Grayscale Bitcoin Trust FUD is now over as the last GBTC unlock totals just 5...

What was once a major bearish narrative exits via the tradesman’s entrance after failing to have any impact on Bitcoin markets. Bitcoin (BTC) investment vehicle the Grayscale Bitcoin Trust (GBTC) completed its share unlockings this week, ending a major talking point both inside and outside crypto.Data from monitoring resource Bybt confirms that as of Thursday, no more unlockings are scheduled.Bitcoin shrugs off another FUD narrativeUnlocking events at GBTC have continued throughout 2021 and, at one point, formed the focal point for bearish BTC price predictions.With the equivalent of tens....

Related News

The Grayscale Bitcoin Trust (GBTC) has made a name for itself in the public markets as not only the first-ever publicly traded trust underlined by a cryptocurrency, but it is also the largest bitcoin trust in the world. However, Grayscale has not had an easy go of it in the last as it had been […]

Will GBTC get to become the first US-based spot bitcoin ETF? The euphoria from six months ago turned into Grayscale hinting that it might sue the SEC if its request is denied. Currently, the climate dictates that the answer will probably be negative, but the company is not giving up. According to CNBC, Grayscale “met privately with the Securities and Exchange Commission last week in an effort to persuade the regulator to approve the conversion of its flagship fund into an ETF.” Related Reading | Grayscale Removes Bancor (BNT) And Universal Market Access (UMA) From Its DeFi Fund The....

Grayscale Bitcoin Trust's premium is now above 30% as institutional demand for BTC continues to increase. The demand for the Grayscale Bitcoin Trust (GBTC) continues to rise with its premium surpassing 30% on Dec. 3. This indicates that Bitcoin (BTC) is seeing increasing institutional demand as its price consolidates above $19,000.The Grayscale Bitcoin Trust is an institutional vehicle that is tradable in the United States through OTC markets. Accredited and institutional investors typically use the trust to obtain exposure to BTC with their brokerage accounts.Why is the Grayscale Bitcoin....

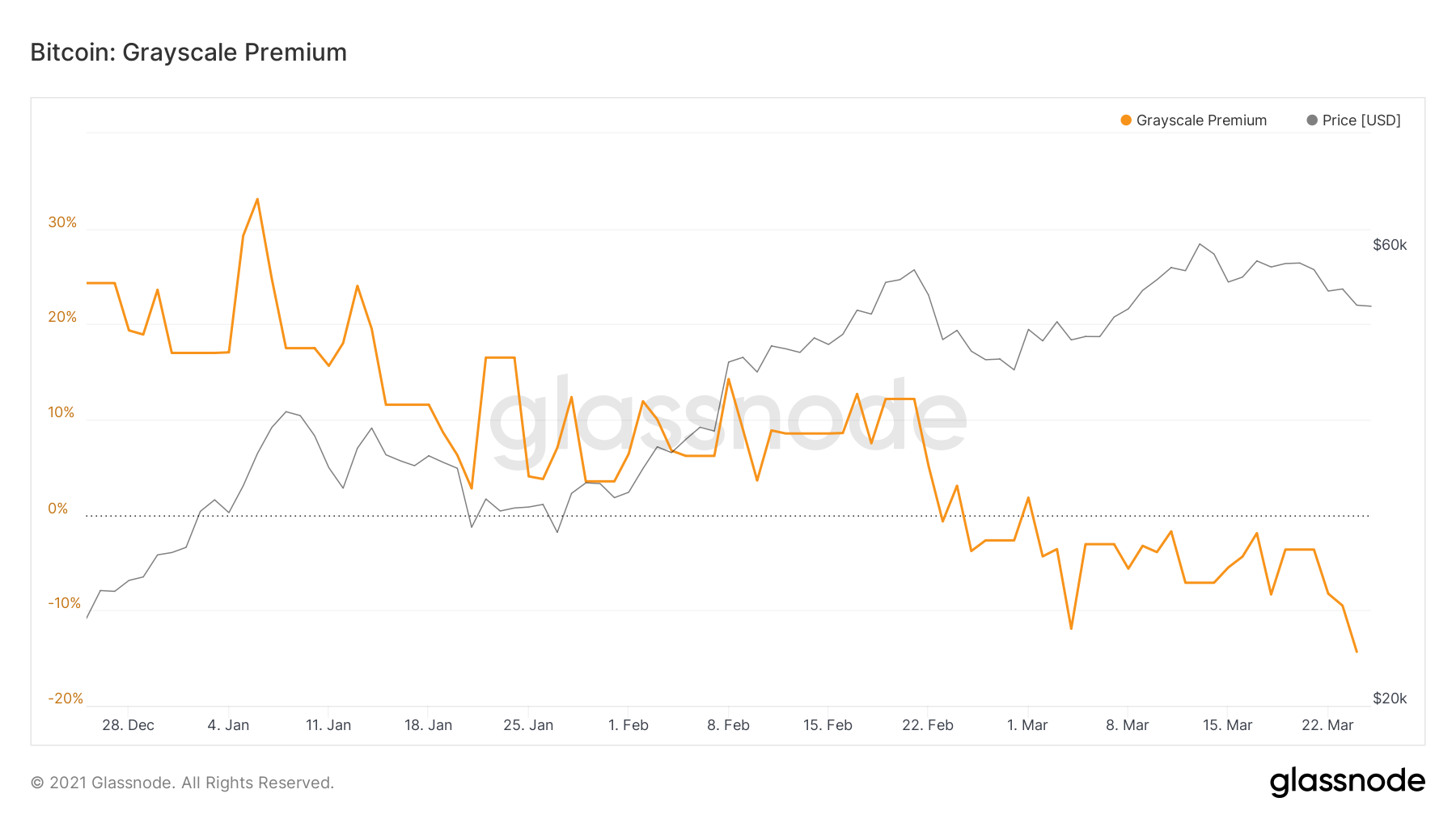

For the past two months, Grayscale Bitcoin Trust (GBTC) has traded at a negative premium to the net asset value (NAV). GBTC historically traded at a high premium relative to the underlying, averaging a 15% premium since the fund’s inception. This was largely due to GBTC being the only investment vehicle easily accessible to institutional […]

Since trading at a negative for nearly 2 months, GrayScale Bitcoin Trust (GBTC) premium plummeted to -14.21% this morning. Historically, GBTC has traded at a high premium relative to the underlying Bitcoin, commanding an average of 15.02% premium since the fund’s inception. But as competition grows and firms create cheaper, more accurate financial products, GBTC’s appeal has dropped dramatically — and its premium clearly shows for it. Analyzing Why Grayscale Bitcoin Trust Premium Continues to […]