Bitcoin Exchange Inflow Hits $2 Billion As Profit-Taking Phase Lingers

After days of intense bearish action, the price of Bitcoin appears to be entering a calmer state, as it recovers above the $86,000 level. The latest on-chain data shows that several investors tried to take some profit in the past week, providing a basis for the premier cryptocurrency registering a double-digit loss. Bitcoin Exchange Inflow Spikes As Price Faces Downward Pressure In a recent post on the social media platform X, crypto analyst Ali Martinez revealed that significant Bitcoin amounts were sent to centralized exchanges in the past week. Data from Santiment shows that about....

Related News

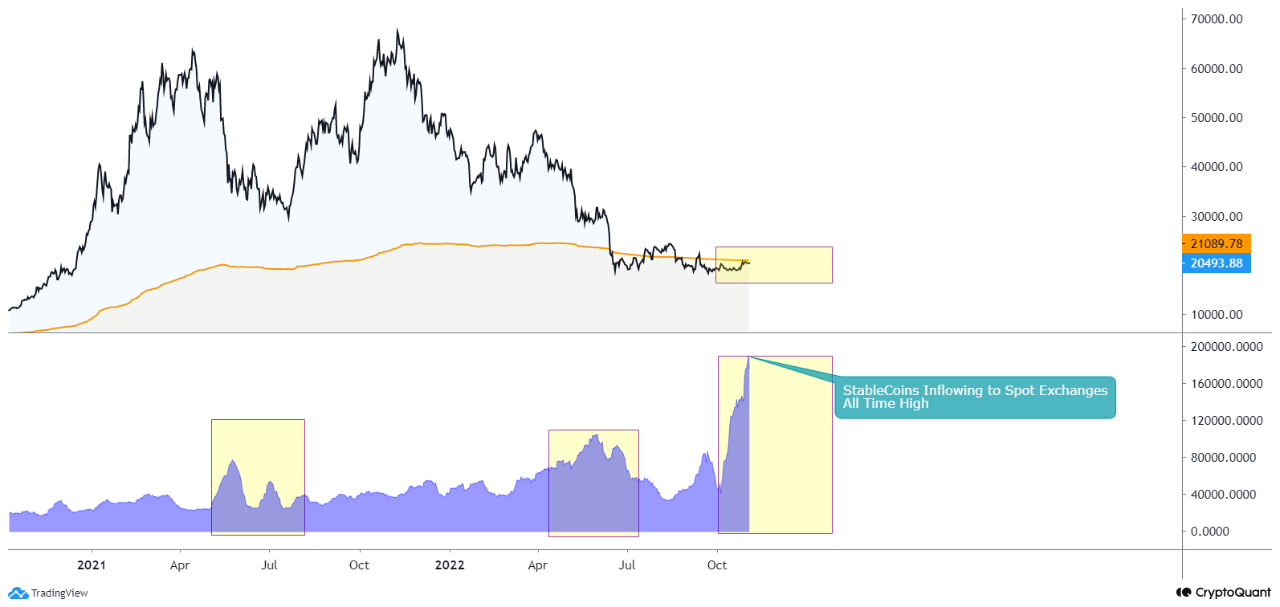

On-chain data shows the stablecoin exchange inflow mean has reached a new all-time high, here’s why this might prove to be bullish for Bitcoin. Stablecoin Exchange Inflow Mean Has Surged Up To A New ATH Recently As pointed out by an analyst in a CryptoQuant post, these inflows can be positive for Bitcoin in the long term, but might be bearish in the short term. The “stablecoin exchange inflow mean” is an indicator that measures the average amount of stablecoins per transaction going into the wallets of centralized exchanges. As stablecoins are relatively stable in value....

Bitcoin’s price is in a tight range Thursday while some investors are moving into ether.

XRP has struggled to maintain its momentum in recent weeks, with the token slipping nearly 10% over the past month. At the time of writing, XRP is trading around $2.96, as the broader market shows mixed signals. While assets such as Ethereum continue to post upward moves, establishing a new high, XRP has instead faced consistent correction, leading market participants to closely monitor whether the trend could extend further or stabilize in the near term. A CryptoQuant analyst has noted that XRP’s current price action comes after an early-2025 rally that saw the token reach the $3.5 to $4....

Bitcoin is heavily riding the renewed bullish wave observed across the broader crypto industry, and its price has now reclaimed the pivotal $120,000 price level. Heightened selling pressure from investors and traders seems to have followed the ongoing upward action in BTC’s price. Massive Profit-Taking Frenzy Hits Bitcoin Investors are currently exhibiting a worrying trend […]

On-chain data shows that shortly after crypto exchange Binance observed Bitcoin inflow of around 12k BTC, price fell by almost 5%. Huge Bitcoin Inflow To Binance As pointed out by a CryptoQuant post, inflow of around 12k BTC was seen on Binance, the largest crypto exchange by market volume. The Bitcoin inflow is an indicator that shows the total amount of BTC transferred to a crypto exchange from a personal wallet. As investors usually send their crypto to exchange wallets for cashing out, altcoin purchasing, etc., the indicator’s value going up would imply there is some selling....