Bitcoin Market Update: Spot Demand Climbs As Short-Term Profits Lose Steam

Bitcoin (BTC) continues to show signs of strength despite experiencing a minor pullback in its most recent trading session. After briefly reaching a 24-hour high of $106,518, the asset retraced slightly and now trades at $104,820, reflecting a modest 0.5% decrease over the past day. Still, the cryptocurrency remains just 3.8% below its all-time high of $109,000 set in January, keeping traders and analysts closely focused on its next move. Notably, the current price action comes as changes in trading behavior emerge across major exchanges. Related Reading: Bitcoin Bulls Face Make-Or-Break....

Related News

Bitcoin (BTC) has seen a slight retreat after reaching an intraday high of $106,704. At the time of writing, the asset trades at $104,686, reflecting a mere 0.4% increase in the last 24 hours. Despite this slight pullback, BTC remains within 3.8% of its all-time high of $109,000 set in January, indicating that bullish momentum is still largely intact. Amid this price performance, data suggests that BTC’s price behavior remains supported by strategic accumulation patterns rather than short-term speculation. The return of large-scale withdrawals from centralized exchanges like Binance and....

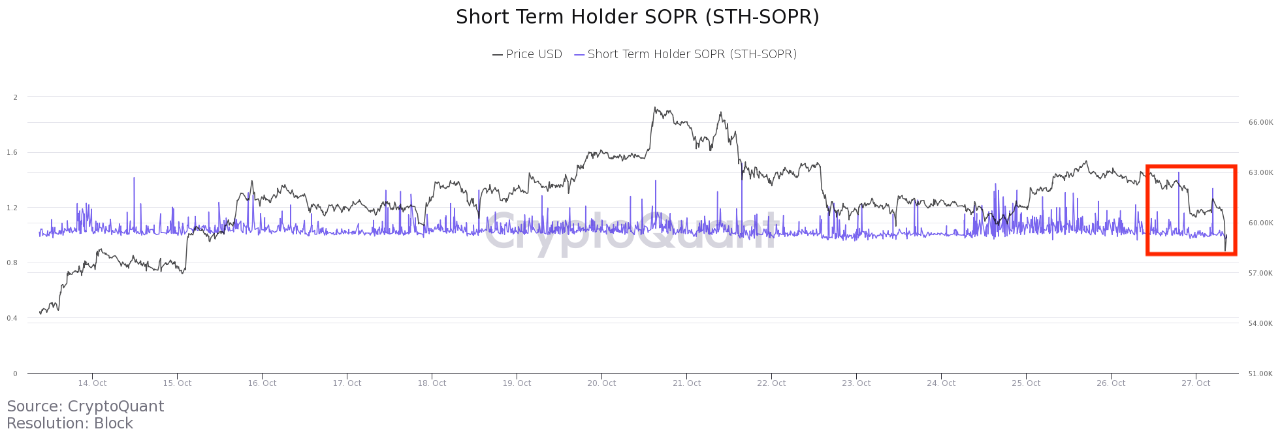

Bitcoin has crashed to $58k, and on-chain data may suggest that profit-taking from short-term holders may be behind the event. On-Chain Data Shows Bitcoin Short-Term Holders Are Taking Profits As pointed out by an analyst in a CryptoQuant post, short-term holders seem to have started taking their profits. And the timing may suggest this to […]

Coinbase Pro is a major bellwether for institutional demand. Now, data from CryptoQuant indicates that short-term selling pressure on Coinbase is mounting. Bitcoin’s (BTC) definitive breakout above $50,000 may have to wait longer to materialize as spot buying pressure on Coinbase Pro shows signs of weakening — at least, in the short term. The Coinbase Premium Index, which measures the gap between the BTC price on Coinbase Pro and Binance, has flipped negative, according to CryptoQuant. In other words, selling pressure on Coinbase appears to be strengthening compared with other exchanges....

Dogecoin has been flashing bullish signs on its short term chart. The coin is currently trading laterally. Over the past week, DOGE registered 7% appreciation. The meme-coin has stabilised on the $0.06 support line. The key support level for the coin stood at $0.064. For DOGE to continue on a bullish path, demand for the coin has to remain in the positive. On the four hour chart, Dogecoin is targeting the $0.07 level. Although buying strength is still in the positive, there has been a minor decline in the buying pressure on the short term chart. If buying strength declines, then a pullback....

The team behind Steam, a digital distribution platform developed by Valve Corporation offering digital rights management, multiplayer gaming and social networking services, has announced that the platform will officially begin to accept payments via bitcoin. CoinTelegraph has reached out to Bitpay for more information about their partnership with Steam. We will continue to update the article as we receive more information from the Bitpay team. Gaming giant Valve and the developers behind Steam hinted the integration of Bitpay on February 9, 2016, when some Steam users discovered a series....