Crypto Currency

Can you imagine yourself walking into a store or shop looking for a new pair of shoes. You are browsing the fine selection of leather walking shoes, and find the perfect pair for your next weekend ramble. You pick up the shoes and go to the sales clerk to make payment, however you notice there are no tills, no cash card machines, how does the store take payment. The clerk then tells you that they only accept cyber-currency or Bitcoins. Thankfully you have your digital wallet on your mobile phone and can make payment and purchase your new shoes.

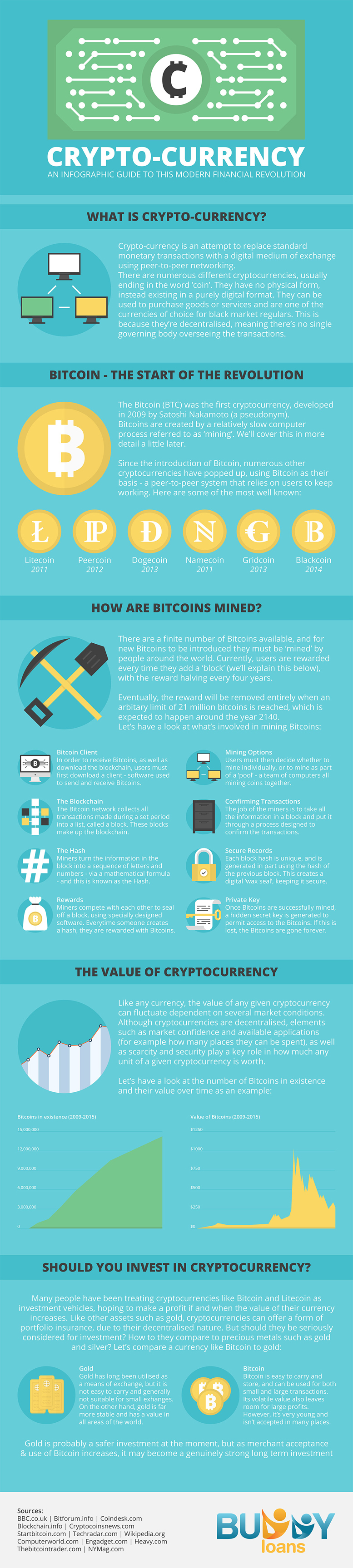

Digital currency or Bitcoins are the wave of how to pay for services and goods in the future, and in some instances for today. It is currency with no physical form, it only exists in the digital world, but that doesn’t mean it has not got value.

Bitcoin The Beginning

Bitcoin was the first crypto-currency developed. There are others, and their names all end in coin, and they all rely on Bitcoin as their basis.

Litecoin: Introduced October 2011, total value $331.5 million.

Peercoin: Introduced August 2012, total value $43.6 million.

Dogecoin: Introduced December 2013, total value $13.5 million.

Namecoin: Introduced April 2011, total value $20.2 million.

Gridcoin: Introduced 2013, total value $389 million.

Blackcoin: Introduced 2014, total value $74 million.

The Mining of Bitcoins

Bitcoins are not like paper notes or coin currency that is printed and placed in circulation. Bitcoins are “mined” by users around the world, with the users being rewarded each time they add a “block”.

Bitcoin Client: In order to receive and send Bitcoins, you first need a client, or software programme to do this.

The Blockchain: All transactions made during a set period are called a block. The blocks then in turn make up the blockchain.

The Hash: The Hash is a mathematical formula that the miners use to turn the blocks into a sequence of letters and numbers.

Rewards: Miners are in competition with each other to be the ones to seal off a block. The miner that does seal off a block, is rewarded with Bitcoins.

Mining Operation: Miners must decide if they want to mine alone, or in groups. Miners can pool together a team of computers mining coins together.

Confirming Transactions: This is where the miners take all the information in a block and using a unique process, confirm the transaction.

Secure Records: Each block has a part of the hash from the previous block attached to it. A digital “wax seal” is created to secure the block.

Private Key: This secret key is what allows access to the bitcoins. If this secret key is lost, the bitcoins are lost as well.

Cryptocurrency’s Value

The value of bitcoins as you can see from above is worth millions and millions. However, just like any currency, there are conditions and changes which can affect the value of a bitcoin. These conditions can be market confidence, how many bitcoins are available, and the demand for them.

Between 2009 and 2015, we have gone from zero to 15million bits coins in circulation. Their value has steadily increased to £1250 currently.

Investing in Cryptocurrency

Just as with anything of value, such as gold, stocks, and commodities, some investors treat bitcoins as a vehicle to invest in and hopefully make money.

Even though currently bitcoins do carry a substantial value, there are no guarantees for the future. In addition, they are a virtual or digital form of currency, so they cannot be physically held. In comparing bitcoins to gold as an investment vehicle, gold is more readily traded, as bitcoins are not yet as widely accepted. Bitcoins may be easier to carry than gold, but more difficult to sell or spend.

Related News