Cryptosigma Bitcoin Exchange Eliminates Price Volatility for South East Asian Users

Cryptosigma is a forthcoming South East Asian bitcoin exchange and mobile wallet app that lets users automatically convert any bitcoins they receive to local currency to avoid price volatility.

Cryptosigma Bitcoin Exchange Eliminates Price Volatility for South East Asian Users

Bitcoin is changing the way people think about and interact with money. However, bitcoin is a young currency, and consequently it is currently subject to often and extreme price volatility. Unfortunately, this growing pain means the price volatility prevents many people from feeling comfortable using bitcoin on a daily basis. Cryptosigma plans to free potential users of bitcoin from their fear of price volatility.

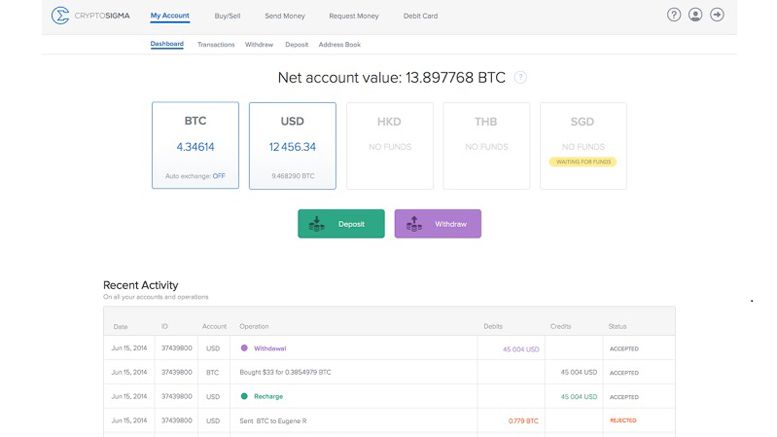

Cryptosigma is a combination bitcoin exchange and mobile wallet service that is slated to launch in early 2015. Like most bitcoin exchanges, Cryptosigma allows users to buy and sell bitcoins for local currency. But what sets Cryptosigma apart is its bitcoin auto-exchange function, which is also integrated into an iOS mobile wallet (an Android wallet should launch soon after).

Protecting Users from Bitcoin Price Drops

The auto-exchange function can be toggled on and off anytime. When turned on, it automatically converts any bitcoins a user receives into the currency of his or her choice at a guaranteed exchange rate into USD or local currency (the same way large payment processors convert received bitcoin for large merchants who accept bitcoin). When the user is ready to spend or send his or her money, the auto-exchange function will automatically convert the USD or local currency deposits back into the appropriate amount of bitcoin for that individual transaction. This protects the user from price volatility, whilst still utilizing all the benefits of bitcoin as a payment protocol or low-cost remittance device. Users can access funds online, through the exchange’s mobile wallet, or via their bitcoin debit card–which can be loaded with funds online or via the app.

Making Wallet Security Paramount

The additional problem with many bitcoin exchanges is that they control user funds, which in effect centralizes those funds. This is a problem bitcoin should not suffer from due to its inherent decentralized nature. The centralization of funds and wallet keys makes users vulnerable to both hackers and exchange fraud. Cryptosigma, however, provides users with a fresh solution by integrating Gem’s multi-signature wallet architecture. This system requires two keys to sign every transaction, Gem maintains one key and the user maintains two. This structure allows users to have complete control of their funds and the signing of transactions at all times. The exchange itself cannot move a user’s funds without a second key, which requires the co-operation of the user.

Cryptosigma Launch Details and Future Plans

Cryptosigma will launch their online exchange platform and iPhone wallet in early January by sending out early-access invites for those who have signed up on their pre-launch page. Early access users get $10 worth of funds credited to their account to play around with, so don’t miss out! After rolling out the exchange and mobile wallet, Cryptosigma plans to extend their functionality in Q2 to provide bitcoin payment processing services for merchants as well as a website tipping button people can easily add to their blog or website to receive tips of less than $1 from those who appreciate their content.

Related News