State Of The Bitcoin Derivative Market

The bitcoin derivatives landscape plays a major role in the bitcoin price in the short term. We have yet to see signs of a bitcoin macro bottom. The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.While it is clear today that the dominant driver in the bitcoin market is its correlation to equity markets, we believe that a true decoupling will take place eventually, and the seeds of that decoupling....

Related News

Bloomberg reported on Monday that Goldman Sachs has begun trading a sort of derivative linked to Ethereum. Goldman Sachs Launches Derivative Product As a torrent of institutional money entered the market in 2021, the investment bank relaunched its crypto activities, with the core of its services focusing around derivatives tied to cryptocurrencies like bitcoin. Goldman […]

For years, the cryptocurrency industry has had a complicated relationship with regulators. An example of regulatory pushback within the crypto space was when Facebook-backed Diem tried to launch its stablecoin. Regulatory limitations have undoubtedly had an impact on derivative brokers and exchanges. Just recently, Binance, one of the biggest exchanges, was forced to shut down crypto derivatives in several countries, including Germany, Italy, and Hong Kong. Since this announcement, derivatives traders have been on edge about what this means for the derivatives market and, most importantly,....

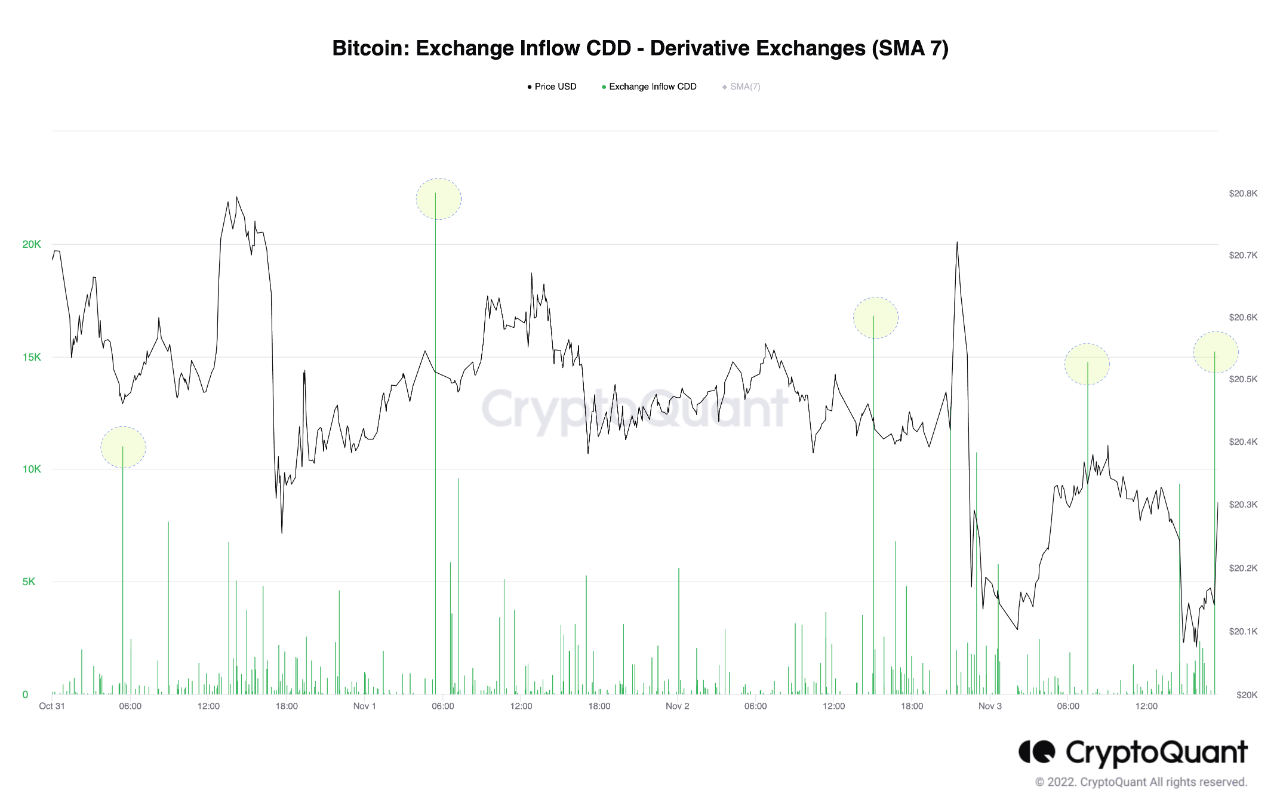

On-chain data shows Bitcoin funding rates have turned positive, suggesting there have been some fresh long openings on derivative exchanges. Bitcoin Funding Rate Turns Green After Derivative Exchange Inflows Spike Up As pointed out by an analyst in a CryptoQuant post, the new long positions can drive the price up in the short term. There are mainly two Bitcoin indicators of relevance here, the derivative exchange inflow CDD, and the funding rates. First, the “derivative exchange inflow CDD” is a metric that tells us whether old BTC supply is moving into derivative exchange....

Australian FX and CFD provider Eightcap has recently announced that it has partnered with TradingView, allowing crypto derivative traders to trade directly from TradingView’s charts into their Eightcap trading accounts. Crypto derivative traders will access Eightcap’s full suite of crypto derivatives, including altcoins, crypto-indices and crypto-crosses. Eightcap’s integration with TradingView is the next step for the award-winning broker as it continues to build a home for crypto traders. TradingView is a charting platform and social network that attracts over 30....

In the past few years, crypto derivative trading has taken off. There is another way to buy and hold cryptos that have appealed to traders who want to make the most out of price movements by using leverage. However, there are risks associated with CFD trading, especially when it comes to cryptocurrency. In 2021, large exchanges had to cease operations due to regulatory issues leaving crypto derivatives traders with no place to trade. That’s where Eightcap, a multi-award-winning regulated CFD broker stepped in, with a fresh offering that stood out for its extensive range of crypto....