Uniswap Labs Limits Access To Certain Tokens, What It Could Mean For The DeFi...

Software development studio Uniswap Labs (UL) announced the restriction of certain tokens via the app.uniswap.org domain. The company claims to be taking part in “creating a better” financial system and has taken the decision after reviewing the regulatory landscape and the actions of other “DeFi interfaces”. The token removed from the domain represented a “very small portion of overall” trading volume on the platform, UL claims. Amongst the restricted tokens is Gold Tether (XAUt), Grump Cat (GRUMPY), iAAVE, iADA, iBNB, sAPPL, sCOIN, and many more....

Related News

Major DeFi tokens, including UMA, Maker, and Uniswap have surged up to 22% in the past 24 hours. The decentralized finance (DeFi) market has generally rebounded following a sustained pullback. There are two main reasons behind the short-term recovery of major DeFi tokens. First, most DeFi tokens were heavily sold since September, causing most to […]

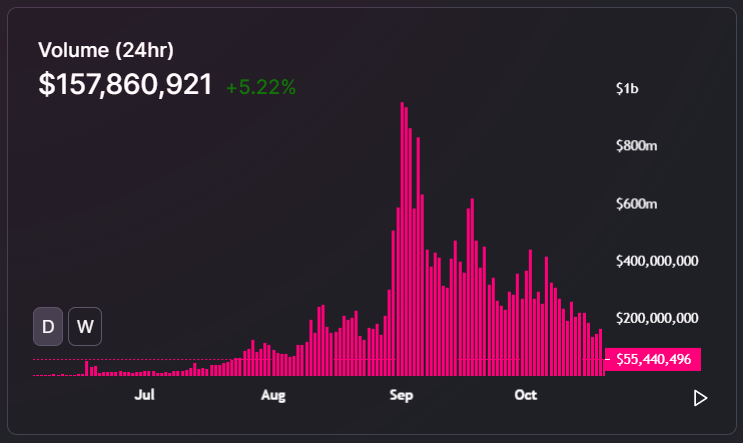

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]

Uniswap said it is betting on her experience with TradFi translating over to DeFi to further help them evolve their place in Web3. On Wednesday, Uniswap announced that former New York Stock Exchange president Stacey Cunningham will join the company as an advisor.Cunningham served as the first female president of the New York Stock Exchange after beginning her career as a trader on its floor. She said in a statement that she believes in the potential of Uniswap’s commitment to fairer markets.Uniswap is betting on her experience with TradFi translating over to DeFi to further help them....

Synthetic tokens and tokenized stocks have made it onto Uniswap Labs’ black list as regulatory concerns mount. The world’s leading decentralized exchange, Uniswap, has announced the delisting of a number of tokens from its app interface.Uniswap Labs made the announcement on July 23, emphasizing that the tokens had been removed from the app interface only, and that the protocol remains immutable:“These changes pertain to the interface at app.uniswap.org — the Protocol remains entirely autonomous, immutable, and permissionless.”The company Uniswap Labs is the software developer that has....

While a number of popular crypto-assets like bitcoin have been consolidating, decentralized finance (defi) tokens have captured significant gains during the last 24 hours. A few defi crypto assets have seen double-digit gains and the leader of the pack is Uniswap which has jumped 20.9% in the last 24 hours.

Uniswap’s Defi Token Leads the Percentage Gains on Sunday

Decentralized finance (defi) tokens are making waves during Sunday’s crypto trading sessions, as a dozen defi tokens have seen better gains than most of today’s well known digital assets.

....