Soaring decentralized exchange volume suggests the DeFi craze is not over

Data shows decentralized exchange volume skyrocketed in the last 6-months and Uniswap leads the pack. Uniswap, the most widely utilized decentralized exchange on Ethereum, has seen explosive growth throughout the second quarter. In fact, less than a month ago, Uniswap’s trading volume surpassed Coinbase Pro as the exchange processed $426 million worth of trades in a 24 hour span.Throughout 2019, the decentralized finance (DeFi) market was relatively stagnant until the concept of yield farming and governance tokens became more popular. Yield farming is a process where investors utilize....

Related News

Driven by the recent NFT and DeFi craze, Solana’s SOL set its all-time high earlier today. According to CoinMarketCap, the cryptocurrency is up 12.62% and 70.86% in the past 24 hours and the past week, respectively. SOL’s explosive growth led to the cryptocurrency’s market capitalization soaring to over $43 billion — surpassing Dogecoin to become […]

Uniswap processed $15.3 billion in monthly volume in September, outpacing Coinbase and signalling that DeFi is here to stay. Data from Dune Analytics shows that in the month of September Uniswap decentralized exchange processed $15.371 billion in volume. In the same period, reports indicate that Coinbase processed $13.6 billion.Monthly decentralized exchange volume. Source: Dune AnalyticsThe significant spike in Uniswap’s volume can be attributed to two major factors. First, the explosive growth of decentralized finance (DeFi) and yield farming of governance tokens caused decentralized....

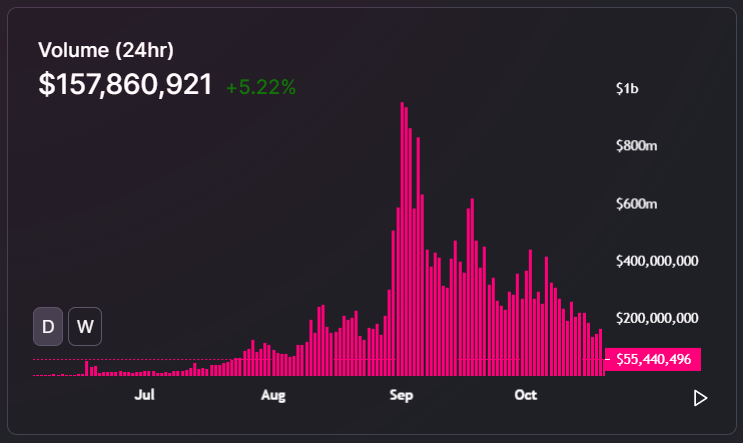

Despite pullback, trading volumes on decentralized exchanges are still significantly higher than Q2. The trading volume on decentralized exchanges, or DEXs, reached $42.6 billion during Q3 2020, marking an increase of 1,132% on the previous quarter, according to a recent industry report from TokenInsight.However, October saw figures pull back a little from September highs, as Bitcoin (BTC) prices started to pump, re-capturing traders' attention following the previous few months' decentralized finance, or DeFi, boom.Volumes in July alone reached $5 billion, which was up one third on the....

DeFi tokens have been around for a few months now — long enough to plot some recurring trends that show some clear patterns. Decentralized exchanges have been around for a while now, but it’s only been since the grip of decentralized finance mania has taken hold that they’ve come into their own. The growth in DEX use has been nothing short of exponential, with volumes pretty much doubling in August and September compared with the preceding months.But is volume alone telling the whole story? Amid the DeFi frenzy, some of the biggest winners have been DeFi governance tokens. Kicking off with....

The decentralized finance (DeFi) market is slumping as large-cap tokens like Uniswap (UNI), Yearn.finance (YFI), and Maker (MKR) decline. Atop the lackluster performance of major tokens, the volume of the Uniswap decentralized exchange has substantially dropped. On September 1, when Uniswap surpassed Coinbase Pro in daily volume, it processed $953.59 million of volume in 24 […]