JP Morgan Wealth CEO Says Clients See Bitcoin as Asset Class to Invest In

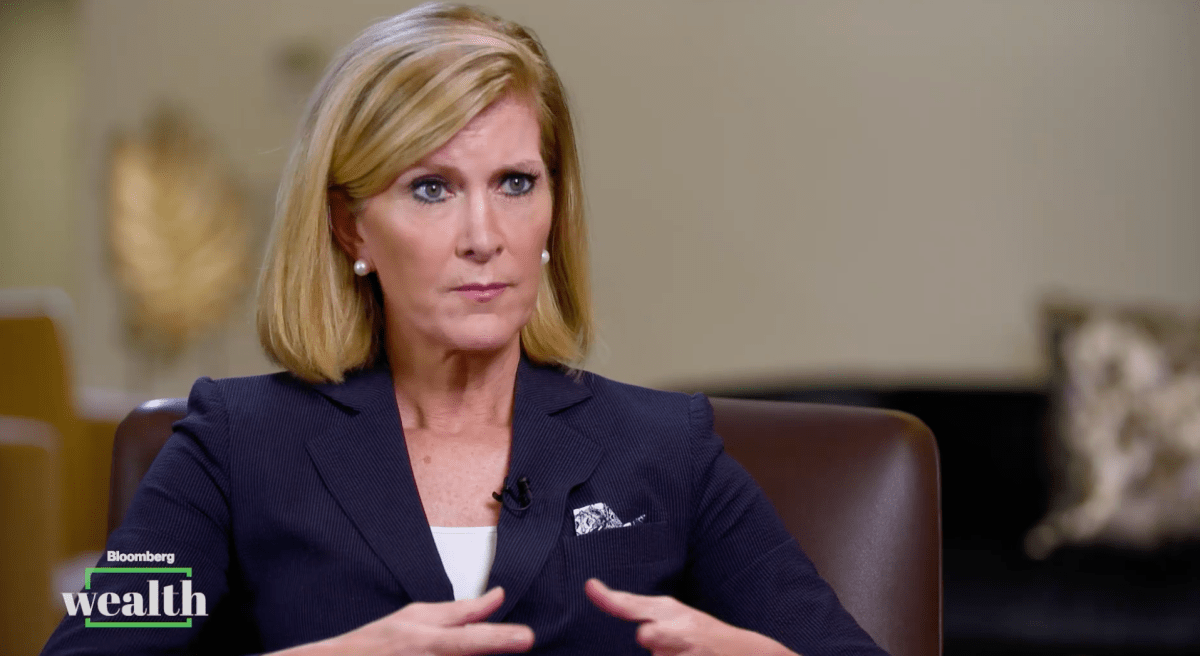

J.P. Morgan's head of wealth management says clients are increasingly viewing Bitcoin as an asset class.JP Morgan Asset & Wealth Management CEO Mary Callahan Erdoes says the banking giant’s clients see bitcoin as an asset class and “want to invest.” The remarks came in a video clip from "Bloomberg Wealth with David Rubenstein” released Tuesday by the media outlet, but that was first recorded on June 7.When asked by Rubenstein whether she would facilitate transactions for clients who love Bitcoin, Erdoes appeared to defer, arguing it’s “blockchains and digital currencies” that are “changing....

Related News

JPMorgan says a lot of its asset and wealth management clients think cryptocurrency is an asset class and they want to invest in it. “Our job is to help them to put their money where they want to invest,” said the CEO of J.P. Morgan Asset & Wealth Management. A Lot of JPMorgan Clients Consider Cryptocurrency an Asset Class Mary Callahan Erdoes, J.P. Morgan Asset & Wealth Management’s CEO, talked about her firm’s approach to cryptocurrencies in an interview with Bloomberg Wealth, published Tuesday. JPMorgan Chase’s asset and wealth management line of business....

The hunger for Bitcoin exposure is on the rise, despite the recent bearish price action. At least, that’s what some J.P. Morgan clients have told the banking giant, according to Mary Callahan Erdoes. CEO for J.P. Morgan Asset & Wealth Management, Erdoes believes that blockchain technology is more relevant than Bitcoin. The former, said the […]

“The volatility you see in it today just has to play itself out,” JPMorgan’s director of asset and wealth management said. Despite Bitcoin (BTC) not yet emerging as an “asset class per se,” JPMorgan considers it important to meet the demand for cryptocurrency investment, according to a senior wealth management executive.A large number of JPMorgan clients see digital currencies like Bitcoin as an asset class, the company’s director of asset and wealth management, Mary Callahan Erdoes, said.In a Bloomberg interview released Tuesday, Erdoes stressed that the bank will continue providing....

One of the largest U.S. investment banks, Morgan Stanley, will be offering its wealth management clients access to bitcoin funds. Goldman Sachs, JPMorgan Chase, and Bank of America’s wealth management divisions do not currently allow their advisors to offer direct investment in bitcoin funds. Morgan Stanley to Offer Wealth Clients Access to Bitcoin Funds Investment bank Morgan Stanley, with $4 trillion in client assets, has become the “first big U.S. bank to offer its wealth management clients access to bitcoin funds,” CNBC reported Wednesday. The firm reportedly told its....

Morgan Stanley’s chief global strategist says that “regardless of where the price of bitcoin goes next, cryptocurrencies are here to stay as a serious asset class.” He added that bitcoin is making progress towards replacing the dollar as a medium of exchange. Morgan Stanley Bullish on Bitcoin and Cryptocurrencies Morgan Stanley’s head of emerging markets and chief global strategist, Ruchir Sharma, published a report entitled “Why Crypto Is Coming Out of the Shadows” on the Morgan Stanley website last week. “Despite the jitters natural in a global....