Fiat inflation has cost Bitcoin hodlers 20% over the past decade

Since 2010, inflation has turned $1 into 84 cents while $1 invested in Bitcoin would be worth $274,000. Bad news — the increase in the Bitcoin (BTC) price over the past decade may have been overstated because of the accompanying fiat inflation. Since Bitcoin is typically denominated in fiat — United States dollars usually — it is not immune to its depreciation.Bitcoin price versus Bitcoin price adjusted for inflation. Source: Cointelegraph.In the decade that followed the economic crisis, the U.S. enjoyed some of the lowest inflation in history, which hovered around 2% annually. However,....

Related News

As high inflation destroys the purchasing power of fiat, these options offer hodlers a way to add to their portfolio without breaking the bank. Experienced crypto traders know that bull markets are for selling and bear markets are for accumulation, but the latter can be difficult amid a backdrop of surging inflation that saps the purchasing power of fiat currencies. As the crypto market heads deeper into crypto winter, with prices in the gutter and developers focused on creating the next popular protocol or breakout token, some crypto fans have begun to explore new ways of increasing their....

Inflation rates have been rising for some time now. This is attributed to the indiscriminate printing of fiat money by the Fed and has been a growing concern to investors, especially those investing for the long term. United States inflation rates have now risen to 7% as Biden’s administration continues to be rocked by inflation concerns. This high growth rate has led investors to look for ways to hedge for inflation. Now, gold has always been the standard inflation hedge. It has dominated the market for decades, and for thousands of years of human civilization, it has been the agreed-upon....

The cost of an Apple iPhone over the years has only gone up. But has the iPhone price over the past decade outpaced the price of BTC, or ETH? Not even close, according to a new report from the folks at CoinGecko. The research team at CoinGecko went on a deep dive into the price […]

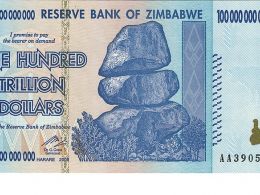

Another fiat currency struggles to stay afloat as the Venezuela Bolivar looks to be in the throes of hyperinflation, which has been forecast for at least the last 18 months. Within black-market currency exchanges, the Bolivar has lost about 50% of its value versus the US Dollar in the month of November. In a sign of desperation, the nation-state has suspended reporting of their inflation rate for the time being. Also read: "BitPagos is Bringing Bitcoin to the Developing World". Will Venezuela Suffer Zimbabwe-levels of Hyperinflation? As you may know, inflation is a part of any fiat....

Inflation is one of those read-the-small-print kind of taxes that people don’t often think about even though it can have a major impact on their finances and, thereby, on their lives. Rising long-term inflation is more insidious than you might think because it can steadily and most assuredly decrease the value of your earnings/savings – especially, if your taxes aren’t indexed to compensate you for the cost of inflation. Inflation has always been the bane of many businesses and individuals alike. One thing is clear: something needs to be done. If cryptocurrency, perhaps Bitcoin, was....