Why Argentina's Debt Default is an Opportunity for Bitcoin

James Downer is a student of International Relations and Computer Science and is fascinated by the collision between the two subjects. In this article, Downer discusses last Wednesday's debt default by Argentina, bitcoin's growing role in the country and its thriving black market for dollars. If Argentina's 'Default Wednesday' had been as bad as its 2001 debt default, the country's citizens would be scrambling en masse for alternatives to the peso - such as bitcoin. When Cyprus, with a population of just over a million, suffered a financial crisis in 2013, freezing bank accounts and....

Related News

Presidential candidate Donald Trump claimed that the US is incapable of defaulting on its debt because of the Federal Reserve’s ability to “print money.” The Republican Party’s presumptive presidential nominee attempted to clarify previous statements that he could persuade America’s creditors to accept less than full payment for the national debt, which was construed by some publications to mean he intended to default. Trump insisted that he meant that the US could simply buy back debt at a discounted rate. “You know, I’m the king of debt. I understand debt probably better than anybody. I....

According to Visual Capitalist, Ghana is now placed second on its list of countries with the highest default risk in 2022. Only four countries, namely, Ukraine 10,856 basis points (bps), Argentina (4,470), El Salvador (3,376), and Ethiopia (3,035) have a credit default swap spread that is higher than Ghana’s at 2,071 bps. El Salvador Has Highest Default Risk After seeing inflation surge to over 29% in June, Ghana, West Africa’s second-largest economy, is now ranked as one of the countries most likely to default this year, Visual Capitalist’s latest sovereign debt....

Working out a repayment plan should be the top priority for the Puerto Rican government, but that will not be the case for the foreseeable future. Puerto Rico is not often mentioned in a positive content when it comes to the financial sector. Neither is this story, unfortunately, as the country decided to default on its debt. But at the same time, the reason for doing so makes a lot of sense. All of this is still somewhat good news to push Bitcoin adoption in the country to new heights, though. Defaulting on debt is never a good thing, particularly not for a region so deeply indebted as....

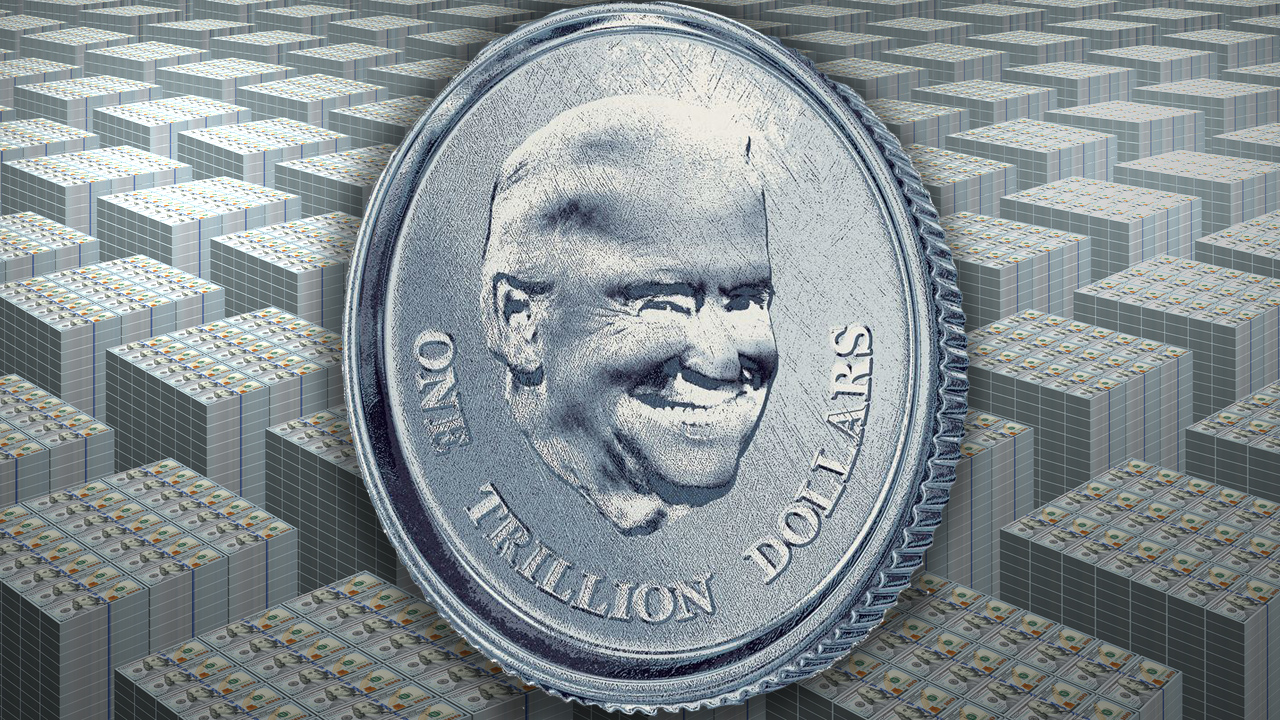

American politicians have been clamoring about the U.S. facing a significant debt crisis and the debt ceiling putting the country at risk of default. Joe Biden spoke about the debt ceiling and told Republicans to “just get out of the way” when it comes to the decision. Meanwhile, a number of U.S. bureaucrats are floating the idea of minting a $1 trillion platinum coin in order to magically bolster the treasury with cash. Trillion-Dollar Coin Concept Strongly Considered by US Politicians, Former US Mint Director Says Platinum Coin Can Be Minted in Mere Hours Simply creating....

Something BIG is happening in Argentina... From December 7 through 8, Bitcoin enthusiasts and those interested in learning about this digital, decentralized phenomena will gather in Buenos Aires, Argentina for the first Latin American Bitcoin Conference hosted by the Fundación Bitcoin Argentina. Why Argentina? The Argentinian Bitcoin community is rapidly growing in reaction to national economic strain, but most importantly due to the opportunities Bitcoin represents as a disruptive technology and economic growth potential. With an inflating Argentinian Peso and limited access to additional....