3 key metrics show DeFi's TVL on the verge of a new ATH

The $4 billion gap between the current decentralized finance TVL and an ATH could be closed using recent implementations from AAVE, Curve and Spell Token. As 2022 gets underway, the decentralized finance (DeFi) sector of the cryptocurrency ecosystem appears to be gaining momentum in what could be an echo of the bullish market seen in seen in early 2021. Data from crypto market intelligence firm Messari shows that over the past 30 days, five out of the top 10 DeFi protocols have seen their tokens post double-digit gains. This is in spite of the struggles that Bitcoin has faced, a dynamic....

Related News

According to various reports, the cryptocurrency network Verge has suffered a 51% attack that led to a massive 560,000+ block reorganization. Analysts believe the Verge network attack could be the deepest blockchain reorganization (reorg) in history with roughly 200 days worth of verge transactions wiped. Reports Show Verge Network Experienced a Massive 560,000+ Blocks Reorg The blockchain Verge and its native token XVG once made headlines for being added to the popular adult website Pornhub. This week, the Verge network has been 51% attacked according to multiple analysts and observers on....

On February 15, the total value locked (TVL) in decentralized finance (defi) platforms is just above the $200 billion range, after a brief slump below that region last week. Out of the entire TVL in defi today, Ethereum commands 59.22% of that value with 532 defi protocols. Metrics during the last seven days show a number of relatively unknown defi protocols have attracted significant TVL percentage gains. Defi TVL Climbs Over 3%, $4.5 Billion in 24-Hour Dex Trade Volume The total value locked (TVL) in defi today is up around 3.3% during the last 24 hours with $208.45 billion. The defi....

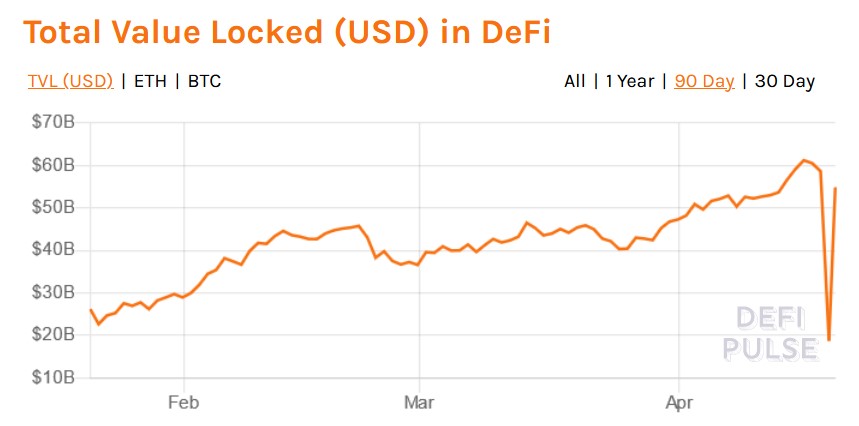

The pullback in the value of Yearn.finance and Aave signals that the DeFi market may be oversold but increasing revenues of the top projects suggests otherwise. Over the last month the crypto market has seen a significant amount of volatility as a 6-month altcoin bull market abruptly came to an end with the most recent Bitcoin (BTC) price rejection at $12,000.At the same time, the DeFi sector saw an amazing run as the total value locked in DeFi platforms surged above $10 billion but at the time of writing the sector is in the midst of a mild correction.DeFi index daily, weekly, monthly....

DeFi platforms have seen a steady surge in user activity and token prices, leading some analysts to say that the ‘DeFi Summer 2.0’ is well underway. After a blistering start to 2021 saw token valuations and trading volumes surge to ignite the current bull market, the DeFi sector as a whole took a break while the NFT sector stepped into the limelight. While investors' attention was elsewhere, DeFi prices have had time to consolidate and project developers were able to focus on protocol upgrades and in the past month, DeFi-related tokens have been gaining traction and look poised for a....

The DeFi sector saw a sharp drooped in its Total Value Locked, according to DeFi Pulse data. At the time of writing, the metric is recovering quickly and stands at $54.93B. Sitting at the number six spot on the top 10 DeFi protocols by TVL with $3.88B, SushiSwap could be on the verge of taking […]