Bitcoin Data Shows Profit Taking From Long-Term Holders Behind Decline To $40k

As the Bitcoin price declines to $40k, on-chain data shows long-term holders have harvested some profits recently. Bitcoin Long-Term Holder SOPR Shows Some Spikes Recently As pointed out by an analyst in a CrypoQuant post, some BTC long-term holders seem to have participated in profit taking over the past day. The relevant indicator here is the spent output profit ratio (or the SOPR in brief), which tells us about the profit ratio of the whole Bitcoin market. The metric works by checking the past history of each coin being sold on the chain to see what price it was moved at before. If this....

Related News

On-chain data shows the Bitcoin long-term holders have participated in a major selloff recently, a sign that may not be ideal for BTC’s price. Bitcoin Long-Term Holders Have Been Distributing Recently As explained by on-chain analyst Checkmate in a new post on X, the Bitcoin long-term holders have just shown their heaviest profit-taking event of […]

Fresh on-chain data suggests that despite Bitcoin (BTC) trading close to its all-time high (ATH), long-term holders (LTHs) are not offloading their holdings. Instead, these investors are continuing to accumulate the world’s largest cryptocurrency by market capitalization, signaling their confidence in further price gains in the coming weeks. Long-Term Bitcoin Holders Are Not Selling Yet According to a recent CryptoQuant Quicktake post by contributor ShayanMarkets, profit-taking among long-term holders remains relatively low, even as BTC trades near its ATH. Historically, profit-taking....

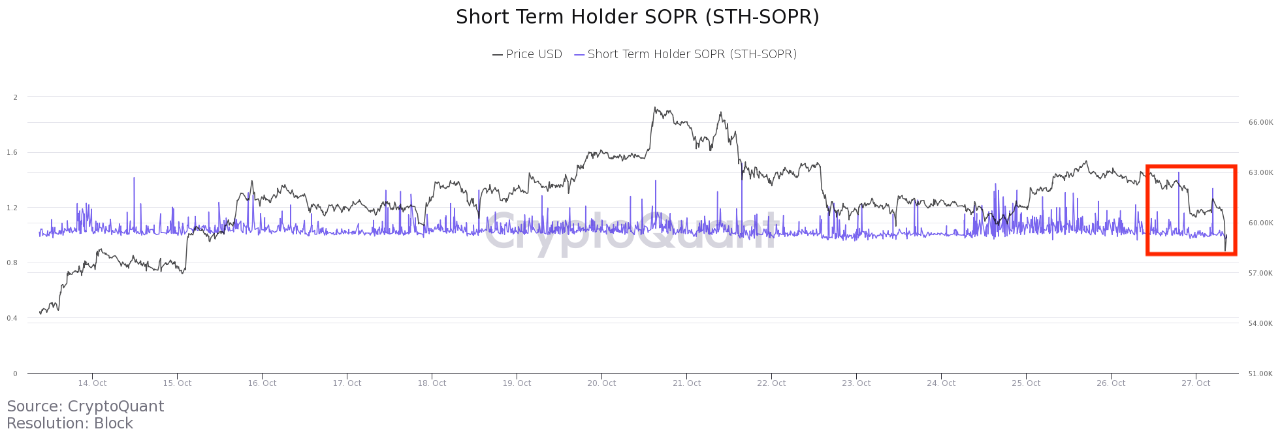

Bitcoin has crashed to $58k, and on-chain data may suggest that profit-taking from short-term holders may be behind the event. On-Chain Data Shows Bitcoin Short-Term Holders Are Taking Profits As pointed out by an analyst in a CryptoQuant post, short-term holders seem to have started taking their profits. And the timing may suggest this to […]

On-chain data shows Bitcoin short-term holders are increasingly selling at a loss following the latest crash in the crypto’s price. Bitcoin Short-Term Holder SOPR Dips Further Below One As pointed out by an analyst in a CryptoQuant post, on-chain data shows that the STH SOPR has decreased to July levels, suggesting that short-term holders are increasingly realizing their losses. The Spent Output Profit Ratio, or “SOPR” in short, is a Bitcoin indicator that tells us whether investors are selling at a loss or a profit during a given period. The metric’s value is....

Even though the Bitcoin price has fallen sharply from its all-time high of $126,000, the decline still does not have that much impact on seasoned BTC investors or long-term holders. On-chain data is showing that these long-term BTC holders are still experiencing notable gains from their positions. Long-Term BTC Holders’ Profit Margins Stay Impressive With […]