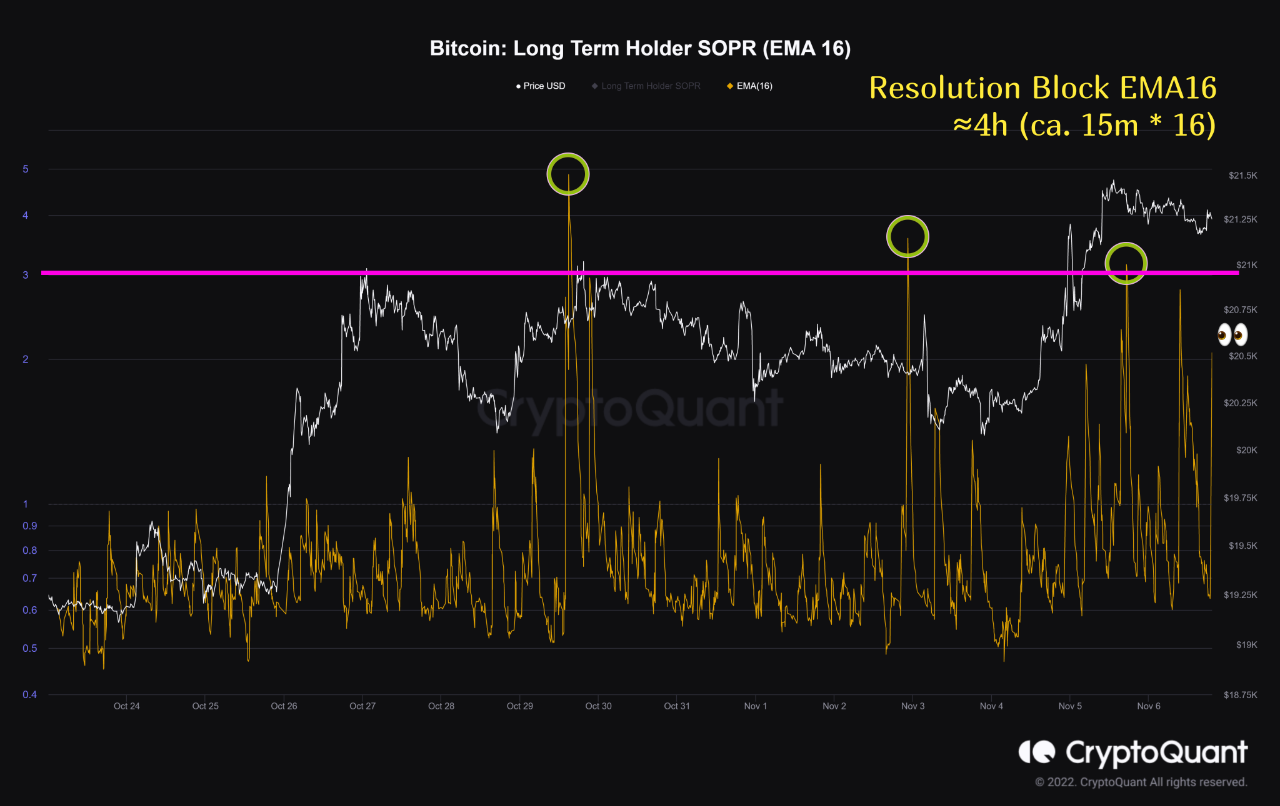

Bitcoin Dips Below $21k As Long-Term Holders Harvest Profits

Bitcoin has declined below $21k during the past day as on-chain data shows signs of long-term holders harvesting profits. Bitcoin Long-Term Holder SOPR Has Spiked Up In Recent Days As pointed out by an analyst in a CryptoQuant post, profit-taking from long-term holders has previously been followed by local tops in the price of the crypto. The relevant indicator here is the “Spent Output Profit Ratio,” which tells us whether the average Bitcoin investor is selling at a profit or at a loss right now. When the value of this metric is greater than 1, it means the holders as a whole....

Related News

Bitcoin has remained sideways for the last couple of months, tossing between the $88K and $75K levels. It hasn’t made any significant moves to either side. New data from Glassnode shows that short-term Bitcoin holders are sitting on significant unrealized losses. On the other hand, however, long-term $BTC holders are still in profit. Keep reading to find out how Bitcoin can move in the weeks to come. We’ll also suggest some of the best altcoins you can buy to benefit from a potential $BTC rally. Is $BTC Bearish Now? It’s still too early to say that BTC has gone into bearish....

Total value locked across decentralized finance-enabled smart contracts has dipped 35% from its peak. The drop in the price of Ether (ETH) is failing to shake out the long-term holders, while the decentralized finance (DeFi) sector is also providing opportunities for investors. So suggests a new Glassnode report that noted many long-term Ether holders (>155 days) are sitting atop profits despite ETH/USD’s 55% decline from its peak level above $4,300. In comparison, the short-term Ether holders (“After almost hitting 46% of the market cap in unrealized gain, short-term holders are now....

Seasoned Bitcoin Holders Are In Distribution Mode Bitcoin’s price action is shifting, and so is the sentiment of investors, especially the long-term BTC holders. The development carries weight in the market because these holders are often considered the most patient and conviction-driven players in the crypto sector. Related Reading: A Major Bitcoin Pivot? Realized […]

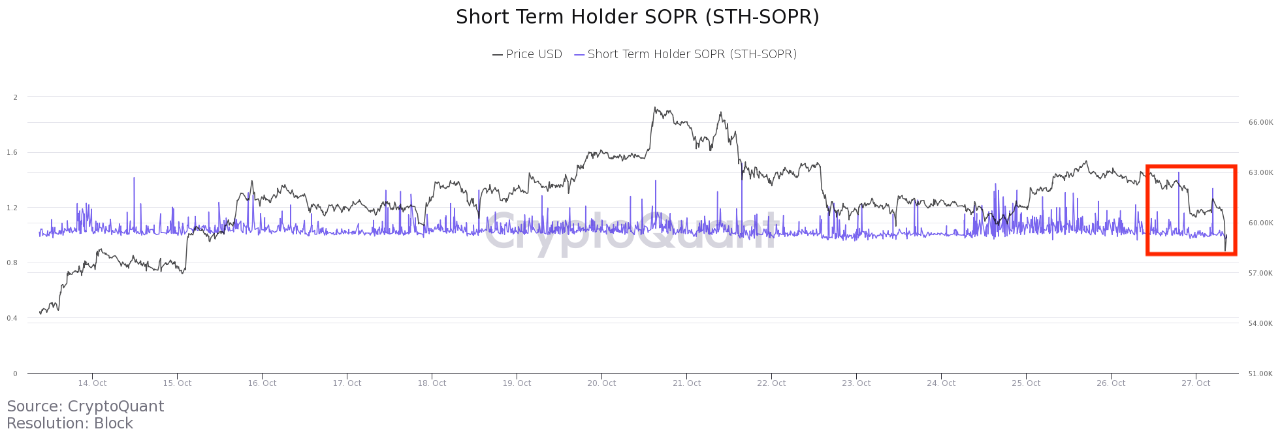

Bitcoin has crashed to $58k, and on-chain data may suggest that profit-taking from short-term holders may be behind the event. On-Chain Data Shows Bitcoin Short-Term Holders Are Taking Profits As pointed out by an analyst in a CryptoQuant post, short-term holders seem to have started taking their profits. And the timing may suggest this to […]

A recent Glassnode report says some long-term holders (LTHs) of bitcoin offloaded part of their holdings and cashed out their profits during a bull-run. Still, the report explains that the sell-off, which has been noticeable since late November, is not necessarily a sign of an approaching bear market. Instead, as the data shows, BTC is poised for another rally. Since Nov. 26, when the price of BTC dropped by more than 17% in 24 hours, the digital asset has recovered and currently trades above $19,000. Some analysts believe that it is only a matter of time before the leading crypto....