Uniswap delists 100 tokens from interface including options and indexes

Synthetic tokens and tokenized stocks have made it onto Uniswap Labs’ black list as regulatory concerns mount. The world’s leading decentralized exchange, Uniswap, has announced the delisting of a number of tokens from its app interface.Uniswap Labs made the announcement on July 23, emphasizing that the tokens had been removed from the app interface only, and that the protocol remains immutable:“These changes pertain to the interface at app.uniswap.org — the Protocol remains entirely autonomous, immutable, and permissionless.”The company Uniswap Labs is the software developer that has....

Related News

The largest decentralized exchange (dex) platform, in terms of trade volume, Uniswap has revealed the dex has removed a number of tokens from the platform interface. The community assumes the tokens could be deemed securities by global regulators. Uniswap users can still swap these tokens via accessing specific smart contracts themselves, as the company behind the platform, Uniswap Labs, simply removed the tokens from the main interface. Uniswap Removes Tokens From Main Interface, Users Discuss Alternative Solutions On July 23, the startup Uniswap Labs announced that the development team....

Software development studio Uniswap Labs (UL) announced the restriction of certain tokens via the app.uniswap.org domain. The company claims to be taking part in “creating a better” financial system and has taken the decision after reviewing the regulatory landscape and the actions of other “DeFi interfaces”. The token removed from the domain represented a “very small portion of overall” trading volume on the platform, UL claims. Amongst the restricted tokens is Gold Tether (XAUt), Grump Cat (GRUMPY), iAAVE, iADA, iBNB, sAPPL, sCOIN, and many more....

“We built this interface so anyone who wants to donate but holds other ERC-20 tokens can do so with one click,” said the Uniswap team. On Tuesday, decentralized exchange Uniswap launched an interface that directly converts ERC-20 tokens — such as Aave, Chainlink’s LINK and Decentraland’s MANA — to Ether (ETH). The coins are then sent to the official crypto wallet addresses of the Ukrainian government, all in a single transaction. In explaining the rollout, Uniswap claimed that the address shared by Ukraine is located on a centralized exchange and only accepts Ether and Tether (USDT). Thus,....

These DEX tokens are quietly accruing triple-digit gains as the total value locked in DeFi reaches new highs each week. DeFi has steadily grown in prominence over the past year thanks in large part to the strong foundations established by decentralized exchanges (DEX) that enable easy access to the latest tokens and projects. While there have been previous iterations of DEX user interfaces, such as IDEX or Etherdelta, it wasn’t until Uniswap launched that trading in the DeFi network really took off and facilitated the launch of the finance tokens. Here are six of the top-performing tokens....

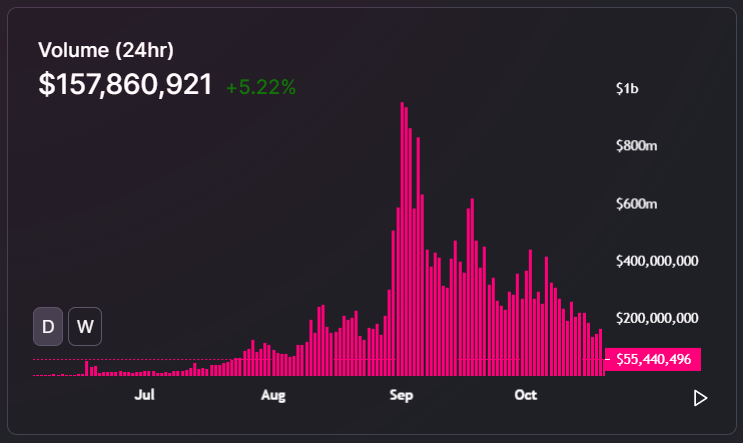

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]