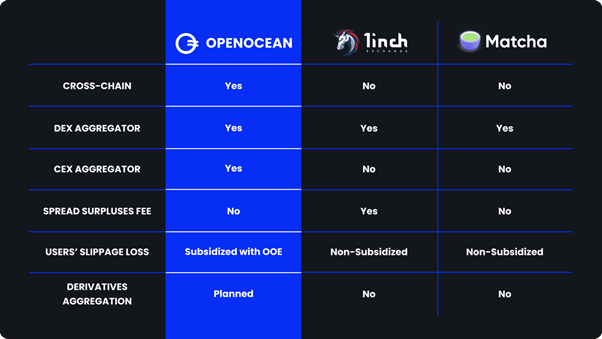

OpenOcean – Aggregating the Full Liquidity Across All Cryptocurrency Markets

User experience has been a longstanding problem in cryptocurrency. Early adopters have accepted many issues that just don’t exist in traditional financial markets, including friction with onboarding, slow block confirmation times, and exchange outages. However, perhaps one of the most significant UX issues for cryptocurrency traders and investors is liquidity. The cryptocurrency markets are heavily […]

Related News

OpenOcean, the leading DeFi and CeFi full aggregation protocol, recently conducted a poll on its Twitter handle asking its community which network they would want to see aggregated next. The community overwhelmingly voted for Polygon Network. While 48.7% of the total votes cast went in favor of Polygon, Solana came second with a little above […]

The 2021 bull market continues to rage on, fueled by an inflow of institutional money, the likes of which has never been seen before in crypto. And it looks set to continue. Most experts agree that we can expect to see further growth over the remainder of this year, with the numbers to back it […]

In early 2009, Bitcoin trading was peer-to-peer, initially via PayPal. However, it only took a few months before the first ramp was launched. Mt Gox and earlier variants were, as expected, rudimentary and centralized. Fast-forward less than a decade later, and crypto trading is a vibrant industry with billions moved every day. Exchanges are critical channels for moving billions of assets between users and chains. As the industry expands and crypto finds adoption, their role will only be magnified. This rise is especially when decentralized finance (DeFi) is at the fore, dangling....

Coinsetter is a Wall Street built bitcoin exchange for firms and individuals. The company’s trading platform puts the power of institutional bitcoin trading at the customers fingertips. Coinsetter offers an industry leading feature set to all types of users by aggregating the feeds of multiple exchanges to offer the best bitcoin prices available anywhere along with a deep liquidity near the market price nearly unmatched. Both businesses and individuals can benefit from using Coinsetter bitcoin exchange. The company’s full exchange feature set is widely available to most customers with....

One of the most important factors in the market is liquidity. The global reduction in liquidity has sent asset classes to new lows and destroys wealth.