Bitcoin’s 2020: The Rise Of Certainty

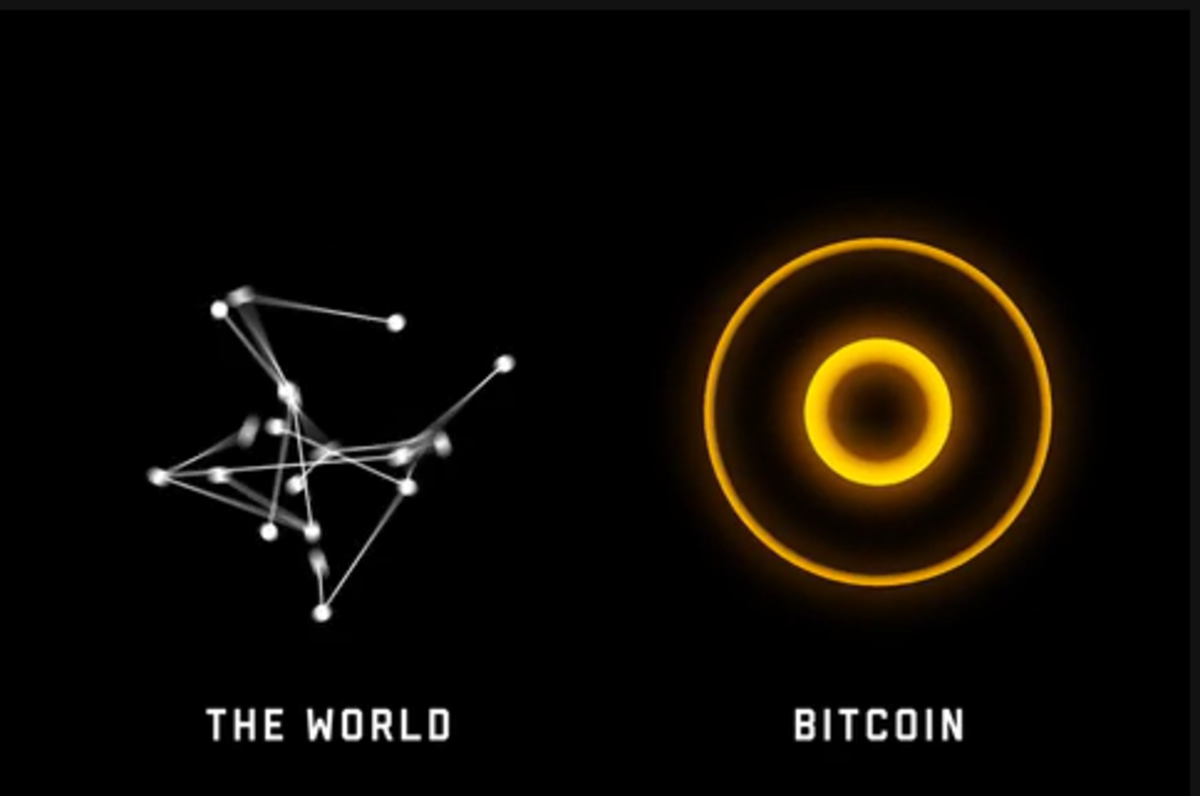

2020 was unforgettable, especially for Bitcoin. To help memorialize this year for our readers, we asked our network of contributors to reflect on Bitcoin’s price action, technological development, community growth and more in 2020, and to reflect on what all of this might mean for 2021. These writers responded with a collection of thoughtful and thought-provoking articles. Click here to read all of the stories from our End Of Year 2020 Series. Source In a year overflowing with chaos throughout the world, Bitcoin continued to function flawlessly and give precisely zero fucks about what the....

Related News

We asked our community to help wrap up Bitcoin’s wild 2020 and predict what could happen in 2021. Here are the results. The post Reader Survey: Bitcoin’s 2020 And 2021 appeared first on Bitcoin Magazine.

In 2020, the Bitcoin development community introduced a number of useful new features, important upgrades and notable improvements. The post Bitcoin’s 2020 In Tech appeared first on Bitcoin Magazine.

Bitcoin’s most critical sector, its most visible new investors and its vocal community came together to define 2020. The post Mining, Institutional Adoption And Community Voice Defined Bitcoin’s 2020 appeared first on Bitcoin Magazine.

A research firm’s head recently claimed Bitcoin’s capped supply could be changed. Bitcoin’s (BTC) price rise has brought all sorts of comments out of the woodwork. Although many carry a bullish tint, some folks still doubt crypto as a new store of value class. David Rosenberg, the chief economist and strategist, as well as president, of the firm Rosenberg Research & Associates, recently described gold’s supply as more predictable than Bitcoin’s."Everybody seems to believe that we're going to get to that 21 million cap on the supply constraint, but there's really nothing in the protocol to....

Crypto analyst Jelle has highlighted a bullish pattern that has been forming on the Bitcoin chart for the last three years. The analyst suggested that it could soon be time for the pattern to play out, with a price target of $100,000 and above in sight if it does. 3-Year Cup And Handle Pattern Could Soon Play Out For Bitcoin In an X (formerly Twitter) post, Jelle stated that it shouldn’t be long before the 3-year cup and handle pattern on Bitcoin’s chart starts playing out. The analyst suggested this could happen as soon as the fourth quarter of this year and noted that the pattern has a....