JPMorgan Says Investors Can Put 1% of Their Portfolios in Bitcoin Despite Cal...

After saying that cryptocurrencies “rank as the poorest hedge for major drawdowns in equities, with questionable diversification benefits,” JPMorgan says investors can put 1% of their portfolios in cryptocurrencies. This can help “achieve any efficiency gain in the overall risk-adjusted returns of the portfolio,” the firm’s strategists explained. Investors Can Allocate 1% of Portfolios to Bitcoin, Says JPMorgan JPMorgan Chase now sees benefits in adding a small percentage of bitcoin to a multi-asset portfolio. The firm’s global head of research, Joyce....

Related News

JP Morgan has outlined three key reasons why investors should add bitcoin to their investment portfolios. Small allocations to cryptocurrencies would “improve portfolio efficiency due to high returns and moderate correlations,” JPMorgan’s analyst explained. JP Morgan Sees Benefits of Hedging With Bitcoin JPMorgan released a report last week entitled “What cryptocurrencies have and haven’t done for multi-asset portfolios.” Published by the firm’s head of Cross-Asset Strategy division, John Normand, the report explores cryptocurrencies’ use for....

Global investment bank JPMorgan has doubled down on its bitcoin price prediction of $146K. The bank’s analyst explained that the price of the cryptocurrency could reach that level if its volatility subsides and institutional investors start investing in bitcoin more than gold in their portfolios.

JPMorgan Renews $146K Bitcoin Price Prediction

JPMorgan released an inaugural report of its new publication last week focusing on the outlook for alternative investments, including digital assets. A new report is expected to be released every two to three months.

The....

Global investment bank JPMorgan says institutional investors are returning to bitcoin, seeing the cryptocurrency as a better hedge than gold. The firm’s analysts describe three key drivers boosting the price of bitcoin in recent weeks, including assurances that U.S. policymakers will not ban cryptocurrencies.

JPMorgan Sees Renewed Interest in Bitcoin

JPMorgan published a research note Thursday stating that institutional investors are returning to bitcoin. Citing the trend of money flowing out of gold into BTC, the firm’s analysts wrote:

Institutional investors....

Global investment bank JPMorgan says cryptocurrency markets are “looking frothy” as retail investors spill over from the stock market into cryptocurrencies and non-fungible tokens (NFTs). Crypto Markets Look Frothy, According to JPMorgan JPMorgan published a note Wednesday on the stock market and cryptocurrencies. It explains that retail investors bought stocks at a record pace over the summer with an estimated net flow into the U.S. stock market of $13 billion in August after reaching a record high of almost $16 billion in July. The JPMorgan analysts asserted that the....

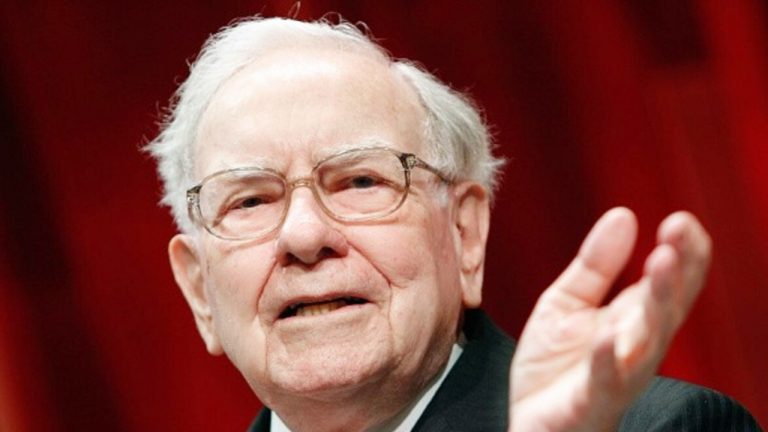

Investment bank JPMorgan conducted a survey of thousands of investors from 1,500 institutions and found that 49% of them think that cryptocurrency is either “rat poison squared,” the term used by Berkshire Hathaway CEO Warren Buffett to describe bitcoin, or “a temporary fad.” 49% of Investors Told JPMorgan Cryptocurrency Is a Fad or ‘Rat Poison Squared’ JPMorgan released the results of a survey it conducted at the firm’s 24th Macro, Quantitative & Derivatives Conference Tuesday. The event took place on June 11; it was attended by some 3,000....