Current Bitcoin Consolidation Zone Could Act As The Next Bear Market Bottom

With only a 30% pullback on the books, it is hard to consider the most recent consolidation phase in Bitcoin much of a correction. But whatever base is currently being built within this range, could act as the next bear market botton after the leading cryptocurrency by market cap tops out and the cycle restarts […]

Related News

With bitcoin rallying, all the focus has been on predicting where the price of the asset will be by the end of the year. The digital asset is undoubtedly going to enter a period where various crashes will send the price down, popularly known as a bear market. Not a lot of attention has been paid to where the price of the asset might bottom out when the market inevitably goes into another bear market. This usually long stretch of low momentum has seen bitcoin lose 94%, 87%, and 84% of its peak value respectively in the last three bear markets. One recurring theme of the bear markets has....

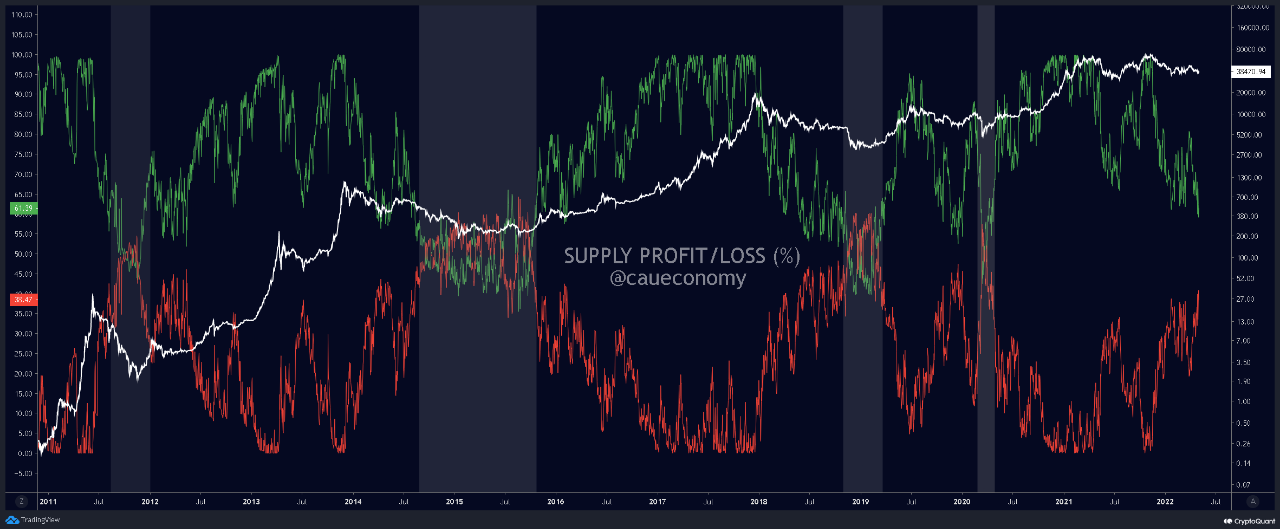

On-chain data shows the Bitcoin supply in loss is still around 48%, which is lesser than the values observed during past bear market bottoms. About 52% Of The Total Bitcoin Supply Is In Profit At The Moment As pointed out by an analyst in a CryptoQuant post, BTC may see further decline before a bottom […]

The chase for the bitcoin bottom is still on since the digital asset fell below its $20,000 price level. Given that the bear market has not been long in the making, it stands to reason that the bull market isn’t here just yet. However, being able to pinpoint when the cryptocurrency has reached as low as it will go can help make smart investment choices and the previous bear trends can shine a light to how it might play out. Previous Bitcoin Bear Markets The most recent bitcoin bear markets point towards some important trends that may occur before a bitcoin bottom is established. The 2018....

On-chain data shows Bitcoin hasn’t yet hit a bear market bottom as the supply in profit is still more than that in loss. Bitcoin Supply In Profit/Loss Says A Majority Of Network Is Still In Profit As explained by an analyst in a CryptoQuant post, past trend may suggest that the current BTC market still […]

Bitcoin. The bottom. Are we there yet? Several higher timeframe metrics suggest BTC’s real bottom will be somewhere around $10,000. Bear markets have historically been challenging to navigate for traders and the conventional set of "reliable" indicators that determine good entry points are unable to predict how long a crypto winter might last.Bitcoin’s (BTC) recent recovery back above the psychologically important price level of $20,000 was a sign to many traders that the bottom was in, but a deeper dive into the data suggests that the short-term relief rally might not be enough proof of a....