Bitcoin cycle is far from over and miners are in it for the long haul: Fideli...

In a jampacked report on digital assets, Fidelity asset management theorizes that miner movements indicate the Bitcoin cycle has a lot more room to run. Fidelity Digital Assets — the crypto wing of Fidelity Investments, which has $4.2 trillion assets under management, shared their “two sats” on the future of the digital assets space. The key takeaways touched upon miners’ behavior and Bitcoin (BTC) network adoption. In the annual report released last week, the group shared some insights into the world of BTC mining:“As Bitcoin miners have the most financial incentive tho make the best....

Related News

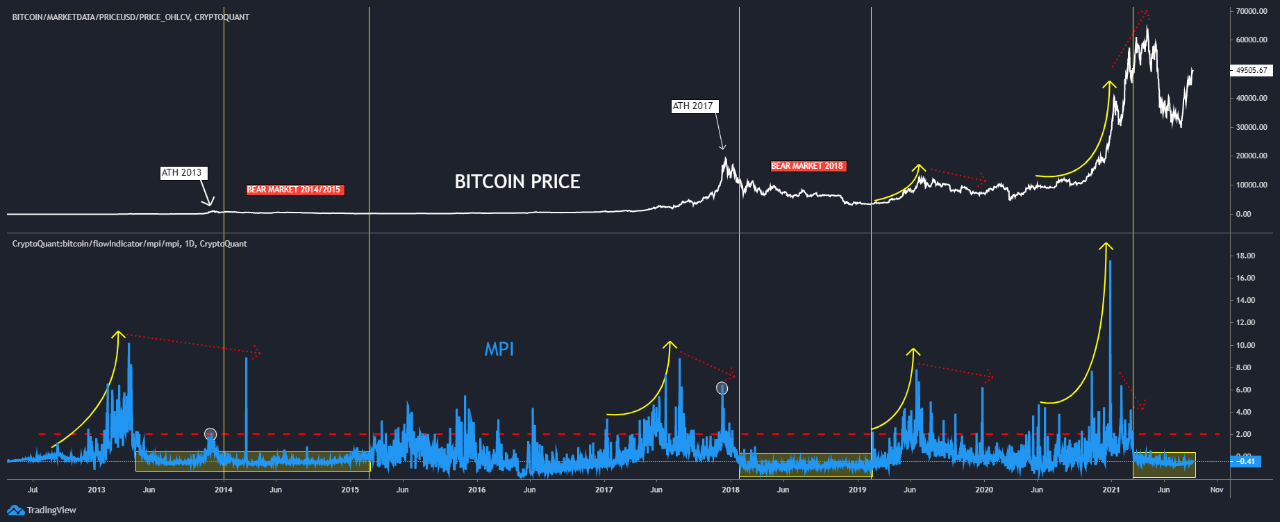

A look at the history of the Miner’s Position Index (MPI) would suggest Bitcoin miners usually sell before the bull run cycle top. The Bitcoin Miner’s Position Index Vs The Price For Various Cycles As pointed out by a crypto analyst on CryptoQuant, the BTC Miner’s Position Index may suggest that miners aren’t good at […]

Bitmain has just released the specifications and a rough shipping time frame of the long-awaited Antminer S9 using the new 16nm process for the ASIC. The new S9 uses 189 chips to achieve this speed across 3 boards. Power consumption has been dropped to 0.1 J/GH for a power pull of roughly 1380 watts. This step up in chip speed and power is still presented in a S7-type design for easy deployment and long term use. Bitmain sees this step from 28nm to 16nm as a crucial change in the mining cycle and long term use of the miners — as opposed to the traditional cycle of releasing a new....

Using a data-driven approach, it is possible to achieve significant return on investment with bitcoin miners, in both the public and private sectors.

The Bitcoin price action has long been used as the standard measurement of its market cycle. While price has served as a convenient benchmark, a crypto analyst argues that it may not be the most reliable tool for understanding the cycle. Instead, his analysis points to a stronger factor that could serve as a better […]

With the market recovering gradually, Bitcoin seems to have found stability above the $120,000 price mark after experiencing a pullback on Tuesday from its current all-time high. The ongoing bull market cycle continues to play out strongly compared to previous ones, and analysts believe that this cycle could be the best one yet. A Historic […]