Ghana Ranked as Country With Second-Highest Debt Default Risk Globally

According to Visual Capitalist, Ghana is now placed second on its list of countries with the highest default risk in 2022. Only four countries, namely, Ukraine 10,856 basis points (bps), Argentina (4,470), El Salvador (3,376), and Ethiopia (3,035) have a credit default swap spread that is higher than Ghana’s at 2,071 bps. El Salvador Has Highest Default Risk After seeing inflation surge to over 29% in June, Ghana, West Africa’s second-largest economy, is now ranked as one of the countries most likely to default this year, Visual Capitalist’s latest sovereign debt....

Related News

A new study has ranked Nigeria as the country most curious about cryptocurrency post the April crypto market crash. The same study findings show Kenya as the second-highest ranked African country. According to Bobby Ong, co-founder of Coingecko, the countries topping the list seem more interested in buying the dip and this highlights “their long-term outlook for cryptocurrencies.”

Nigerian Solana Searches Third Highest Globally

After the cryptocurrency market crashed in April, a new study found Nigeria as the number one ranked country among English-speaking....

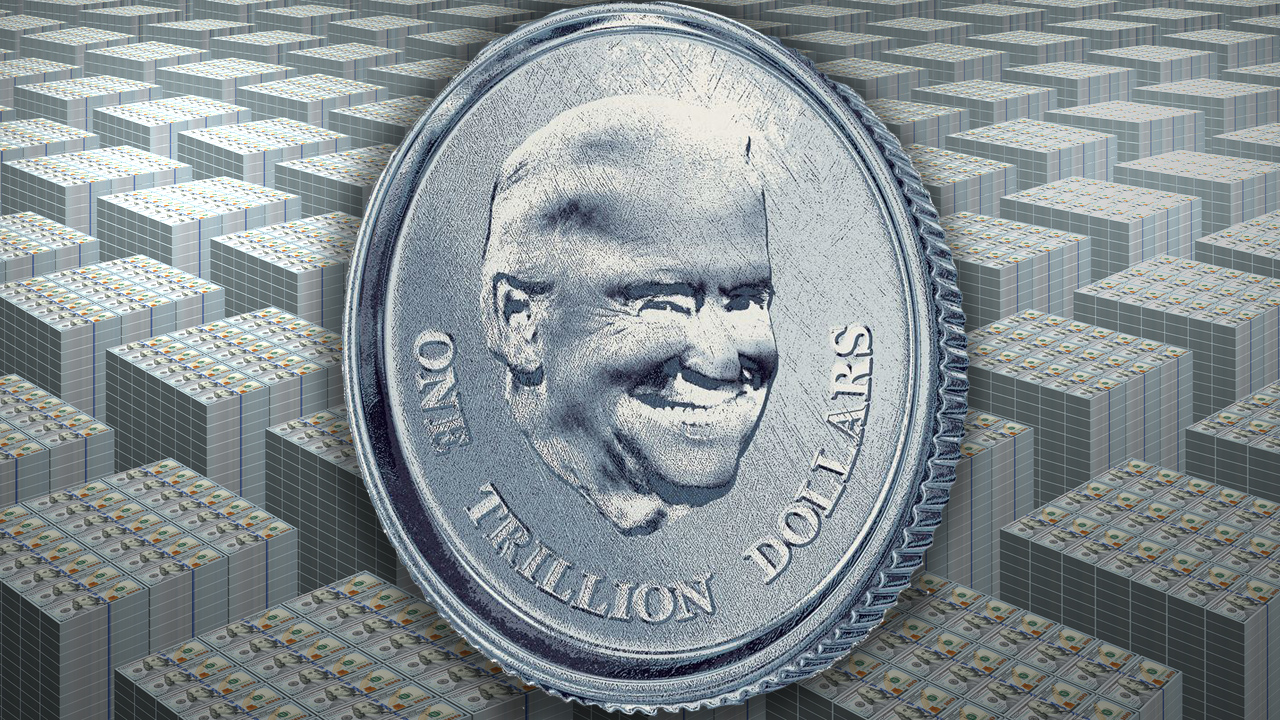

American politicians have been clamoring about the U.S. facing a significant debt crisis and the debt ceiling putting the country at risk of default. Joe Biden spoke about the debt ceiling and told Republicans to “just get out of the way” when it comes to the decision. Meanwhile, a number of U.S. bureaucrats are floating the idea of minting a $1 trillion platinum coin in order to magically bolster the treasury with cash. Trillion-Dollar Coin Concept Strongly Considered by US Politicians, Former US Mint Director Says Platinum Coin Can Be Minted in Mere Hours Simply creating....

Presidential candidate Donald Trump claimed that the US is incapable of defaulting on its debt because of the Federal Reserve’s ability to “print money.” The Republican Party’s presumptive presidential nominee attempted to clarify previous statements that he could persuade America’s creditors to accept less than full payment for the national debt, which was construed by some publications to mean he intended to default. Trump insisted that he meant that the US could simply buy back debt at a discounted rate. “You know, I’m the king of debt. I understand debt probably better than anybody. I....

Ghana’s ongoing economic woes appeared to worsen in July after data from the country’s statistical agency, Ghana Statistical Service, suggested that the inflation rate is now nearly 31.7%. The nearly 2% increase in the country’s inflation rate comes at a time when the local currency is reported to have depreciated by as much as 30% since the start of the year.

Economist Recommends Installation of Currency Board

According to the latest data from Ghana Statistical Service (GSS), the West African nation’s year-on-year inflation rate for July rose to....

James Downer is a student of International Relations and Computer Science and is fascinated by the collision between the two subjects. In this article, Downer discusses last Wednesday's debt default by Argentina, bitcoin's growing role in the country and its thriving black market for dollars. If Argentina's 'Default Wednesday' had been as bad as its 2001 debt default, the country's citizens would be scrambling en masse for alternatives to the peso - such as bitcoin. When Cyprus, with a population of just over a million, suffered a financial crisis in 2013, freezing bank accounts and....