As Visa and Mastercard raise fees, merchants may look to crypto

Cryptocurrencies have fees, but so do payment cards. Credit card providers charge merchants a cut of the payments they accepted, called interchange fees or swipe fees. With two major card providers aiming to elevate rates, could crypto become an alternative? “Visa Inc. and Mastercard Inc. are planning to raise swipe fees for some types of credit-card purchases in April,” the Wall Street Journal reported on Wednesday, adding: “Though invisible to consumers, they [interchange fees] are glaring to merchants, which often end up paying fees of about 2% of their customers’ credit-card purchases.....

Related News

A new way to pay by bitcoin is on the horizon, a bitcoin debit card called iBTCard. That name stands for International Bitcoin Transfer Card. The company behind the project, Tradecoinz LLC, is hoping to provide an alternative payment method to VISA and MasterCard, but in a way that most people can recognise and understand. We spoke to the founder and CEO of Tradecoinz, Cameron Halter, who told us that iBTCard will register with FinCEN as a money services business (MSB). He also stated that there will be policies in place to prevent theft and money laundering. One of those methods is a....

Walmart Canada has decided to stop accepting Visa cards as it feels that the fees charged by Visa are too high. Can Bitcoin provide a viable alternative to high charging payment processors like Visa? Credit Cards – An Expensive Affair. Credit cards are popular among customers as they provide a convenient way to pay, at no additional cost. However, merchants who accept credit cards are charged up to 2.5% of the transaction value as fees. Merchants are also subject to chargebacks over disputed transactions, which eats into their profits. Strong duopoly controls the market. The payment....

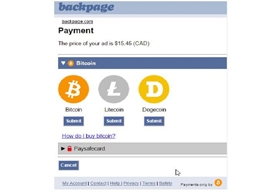

Backpage says “screw off” to squeamish credit card companies Visa and MasterCard by dropping fees for adult ads and announcing that it is going to accept all digital currencies like Bitcoin, Litecoin, and Dogecoin. Some estimates say Backpage’s acceptance could open up a $100m (£64m) opportunity for Bitcoin, since it is one of the site’s only remaining payment options. This decision came as Visa and MasterCard cut off their services to Backpage, citing illegal or brand-damaging activities as the reason. Therefore, users who want to post ads on Backpage must now use Bitcoin, Litecoin, or....

When Bitcoin supporters praise their favorite currency, one of the great attributes everyone discusses is the network’s low fees, paling in comparison to the major credit card companies such as Mastercard and Visa. Now, with Walmart dropping support for Visa in Canadian stores due to high fees, bitcoin could have a chance to shine. Walmart and Many....

The cost of traditional banking transactions has come into focus once again as Amazon announced it would no longer accept Visa credit cards for payment in the UK. It was part of a battle that began earlier this year in Singapore and Australia where the e-commerce giant took steps to deter Visa credit card payments. An Amazon spokesperson explained, “We believe the cost of accepting credit card payments should be going down over time to allow merchants to reinvest savings into low prices and shopping enhancements. Yet despite technical advancements, some cards’ cost of payments continue to....