Core Scientific to increase ASIC server capacity by 75 MW

The Nasdaq-listed Bitcoin miner expects to generate $50 million in annual revenue once the ASIC servers are fully operational. United States Bitcoin (BTC) miner Core Scientific has signed a new colocation agreement to increase its data center hosting capacity by 75 megawatts (MW), a move intended to showcase the company’s ongoing commitment to boosting its infrastructure capabilities amid the ongoing bear market. The new agreement will generate roughly $50 million in annual revenue for Core Scientific once the ASICs are fully deployed, the company announced Tuesday. The agreement includes....

Related News

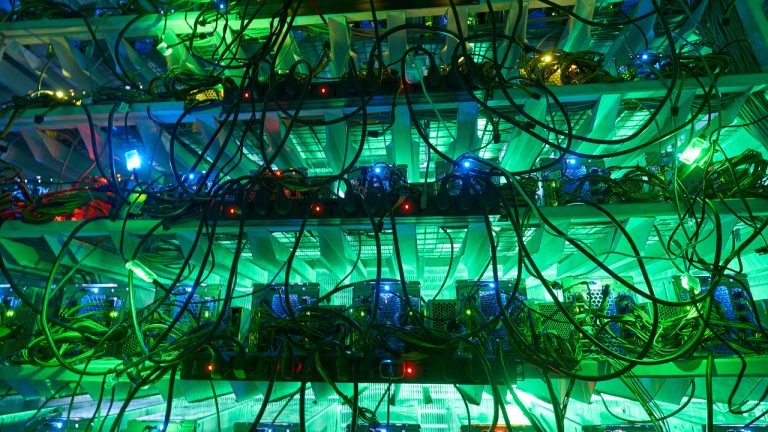

While the current quarter in the crypto market has been bad for many companies as Bitcoin dropped, it has been successful for some. Core Scientific has proven that market lows can be beneficial if the right opportunity is identified. The U.S-based crypto mining company produced 1,334 BTC in August and sold over 1,125 Bitcoin for $25.9 million in approximate. According to Core Scientific’s August Production and Operational updates, it operated 25,451 ASIC servers for colocation and self-mining. Also, data shows that the hash rate produced was about 21.54EH/s (hash rate per second). Related....

The sale left the firm with 1,959 BTC at the end of the second quarter, a more than 75% drop when compared with its reported 8,058 BTC holdings as of May 31. United States-based cryptocurrency mining firm Core Scientific sold more than 7,000 Bitcoin in June to pay for servers, increase its data capacity, and settle debts.In a Tuesday announcement, Core Scientific said it had sold roughly $167 million worth of Bitcoin (BTC) in June at an average price of $23,000 — 7,202 BTC. The sale left the firm with 1,959 BTC — roughly 21% of its holdings — and $132 million in cash as of June 30, a....

One of the largest publicly listed bitcoin miners, Core Scientific, has shaken investors with a recent filing with the U.S. Securities and Exchange Commission that raises the possibility the company may apply for bankruptcy protection. The filing notes that Core Scientific will be unable to pay down debt payments due for Oct. and early Nov. 2022. SEC Filing Shakes Core Scientific Investors, CORZ Slides 97% in 12 Months Bitcoin miners are having issues after the price of bitcoin (BTC) has slid roughly 70% against the U.S. dollar since Nov. 10, 2021. Moreover, the network’s mining....

Core Scientific, a major blockchain hosting and digital asset mining company, is going public through a merger with Power & Digital Infrastructure Acquisition Corp. The deal values the combined company at approximately $4.3 billion. Core Scientific to List on Nasdaq Core Scientific Holding Co., one of the largest blockchain hosting and digital asset mining companies in North America, announced Wednesday its plan to go public on Nasdaq via a special purpose acquisition company (SPAC). The crypto firm has entered into “a definitive merger agreement” with Power & Digital....

A major North American blockchain hosting provider announced its expansion by ordering over 58,000 additional S19 Series Antminers, as part of an agreement arranged with the Chinese mining hardware manufacturer. US Contract Miner Core Scientific Arranges Purchase of Over 58,000 Bitmain S19 Antminers According to the announcement, Bitmain’s deal expects to facilitate Core Scientific customers’ purchases through September 2021. The purchase agreement will bring total purchases to 76,024 next-generation bitcoin (BTC) miners, the S19 and S19 Pro Antminers for the past 16 months,....