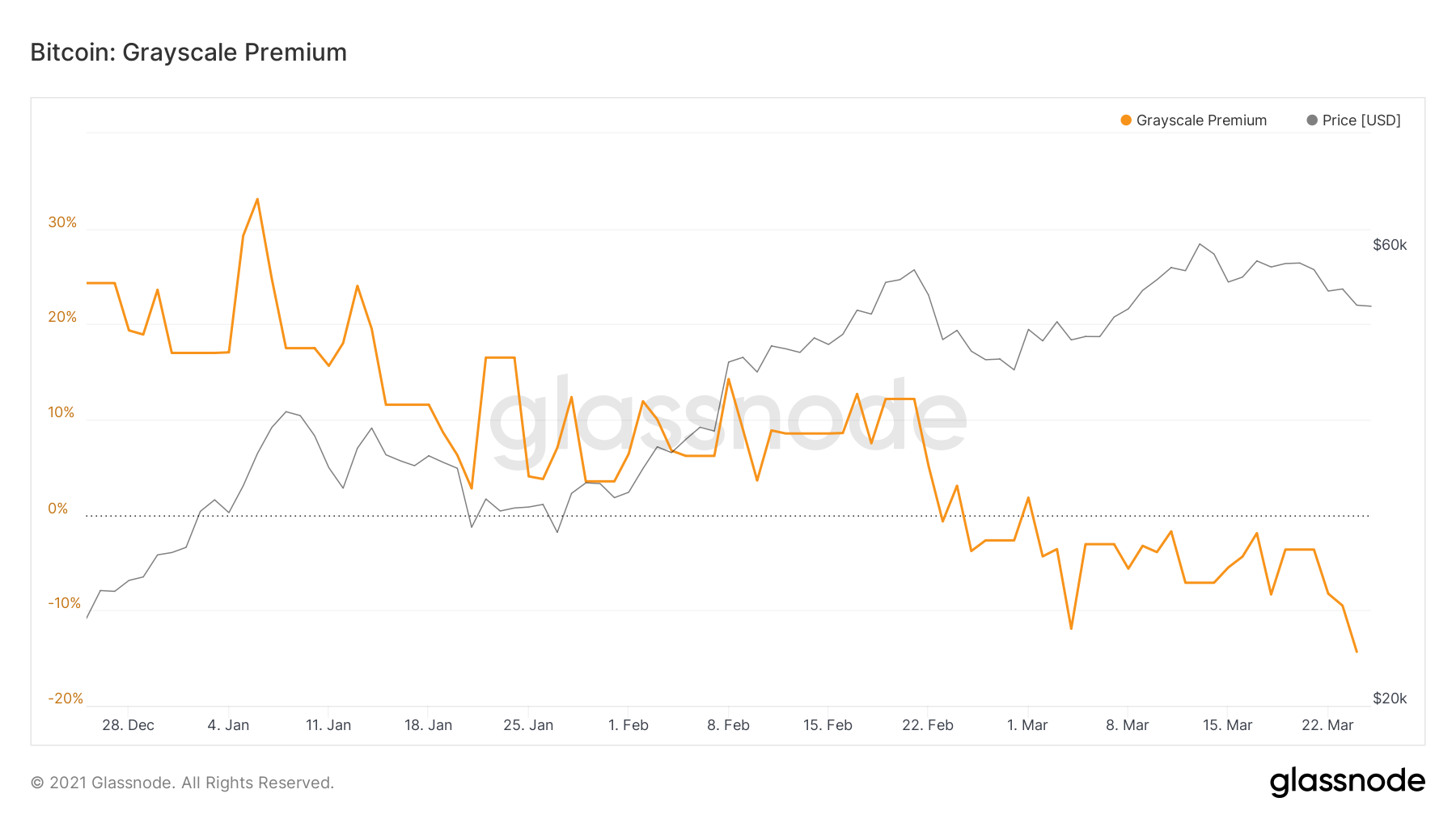

Since trading at a negative for nearly 2 months, GrayScale Bitcoin Trust (GBTC) premium plummeted to -14.21% this morning. Historically, GBTC has traded at a high premium relative to the underlying Bitcoin, commanding an average of 15.02% premium since the fund’s inception. But as competition grows and firms create cheaper, more accurate financial products, GBTC’s appeal has dropped dramatically — and its premium clearly shows for it. Analyzing Why Grayscale Bitcoin Trust Premium Continues to […]