Bitcoin seller exhaustion hits 4-year low in 'typical' bear market move

Low volatility and high on-chain losses for Bitcoin, but overall UTXOs in loss still have a way to go to match previous market bottoms. Bitcoin (BTC) sellers may not have capitulated enough, but current trends are “typical” of the end of bear markets.According to data from on-chain analytics firm Glassnode, seller behavior suggests that a macro price bottom is forming.Analyst: Seller exhaustion "near" bear market lowsIn the latest hint that Bitcoin’s latest bear market is nearing its end, Glassnode has revealed that the network is currently weathering a “perfect storm” of low volatility....

Related News

What to Know: 1️⃣ Bitcoin’s rebound from extreme oversold RSI levels came with $206M in liquidations, signaling seller exhaustion rather than a confirmed trend reversal. 2️⃣ $XRP and especially $ZEC are leading the market bounce, with $ZEC up over 900% year-to-date as privacy-focused tokens outperform broader altcoin sectors. 3️⃣ Best Wallet Token underpins a non-custodial […]

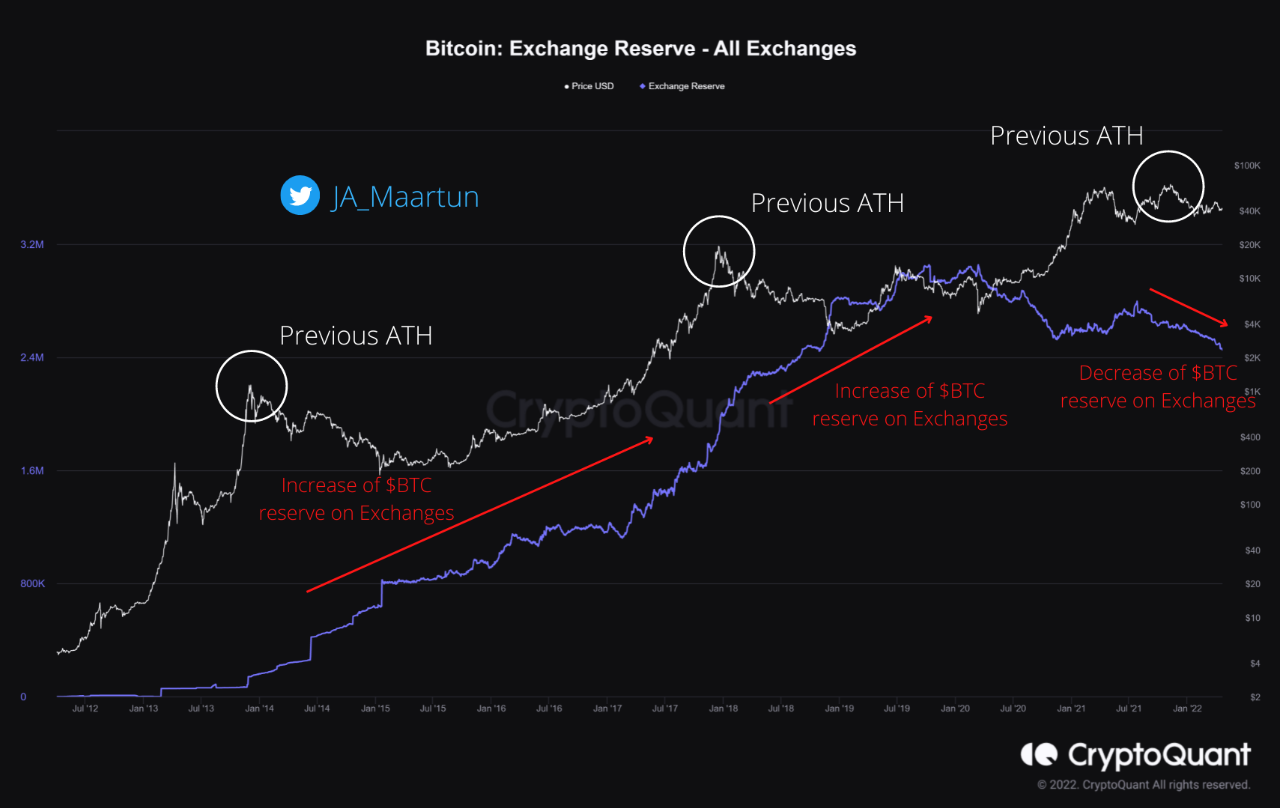

A quant has explained using on-chain data why the current Bitcoin bear market looks to be different from the previous ones. Quant Suggests This Bitcoin Bear Market Is Unlike The Rest As explained by an analyst in a CryptoQuant post, the exchange reserve continuing to trend down since the price all-time high isn’t typical of […]

The Bitcoin cycle top would likely come in at price levels above $166,000 per coin if history repeats. After breaking out of the two-months ascending triangle, the price of Bitcoin (BTC) is firmly staying above $60,000. Current on-chain volume suggests investors are still strongly buying Bitcoin at current price levels.Furthermore, the current price is not even close to a short-term price top when comparing to historic network valuation multiples.BTC price bull run not overheated, investor activity showsWhile bear market bottoms often coincide with seller exhaustion, bull cycle tops happen....

In this episode of NewsBTC’s daily technical analysis videos, we examine the bloodbath across crypto today and the new record low for this Bitcoin bear market. Take a look at the video below: VIDEO: Bitcoin Price Analysis (BTCUSD): November 8, 2022 It was a highly volatile day in crypto markets, led by a battle between FTX and Binance that ultimately might end with Binance owning FTX.com. The two company’s CEO’s public spat caused the already fearful crypto market to collapse further. As a result, Bitcoin price made a new bear market lower low, setting a new record low....

Bitcoin price wallows near a 15-month support line near $434. The market seems somber after a frustrating 5 months that had produced nothing in the chart to write home about. Perhaps it’s Saturday’s blue moon or perhaps it’s sheer exhaustion from ecosystem overload during the past year… Not much to report as price slowly keels over into downside. The Bear is not showing any more commitment than his friend, Ferdinand the Bull, had during the past several months of non-advance in the chart. In the OKCoin Quarterly Futures chart, price can be seen drawing out a typical sideways plateau prior....