Bitcoin Crash Dominated By US Selling, CryptoQuant Data Shows

On-chain analytics firm CryptoQuant has revealed how selling from US Bitcoin investors has dominated during the recent market downturn. Bitcoin Coinbase Premium Gap Points To US Selloff In a new thread on X, CryptoQuant has talked about some key pieces of data related to the US-dominated Bitcoin selloff. The first indicator that CryptoQuant has shared is the “Coinbase Premium Gap,” which keeps track of the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair). Related Reading: Dogecoin’s Strongest Support Zone Revealed—Here’s The Level....

Related News

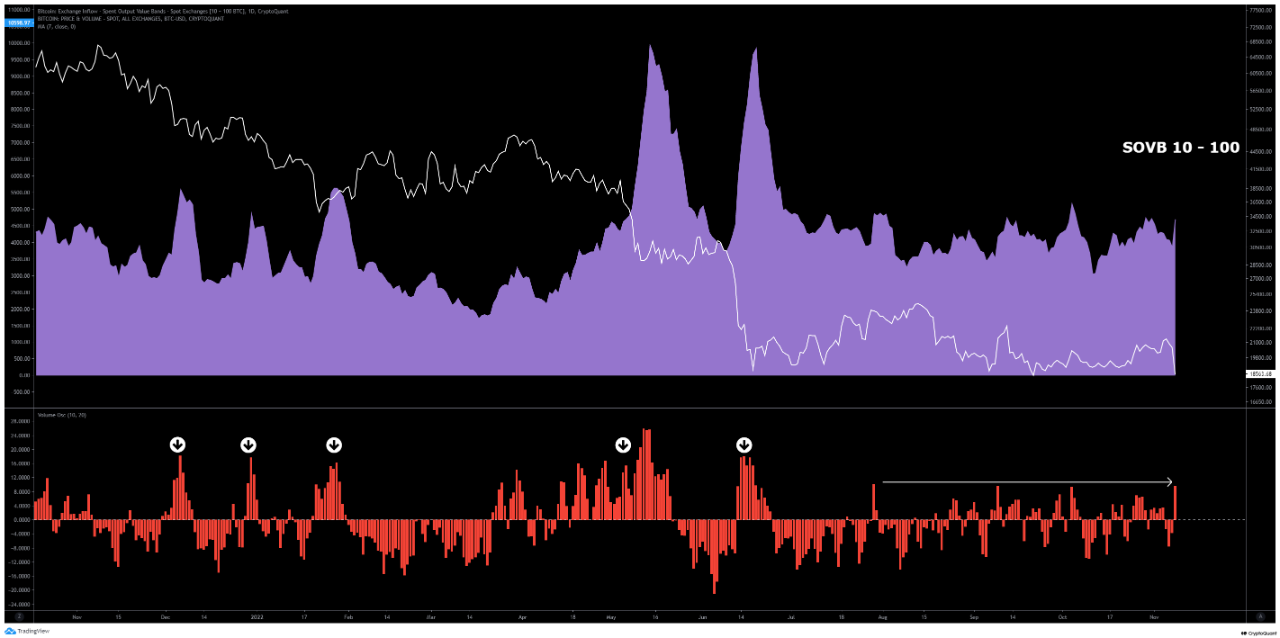

On-chain data shows Bitcoin whales with more than 1k BTC were the main sellers in the latest crash, as other cohorts displayed muted activity. Bitcoin Spent Output Value Bands Shows Spike From 1k-10k Group As pointed out by an analyst in a CryptoQuant post, unlike in the previous declines, the 10-100 BTC and 100-1k BTC cohorts didn’t show any spikes in activity during the latest crash. The relevant indicator here is the “Spent Output Value Bands” (SOVB). which displays the number of coins being moved by each value band in the Bitcoin market. These “value....

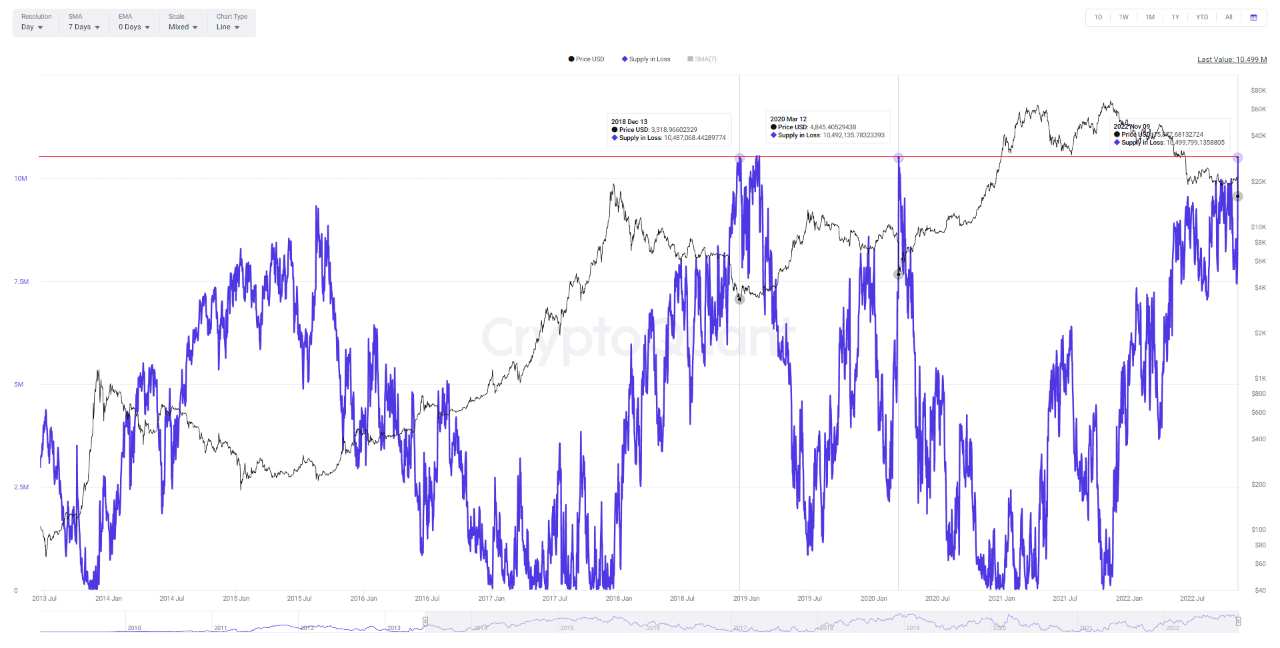

On-chain data shows the amount of Bitcoin supply in loss has now reached levels similar to during the COVID crash and the 2018 bear market bottom. Bitcoin Supply In Loss Spikes Up Following The Latest Crash As pointed out by an analyst in a CryptoQuant post, the BTC supply in loss has set a new record for this year following the FTX disaster. The “supply in loss” is an indicator that measures the total amount of Bitcoin that’s currently being held at some loss. This metric works by looking at the on-chain history of each coin in the circulating supply to see what price it....

On-chain data shows Bitcoin inflows are trending up, a sign that whales might be increasing their dumping. This could prove to be bearish for the coin. Bitcoin Inflows Move Up As Whales Continue To Sell As pointed out by a CryptoQuant post, on-chain data highlights that BTC inflows to exchanges have been going up. The “all exchanges inflow” is an indicator that shows the amount of Bitcoin that holders are depositing to exchanges on a given day. When the value of this metric moves up, it means more investors are sending their coins to exchanges. Holders usually deposit their BTC....

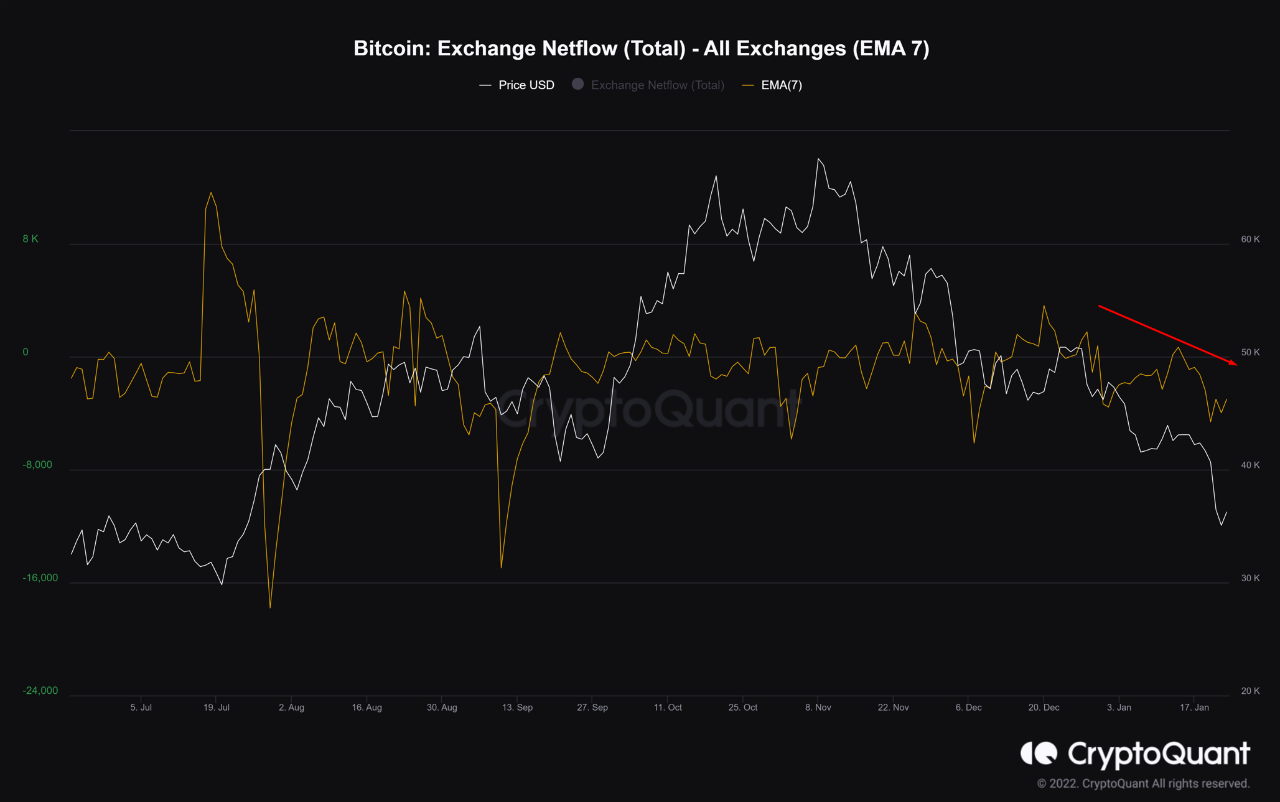

On-chain data shows Bitcoin netflows have increasingly become negative since the crash, meaning investors have been buying the dip. Bitcoin Netflows Becoming More Negative Since The Crash As pointed out by an analyst in a CryptoQuant post, BTC netflows have started to turn more negative since the crash a few days back. The “all exchanges […]

On-chain data shows the Bitcoin Supply in Profit has taken a significant hit following the crash the cryptocurrency has seen recently. Bitcoin Supply In Profit Dropped To Around 81% During The Crash As explained by an analyst in a CryptoQuant Quicktake post, the latest drawdown in the cryptocurrency has resulted in a portion of the […]