The Performance Cycle Of Public Bitcoin Miners

Using a data-driven approach, it is possible to achieve significant return on investment with bitcoin miners, in both the public and private sectors. The below is a full, free article from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.The purpose of this release in specific will be twofold; the first will be to update readers on the latest updates for publicly-traded miner hash rate, production, and bitcoin holdings.....

Related News

Efforts to keep Bitcoin mining operations afloat may end up pushing the spot BTC price even lower. The share of the Bitcoin (BTC) network controlled by publicly held mining companies could grow to 40% by mid-2023, according to a new report by Hashrate Index. But this could bring more stress to an already bearish BTC market.Public Bitcoin miners’ hash rate jumps 295% in a yearThe outlook appeared after assessing the hash rate performance of Core Scientific, Marathon Digital Holdings, Riot Blockchain and other public miners over the last 12 months. Notably, these firms increased their....

Bitcoin public mining companies have been struggling along with the rest of the crypto market. With the decline in the price of bitcoin, these companies had seen their cash flow decline, driving come to the brink of bankruptcy. However, while it seemed like the losses that public BTC miners have incurred have happened in the bear market run, it goes back even father back. Bitcoin Miners Are Barely Profitable Public bitcoin miners, both large and small, had grown in popularity over the last year. Their stocks allowed investors to bet on the crypto market without having to buy any of the....

Data shows the public Bitcoin mining companies have plans to expand their hashrate by around 50% by the end of the year, Public Bitcoin Miners To Add 27 EH/s To Their Hashrate In Remaining Part Of 2022 As per a post from Arcane Research, the combined hashrate of these miners will reach around 80.7 EH/s […]

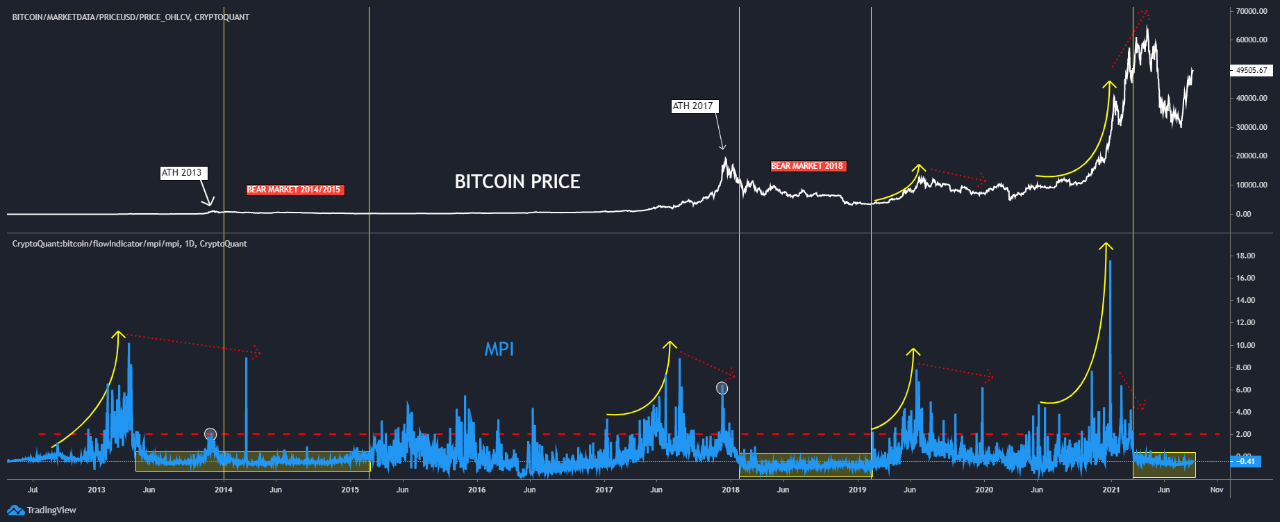

A look at the history of the Miner’s Position Index (MPI) would suggest Bitcoin miners usually sell before the bull run cycle top. The Bitcoin Miner’s Position Index Vs The Price For Various Cycles As pointed out by a crypto analyst on CryptoQuant, the BTC Miner’s Position Index may suggest that miners aren’t good at […]

In a jampacked report on digital assets, Fidelity asset management theorizes that miner movements indicate the Bitcoin cycle has a lot more room to run. Fidelity Digital Assets — the crypto wing of Fidelity Investments, which has $4.2 trillion assets under management, shared their “two sats” on the future of the digital assets space. The key takeaways touched upon miners’ behavior and Bitcoin (BTC) network adoption. In the annual report released last week, the group shared some insights into the world of BTC mining:“As Bitcoin miners have the most financial incentive tho make the best....