This Bear Market Indicator Says Bitcoin Price Is Headed For Crash To $40,000,...

The Bitcoin price could be headed for more pain, as a crypto analyst has identified a new bear market indicator that suggests a crash to $40,000 is imminent. The analyst has predicted when this deep price decline is set to occur, warning investors to remain cautious or risk selling at a loss. Xanrox, a crypto analyst on TradingView, shared a detailed price analysis of Bitcoin on March 17, predicting that the pioneer cryptocurrency is set to crash to $40,000 by 2026. The analyst revealed that Bitcoin follows a predictable cycle pattern tied to its halving events, which occur every four....

Related News

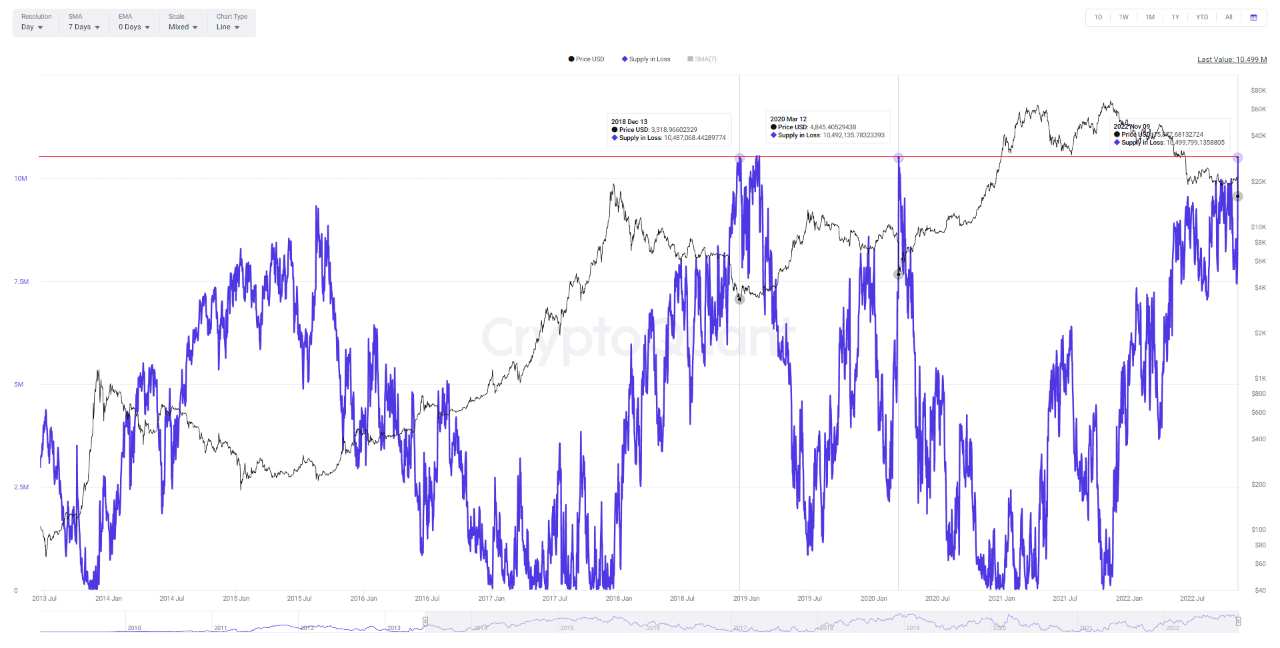

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....

Bitcoin NUPL indicator has sharply dropped in value recently, a trend that may signal the start of the early bear market period. After The Crash, Bitcoin NUPL Value Has Declined To 32.5% According to the latest weekly report from Glassnode, the BTC NUPL’s recent trend may suggest that the early bear market is now beginning. The “Net Unrealized Profit and Loss” (or NUPL in short) is an on-chain indicator that measures the difference between the relative unrealized profit and the relative unrealized loss. NUPL = (Market Cap – Realized Cap) / Market Cap In simpler....

Sentiment around Bitcoin has suffered a major hit in recent weeks after the price fell below $100,000. This has led to a series of bearish predictions for the cryptocurrency, as many analysts and investors alike believe that the crash is far from over. One analyst, who goes by Mr. Wall Street on the X (formerly Twitter) platform, has predicted a step decline, revealing how low the Bitcoin price will go and when the crash should be expected to be over. Bitcoin Headed below $60,000? In the post, Mr. Wall Street expressed that the Bitcoin price has already hit its cycle top, and as such,....

Let’s cut to the chase: Glassnode thinks we’re in a bear market. In their latest “The Week On-Chain” newsletter, the company tries to “establish the likelihood that a prolonged bear market is in play” by “using historical investor behaviour, and profitability patterns as our guide.” One thing’s for sure, the recent crash was severe, and “such a heavy drawdown is likely to change investor perceptions and sentiment at a macro scale.” Related Reading | Bitcoin Leads As Markets Sees Record Outflows. Bear Market Incoming? How severe was it? According to Glassnode, “this is now the second....

With the Bitcoin price struggling recently, the expectations are that the crypto market is headed into another bear run. This is characterized by Bitcoin losing $100,000 after over four months, and has not been able to reclaim this major level. Meanwhile, sell-offs among whales have continued, putting billions of dollars worth of selling pressure on the cryptocurrency. As such, the probability that Bitcoin is going into a bear market has shot up considerably during this time. Analyst Warns Of Imminent Bitcoin Bear Market Crypto analyst Titan of Crypto has taken to the X (formerly Twitter)....